In today’s Super Seasonals: Trade of the Week we will look at Yum! Brands (YUM).

Yum! Brands, Inc. is a service restaurant company, which engages in the development, operation, franchise, and licenses of a system of restaurants. It operates through the following segments: KFC Division, Pizza Hut Division, Taco Bell Division, and Habit Burger Grill Division.

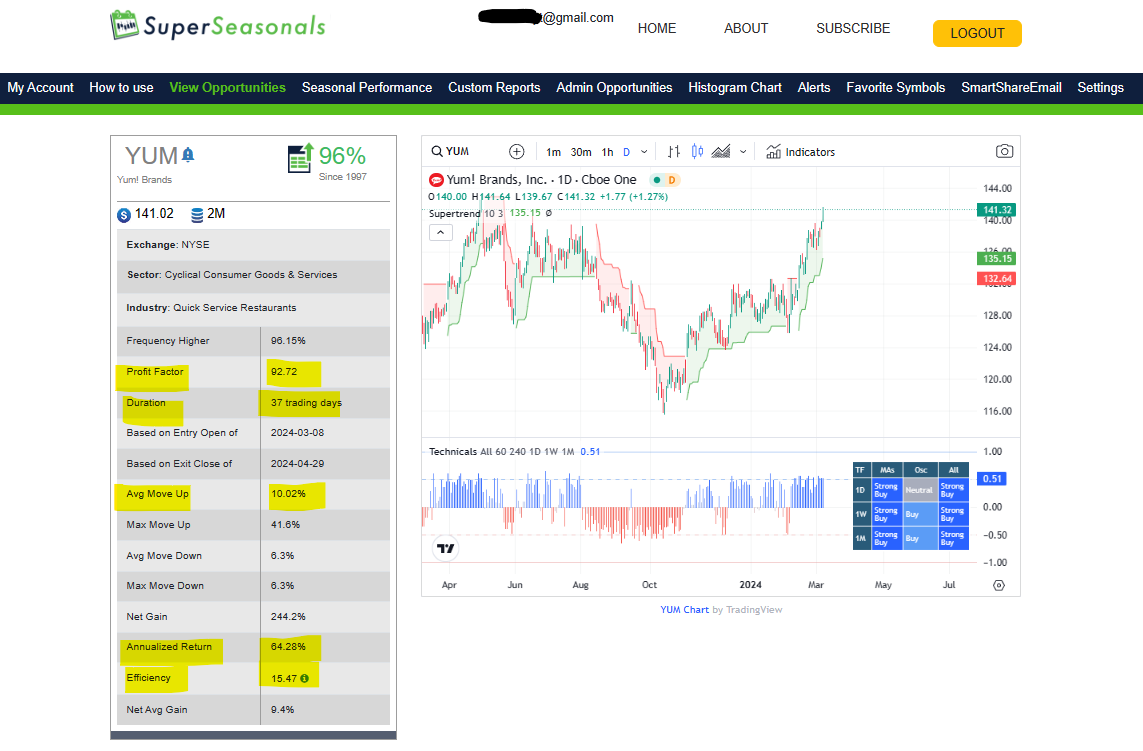

Below are the seasonal stats over the next couple of months. Additionally, a daily time-frame chart indicates the stock is in a bullish technical condition.

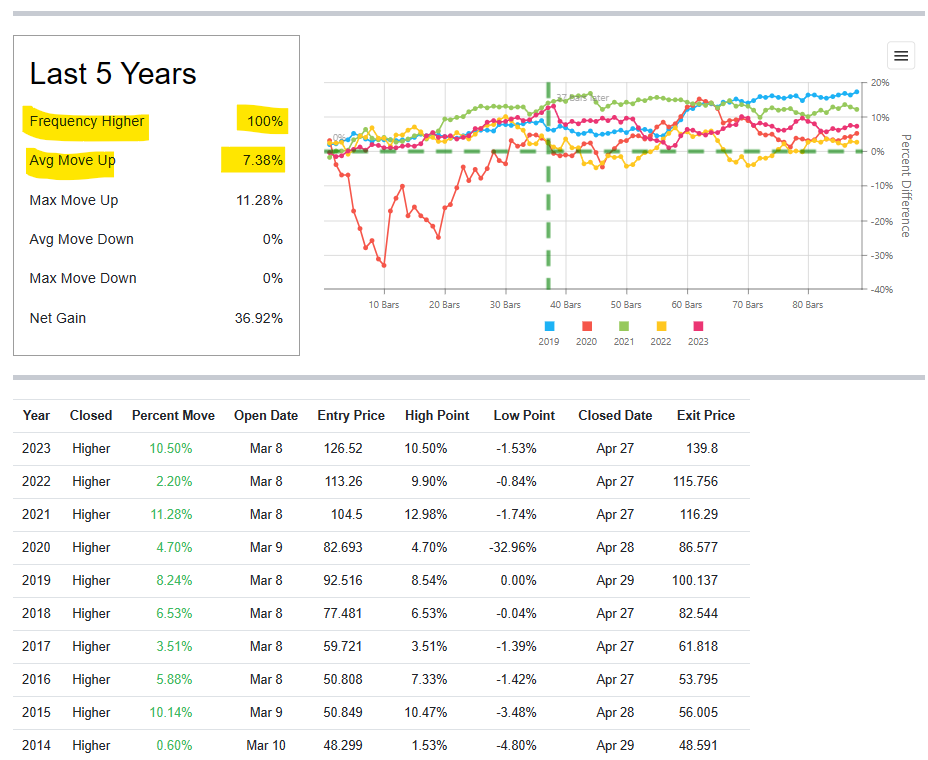

Below is a snippet of the last 5-10 years, from a recency bias standpoint, the seasonals still appear to be in alignment. Notice it had a COVID 2020 sell-off, then recovered.

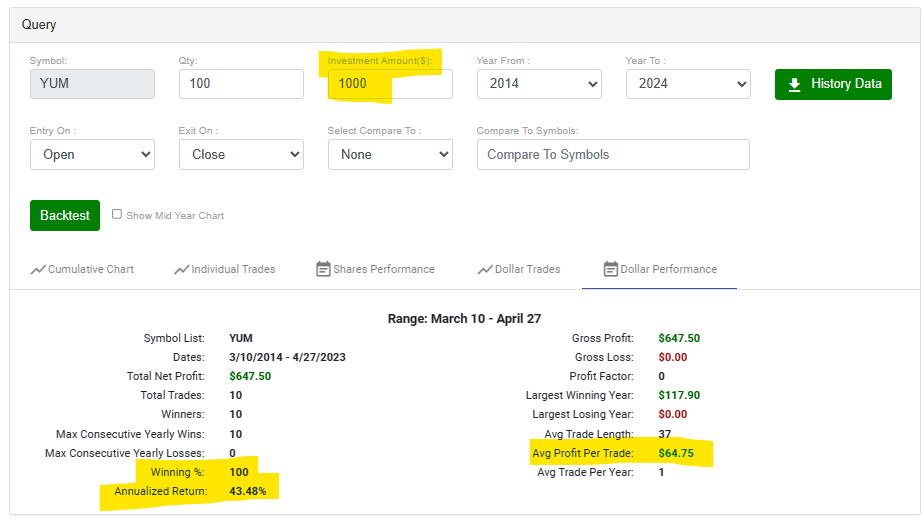

Below is a backtest of the past 10 years. If one invested $1,000 to buy shares of the stock, they would have an average $64.75 profit, or 6.45% ROI in 37 trading days. This comes out to an 43.48% annualized return.

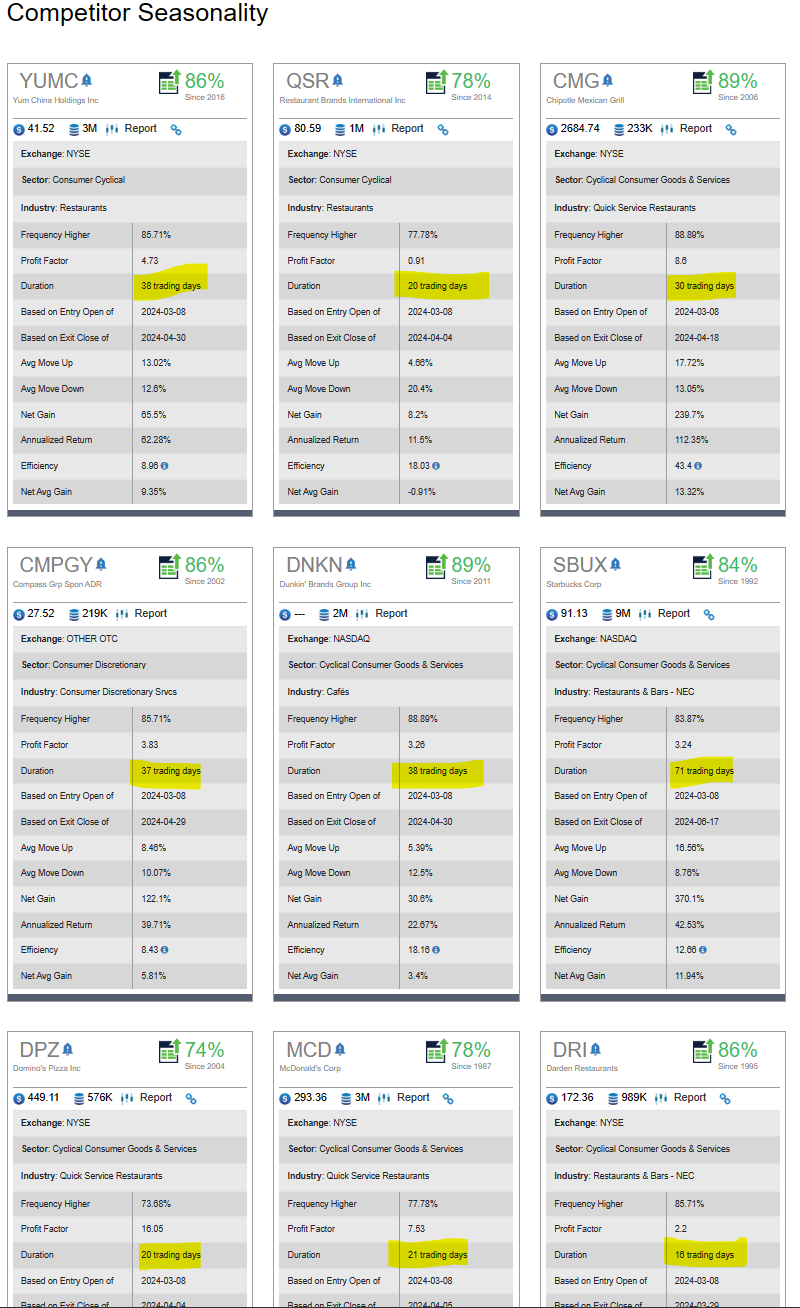

Below is the competitor seasonality. I do not weigh a ton on this, because sometimes the datafeed does not include every competitor. However, it is good to see alignment amongst some competitors for the start of a seasonal move. All of these stocks have positive moves over the next month or two.

As you likely know, there are literally dozens of solid ways to approach trading Yum! Brands (YUM) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Yum! Brands (YUM) and other solid seasonal opportunities click here SuperSeasonals.

Trade Smart,

Chad Shirley