In today’s Super Seasonals: Trade of the Week we will look at Starbucks Corp (SBUX).

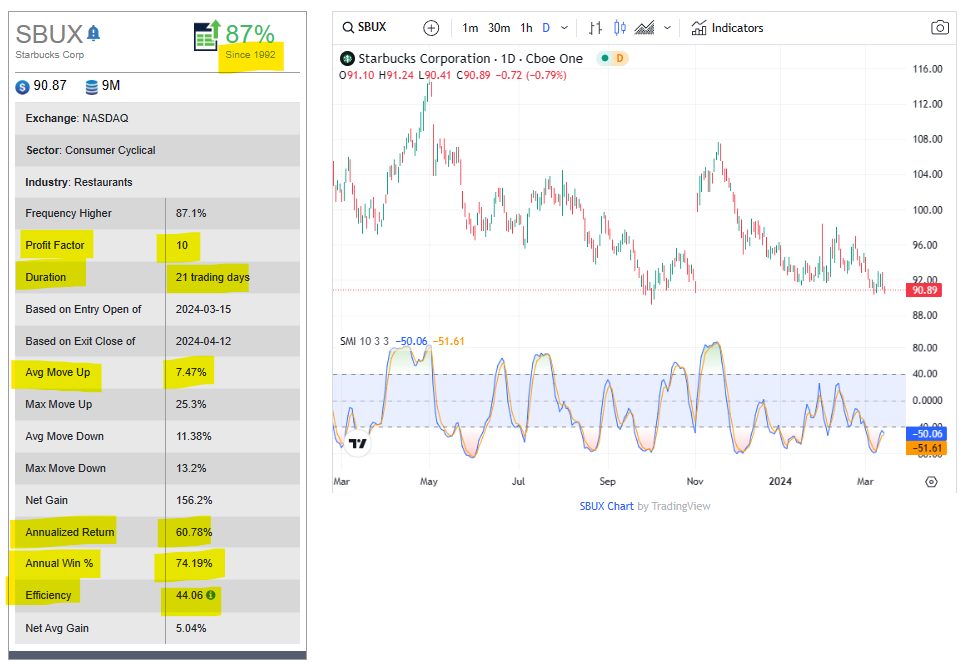

Since 1992 the stock price has gone up 87% of the time during this seasonal period. Below are some key seasonal stats on Starbucks over the next 21 trading days.

- Profit Factor: 10 (For every $1 in loss, it made $10 in gains)

- Avg Move Up: 7.47%

- Annualized Return: 60.47%

- Annual Win Percent: 74.19% (How often the stock made annual gains)

- Efficiency: 44.06 (How many times more efficient it was versus the annual buy and hold of the stock)

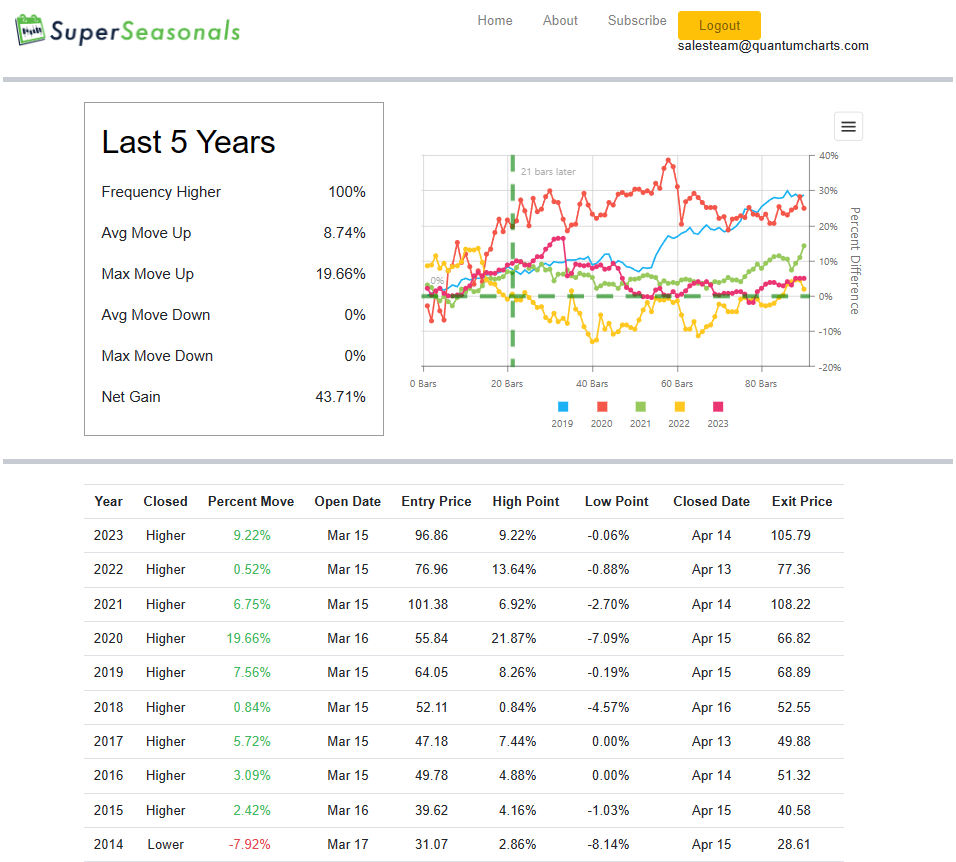

Below is a picture of the past 5-10 years of the seasonal period to give us a close up look at recency bias. On the surface, the pattern of seasonality still appears to be relevant.

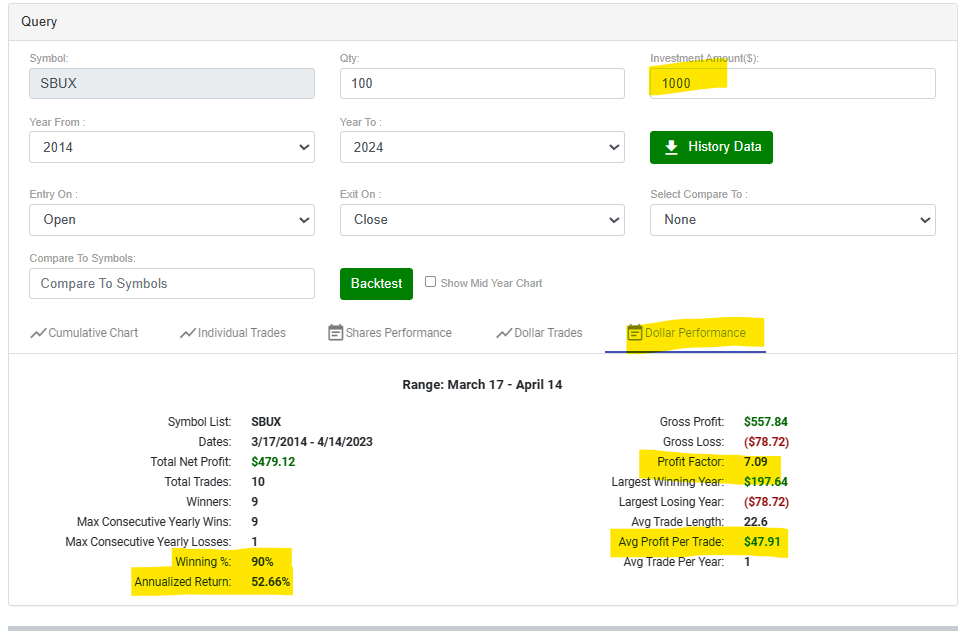

Below is a 10 year backtest on results for every $1,000 invested to buy shares of the stock:

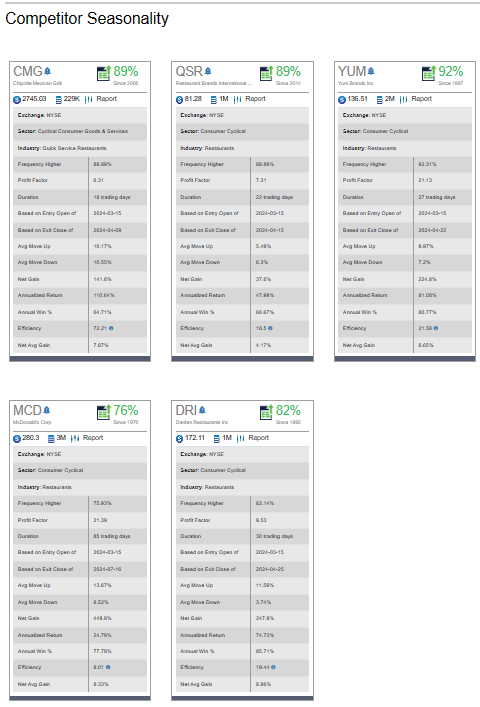

Looking at Competitor Seasonality, at a glance it appears that others have a bullish seasonal tendency to start a move up as well…this is nice to see alignment.

As you likely know, there are literally dozens of solid ways to approach trading Starbucks Corp (SBUX) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Starbucks Corp (SBUX) and other solid seasonal opportunities click here SuperSeasonals.

Trade Smart,

Chad Shirley