In today’s Super Seasonals: Trade of the Week we will look at Old Dominion Freight Line, Inc. (ODFL).

Old Dominion Freight Line, Inc. engages in the provision of regional, inter-regional, and national less-than-truckload services through a single integrated, union-free organization. Its services include container drayage, truckload brokerage, and supply chain consulting.

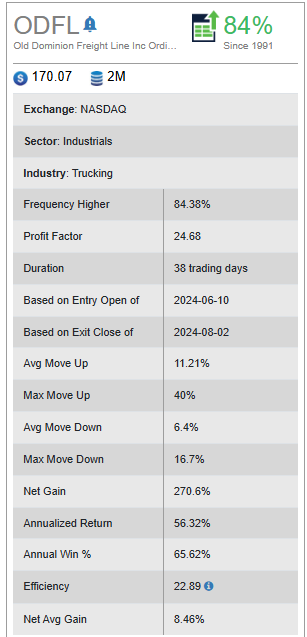

Below are the seasonal snippets on ODFL since 1991:

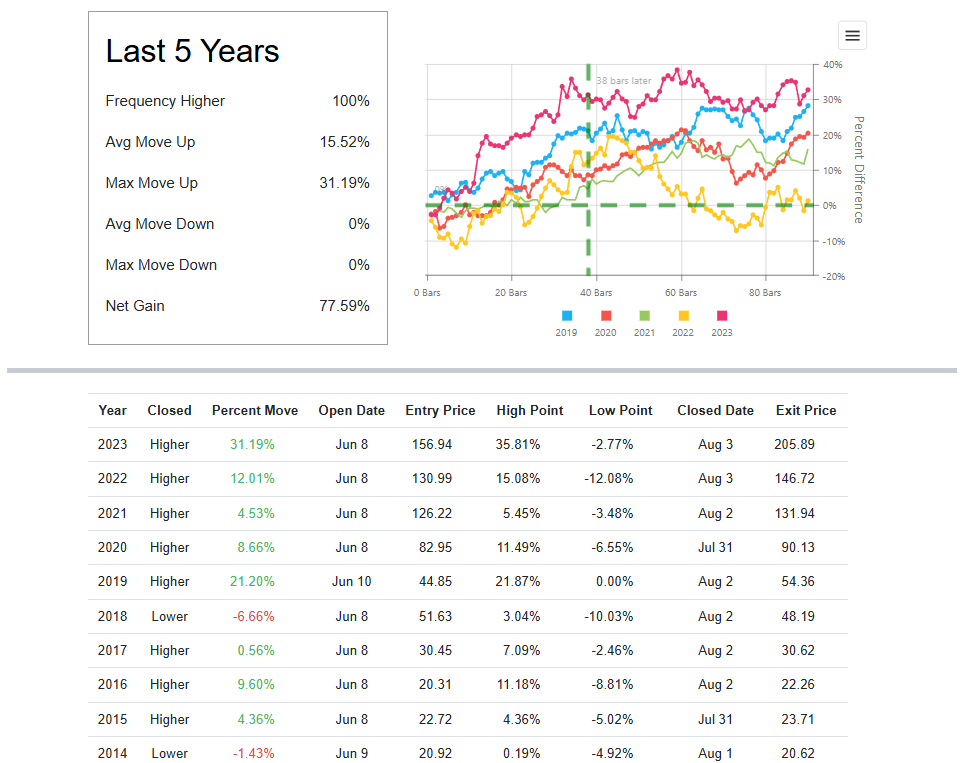

Below are the 5-10 year seasonals, from a recency bias standpoint…

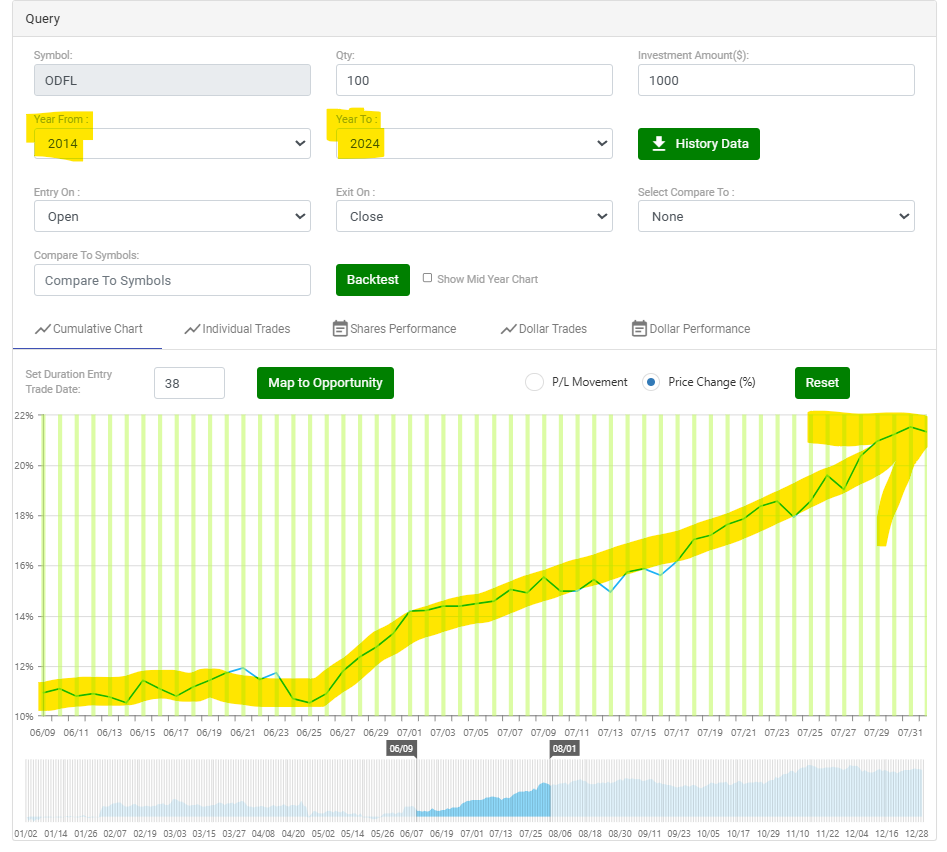

Below is a Cumulative Chart of ODFL…notice that the stock has a tendency to go sideways for a couple of weeks, then it takes off to the upside, historically…

Let’s look at some histogram charts, to find a big picture and alignment in the stock, the broad market, the sector and the industry…then I’ll summarize at the end.

Below are the Monthly Movements for the stock ODFL…June is not a great month, but July is.

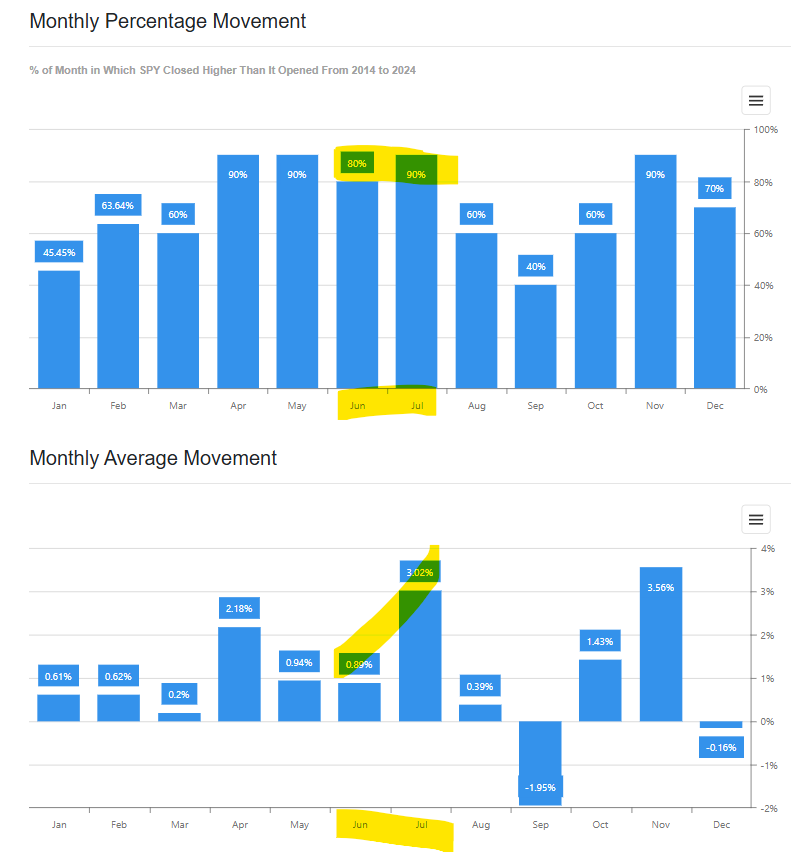

Below are the Monthly Movements for the broad market ETF “SPY”…June and July look great.

Below are the Monthly Movements for the Industrial sector ETF “XLI”…June and July, not terrible.

Below are the Monthly Movements for the transportation industry ETF “IYT”…June, coin toss, July pretty good.

What all these histograms tell me, over the past 10 years, is that the month of June open/close has a slight bullish tendency, to rather flat. But moving into July, everything looks really good. So, from a seasonal perspective, the historical probabilities lean towards a bullish move through the end of July.

As you likely know, there are literally dozens of solid ways to approach trading Old Dominion Freight Line, Inc. (ODFL) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Old Dominion Freight Line, Inc. (ODFL) and other solid seasonal opportunities click here SuperSeasonals.

Trade Smart,

Chad Shirley