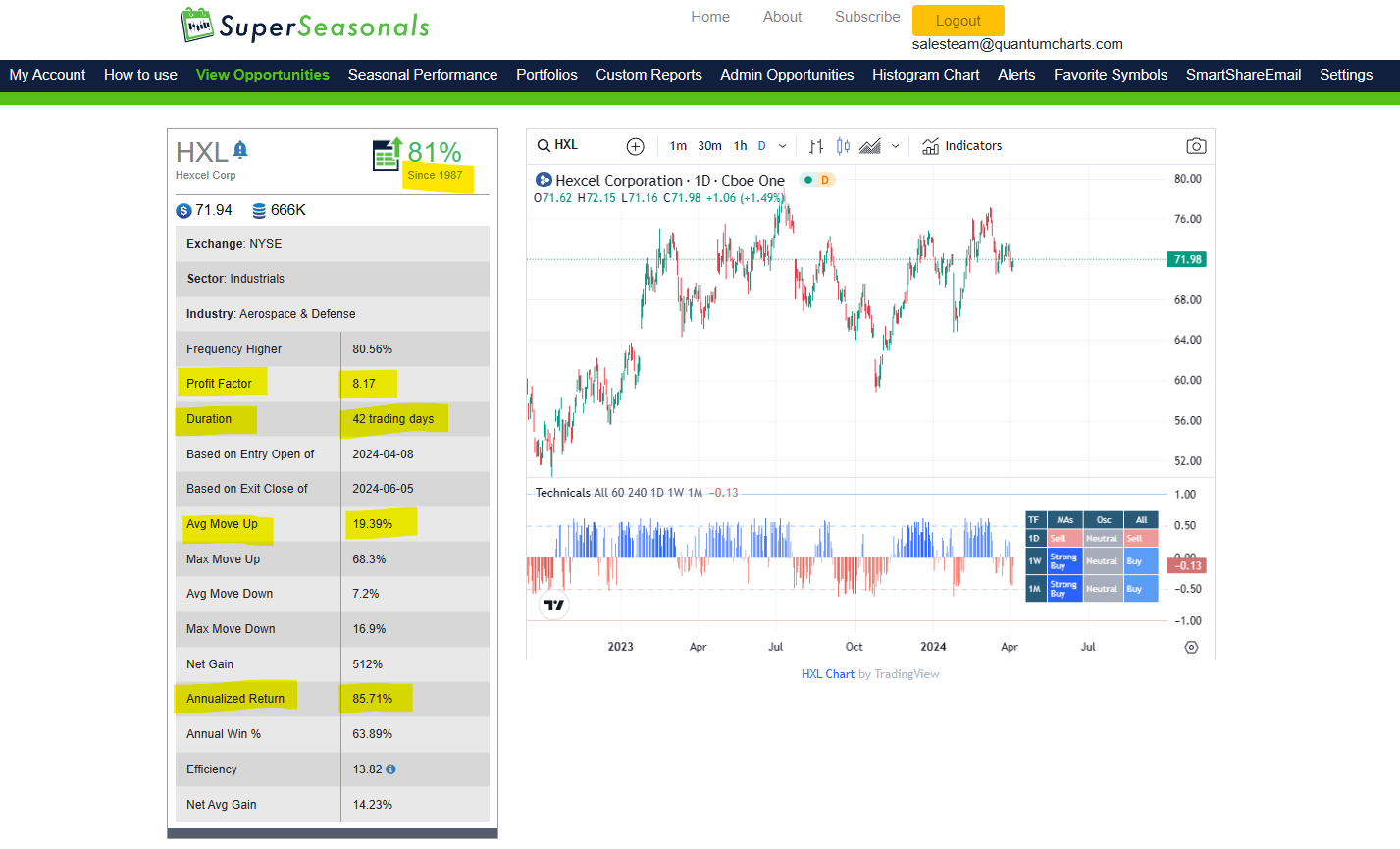

In today’s Super Seasonals: Trade of the Week we will look at Hexcel Corp (HXL). The company operates within the Industrial sector, primarily within the Aerospace and Defense industry.

Hexcel Corp. engages in the development, manufacture, and marketing of lightweight structural materials. It operates through the Composite Materials and Engineered Products segments. The Composite Materials segment includes carbon fiber, specialty reinforcements, resins, prepregs and other fiber-reinforced matrix materials, and honeycomb core product lines and pultruded profiles. The Engineered Products segment refers to the lightweight high strength composite structures, engineered core and honeycomb products with added functionality, and additive manufacturing.

Below are the seasonal statistical snippets of Hexcel Corp over the next 42 “trading” days…

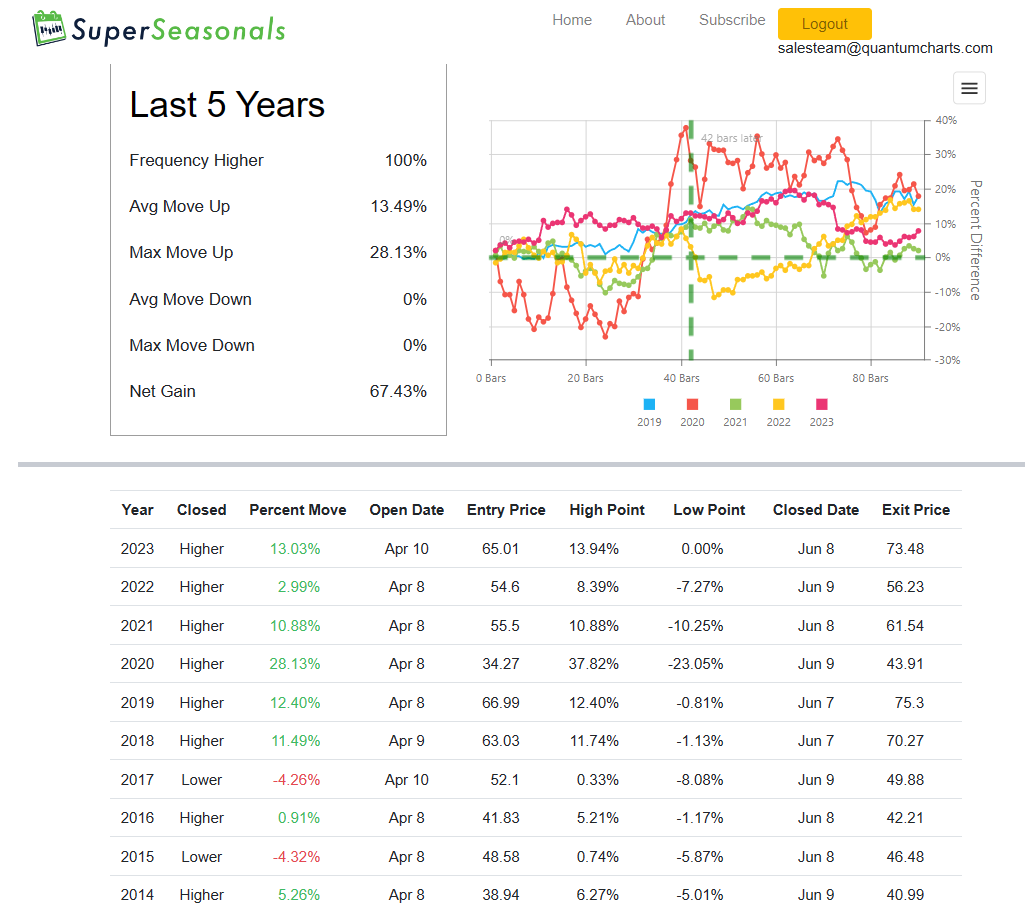

Below are the last 5-10 year seasonals, from a recency bias perspective…things still look good in regards to seasonals still being intact. We usually want to see 80%+ winners within the past 5-10 year period.

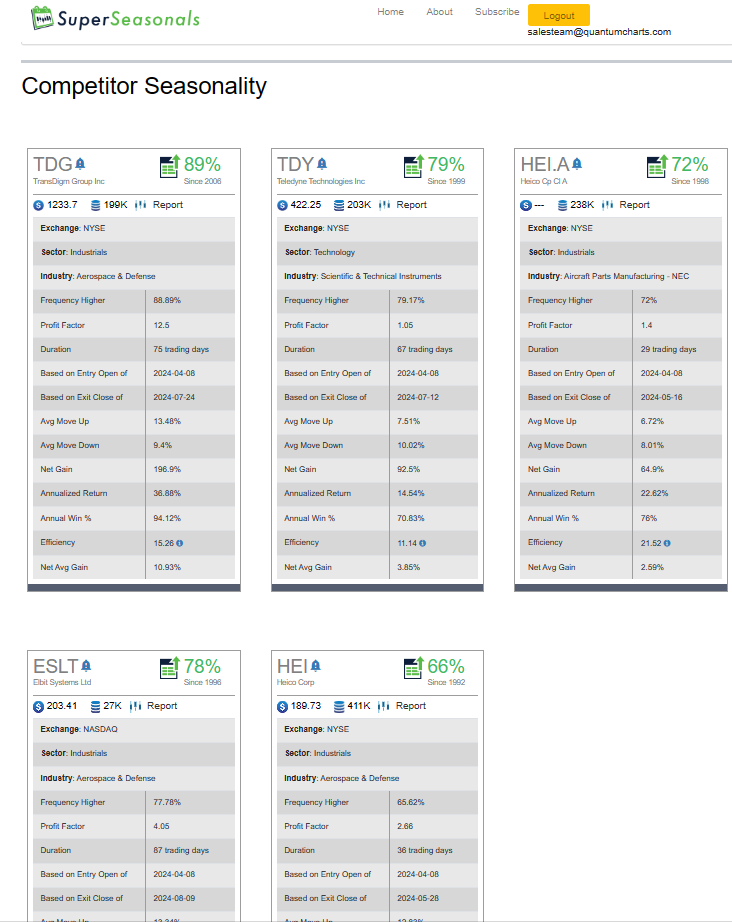

Below are a few competitors, and all their seasonals appear to have a bullish seasonal start as well. This is a nice alignment to see, but not necessarily that much weighting to it.

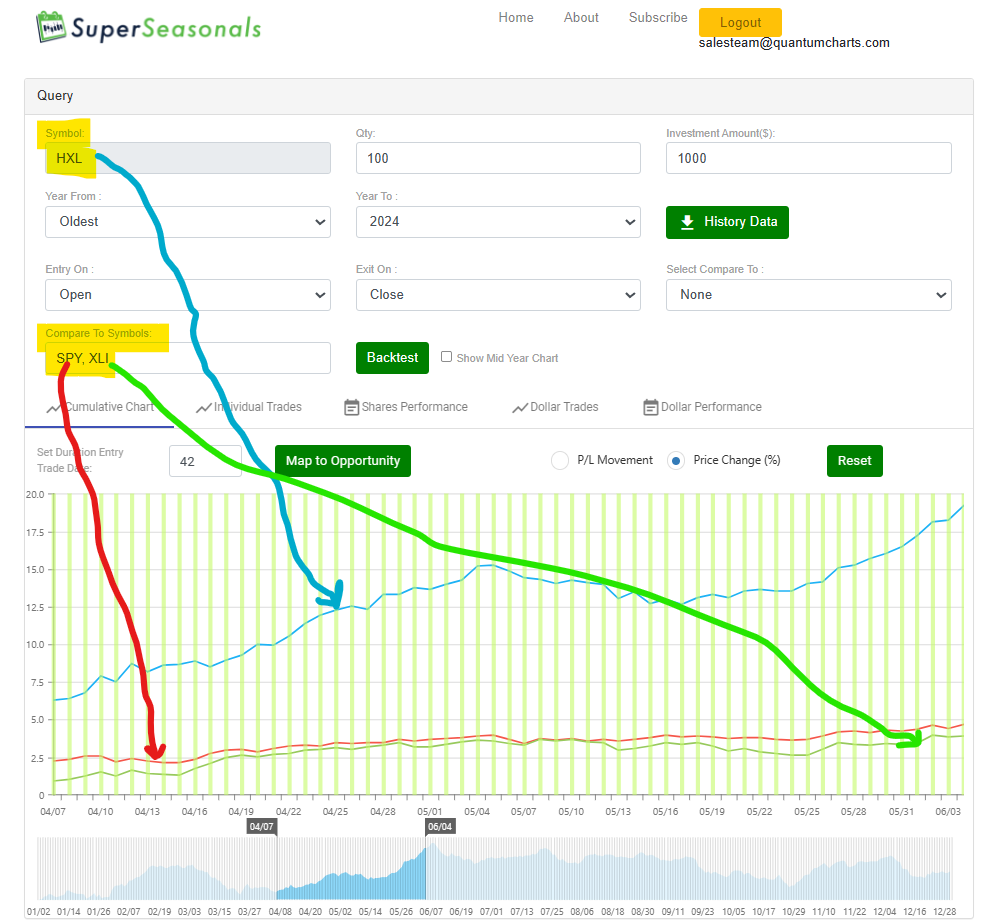

Below is a comparison of the stock, HXL, and a comparison to the broad market (SPY) and an Industrials ETF (XLI). What we see is that both the broad market and the sector tend to have a bullish drift toward this same time period. This is nice to see that alignment, but it’s not always an end-all/ be-all per se.

As you likely know, there are literally dozens of solid ways to approach trading Hexcel Corp (HXL) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Hexcel Corp (HXL) and other solid seasonal opportunities click here SuperSeasonals .

Trade Smart,

Chad Shirley