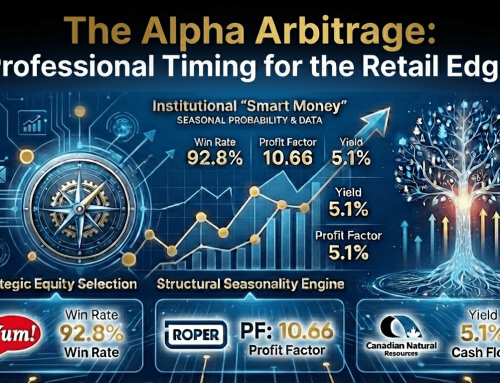

As a market veteran with two plus decades of following the markets, I’ve learned one undeniable truth: Wall Street is a creature of habit. While the retail crowd chases headlines, the “Smart Money” plays the calendar, or at least is well aware of it. We are approaching one of the most statistically powerful windows of the year—the December-to-February corridor. This period combines the “Santa Claus Rally,” year-end portfolio rebalancing, and the famous “January Effect” into a single, potent opportunity.

I have analyzed the seasonality data provided from the Super Seasonals software based on a pre-built scanner that I customized within the application—filtering for win rate (frequency), risk/reward ratio (profit factor), historical consistency etc. Login to SuperSeasonal.com to see all the detailed stats and the calendar time windows of optimal entry and exit dates.

Here are my Top 5 “Strong Buy” Candidates for the upcoming winter season, along with the fundamental “Why” behind their moves.

Sector: Healthcare (Medical Devices)

- The “Why”:

- The Deductible Flush: This is a classic medical device phenomenon. Patients rush to schedule elective surgeries (hips, knees) in Q4 before their insurance deductibles reset on January 1st. This revenue gets booked in Q4 and reported in late January/early February, often leading to an earnings beat.

- The J.P. Morgan Effect: Every January, the healthcare industry descends on San Francisco for the J.P. Morgan Healthcare Conference. It is the Super Bowl of biotech/medtech. Companies like ZBH often pre-announce strong numbers or unveil new tech here, driving the stock price up in early January.

Sector: Information Technology (IT Services)

- The “Why”:

- Use-It-Or-Lose-It: Corporate IT departments often have a “use it or lose it” mentality with their budgets at year-end. They rush to sign contracts in December to secure funding for the next year.

- New Year, New Projects: As the calendar turns to January, these new contracts officially kick off. The holding period through mid-February captures the optimism of Q1 guidance and the “budget flush” revenue recognition.

Sector: Technology (Semiconductors)

- The “Why”:

- The Consumer Tech Ramp: ASE handles chip assembly and testing. Their stock often runs in anticipation of the Consumer Electronics Show (CES) in January, where new gadgets are revealed.

- Lunar New Year Inventory: As a Taiwan-based giant, ASX often sees inventory builds ahead of the Lunar New Year shutdowns (which usually fall in late Jan/early Feb), creating a distinct cyclical demand spike during this window.

Sector: Energy (Oil & Gas Midstream)

- The “Why”:

- Heating Demand: It sounds simple because it is. EPD moves NGLs (Natural Gas Liquids) and gas. Winter is peak demand season for heating fuels.

- Tax-Loss Rebound: EPD is an MLP (Master Limited Partnership). Investors often sell these in Oct/Nov for tax-loss harvesting. By December and January, that selling pressure vanishes, and “income hunters” rush back in to capture the dividend, causing a reliable bounce (Entry: Dec 1).

Sector: Healthcare (Medical Instruments)

- The “Why”:

- Flu Season Defense: BDX makes the needles, syringes, and diagnostic kits used heavily during the winter flu and respiratory virus season.

- Safety Flight: When volatility hits the market in December (often due to tax selling), funds rotate into “Safety” stocks. BDX is a Dividend Aristocrat and a defensive staple, making it a magnet for capital preservation flows into the new year.

The data points (login to SuperSeasonal.com to drill down on all the dates and numbers) to a unified entry date of December 1st, 2025. This suggests the optimal strategy is to position just as the tax-loss selling season concludes (end of November) and ride the wave of institutional buying that typically floods the market at the start of the new year.

Trade smart,

Chad Shirley