In today’s Super Seasonals: Trade of the Week we will look at W.R. Berkley Corp (WRB).

W.R. Berkley Corp. is an insurance holding company, which engages in the property casualty insurance business. It operates through the following segments: Insurance and Reinsurance & Monoline Excess. The Insurance segment includes excess and surplus lines, admitted lines, and specialty personal lines throughout the United States, as well as insurance businesses in the United Kingdom, Continental Europe, South America, Canada, Mexico, Scandinavia, Asia, and Australia. The Reinsurance & Monoline Excess segment is involved in the reinsurance business on a facultative and treaty basis, primarily in the United States, United Kingdom, Continental Europe, Australia, the Asia-Pacific region, and South Africa.

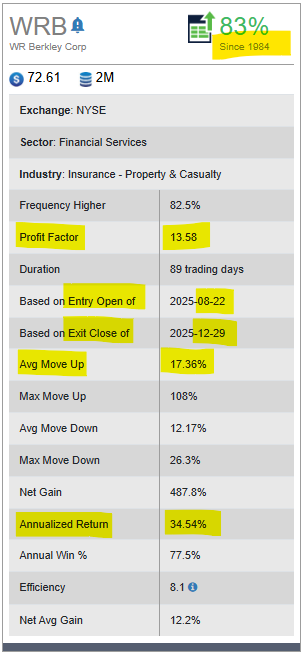

Below is a snippet of the seasonal patterns the software uncovered since 1984…

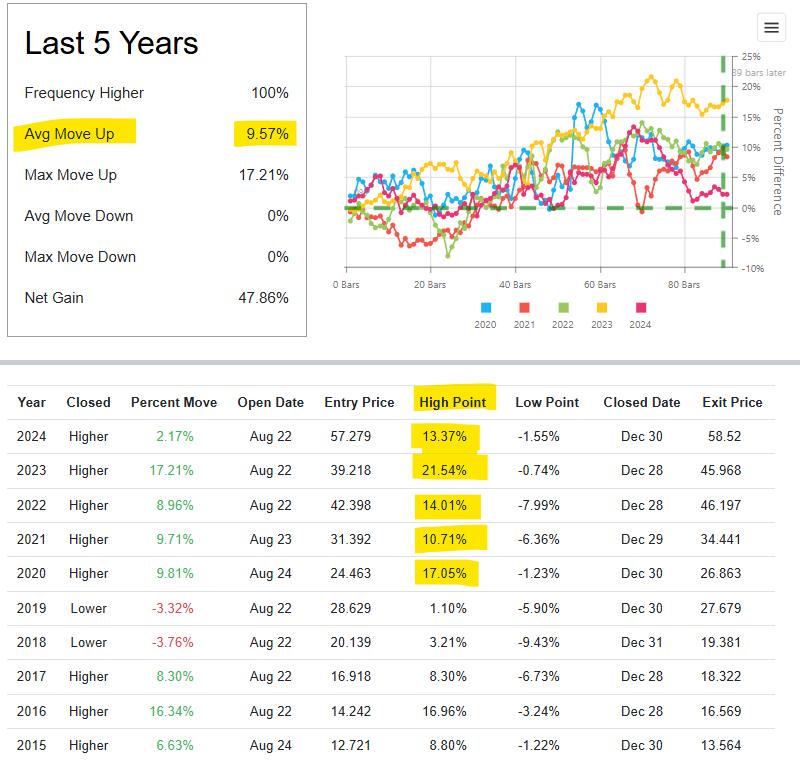

Below is a look at the past 5-10 years of the upcoming pattern…solid High Points over the past few years…

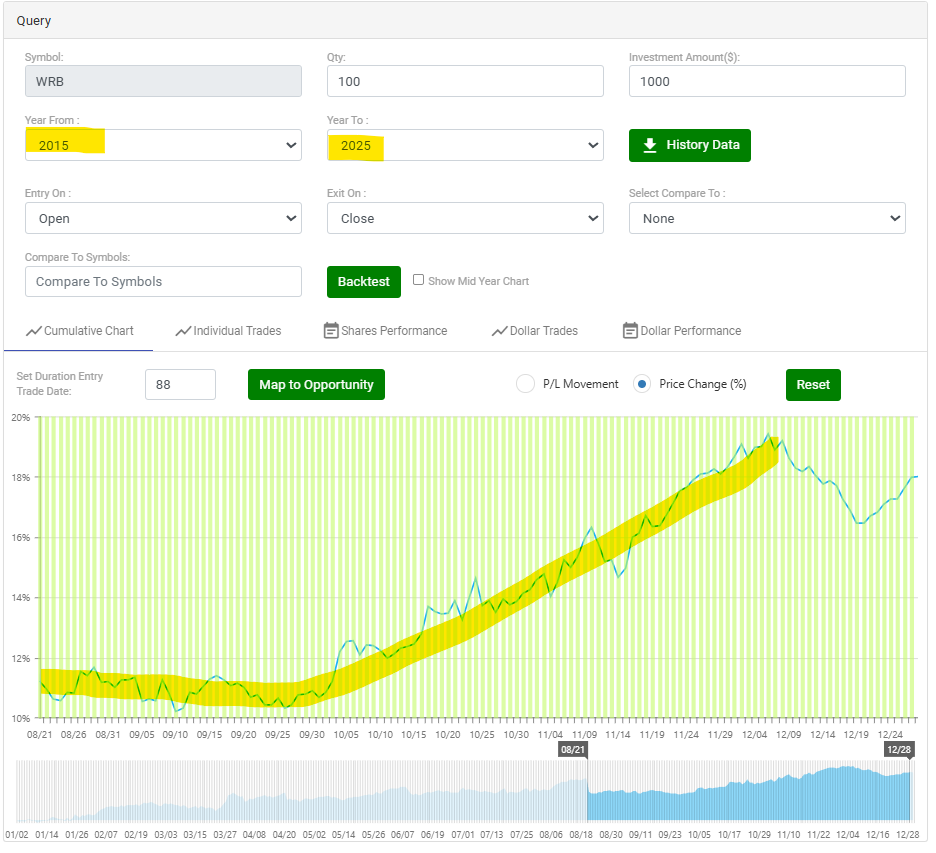

Below is a look at the average price mean on a Cumulative Chart over the past 10 years…

As you likely know, there are literally dozens of solid ways to approach trading W.R. Berkley Corp (WRB) with a bullish bias.

The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties.

Please remember to fully understand the risk before trading anything.

It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley