In today’s Super Seasonals: Trade of the Week we will look at Vipshop Holdings Limited (VIPS).

This popped-up an Alert Reminder that I enabled a while back, totally forgot about it.

The Alert Reminder (it’s the icon beside the symbol below) is one of my favorite features about Super Seasonals.

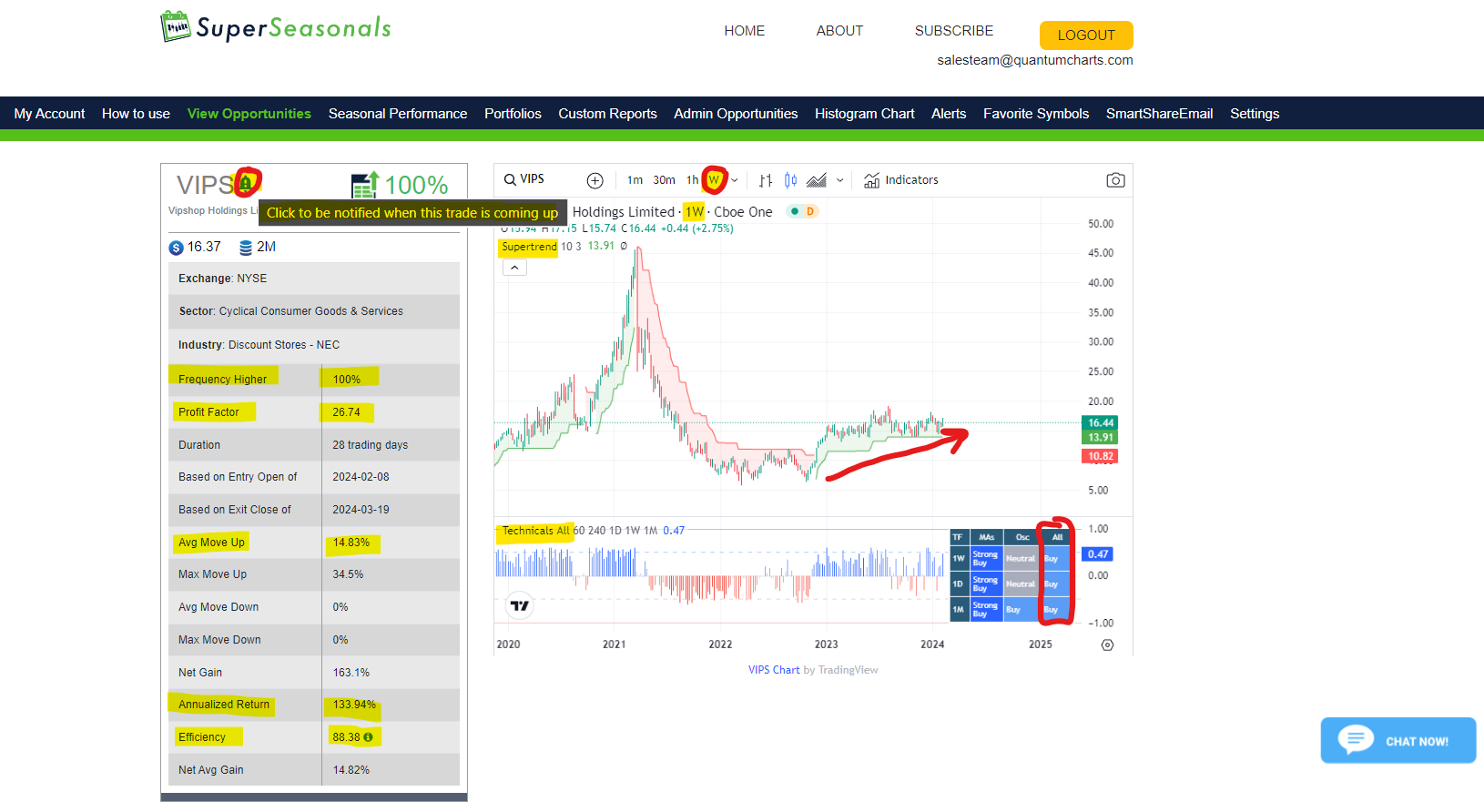

Below are the seasonal stats on Vipshop Holdings Limited (VIPS)

- 100% of the time it has gone UP during this seasonal period since 2012.

- Profit Factor = 26

- Avg Move Up = 14% (in just 28 trading days)

- Annualized Return: 133%

- Efficiency: 88-times more efficient than Buy/Hold of stock.

The Weekly chart above is in a bullish trend (“SuperTrend” indicator), and the composite of several technicals (“Technicals All” indicator) have a Buy rating. Thus technically, the stock is in a bullish mode, from an investment standpoint

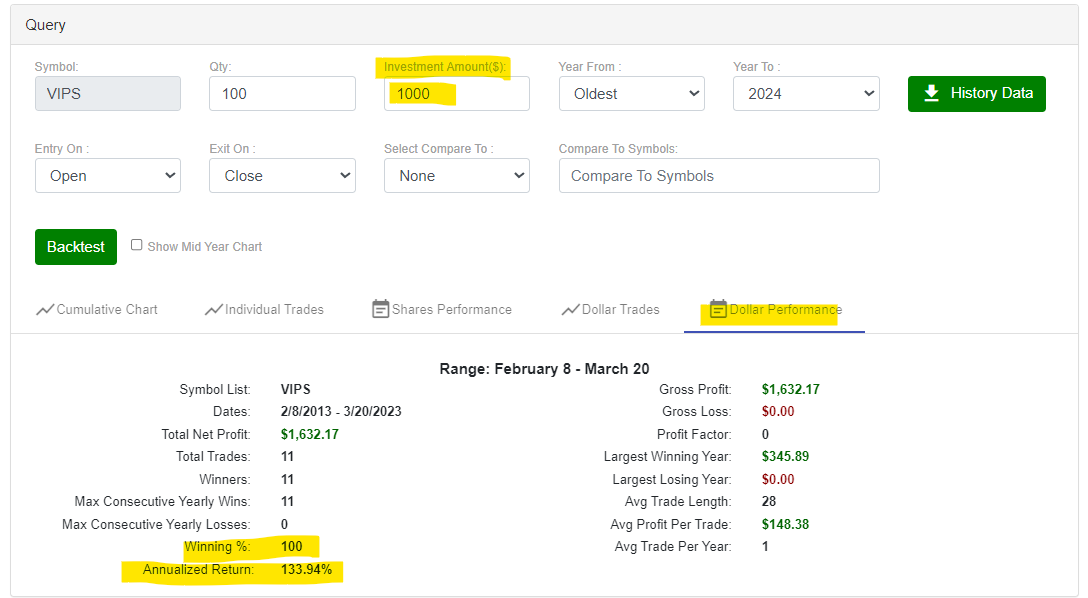

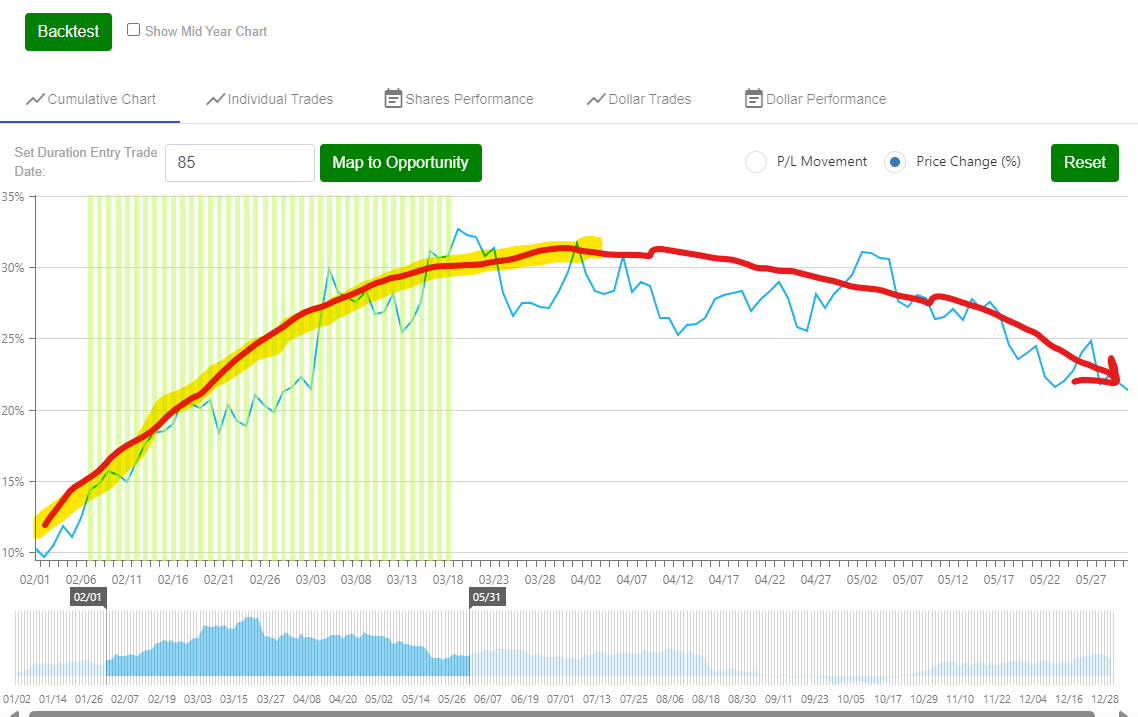

Below is a backtest of $1,000 invested every year to buy shares of the stock. It made $1,632 in profit. That equates to an 133% annualized return, which is amazing.

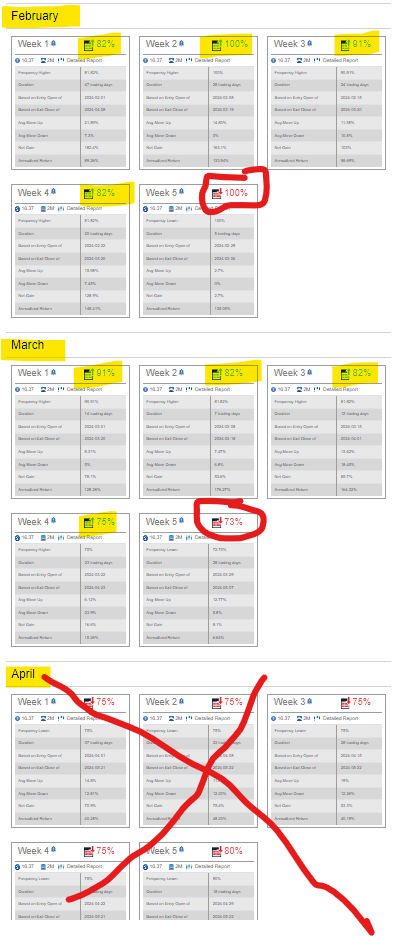

Looking at the Week by Week seasonal starts…you may not want to be holding the stock during the month of April, or it might be a good time to look at bearish trades that meet your risk criteria profile.

A visual from a Cumulative Line chart…falls off in April, historically.

As you likely know, there are literally dozens of solid ways to approach trading Vipshop Holdings Limited (VIPS) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Vipshop Holdings Limited (VIPS) and other solid seasonal opportunities click here SuperSeasonals .