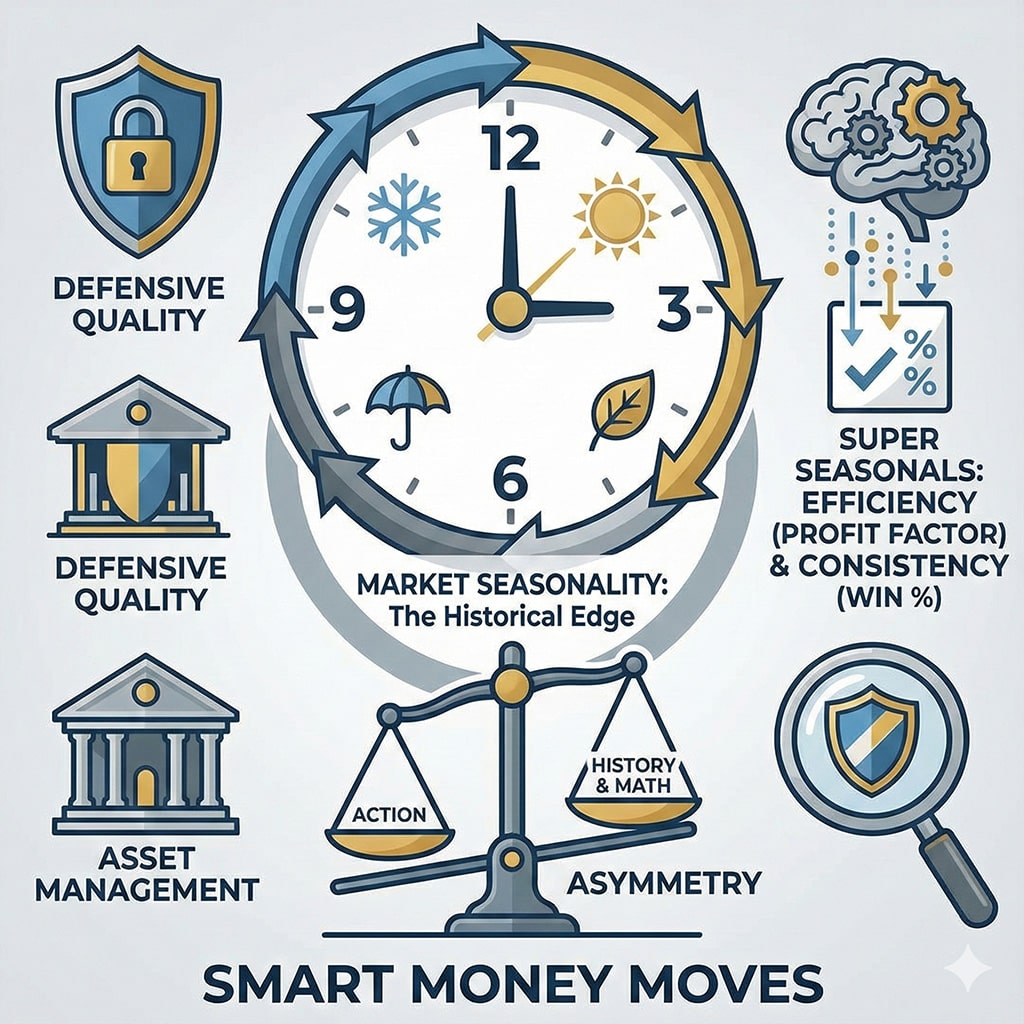

Welcome back to another edition of our weekly market newsletter. In my years of trading and investing, I don’t just look for “action”—if it’s available, I look for asymmetry as an added edge. Oftentimes, I want trades where history is weighted in my favor and the “math” does some of the heavy lifting.

One foundation of my investment thesis that has served me well has been market seasonality. Stocks don’t move in a vacuum; they move according to fiscal cycles, tax strategies, cultural events, and inventory replenishments.

After partially rotating out of some profitable tech and telecom positions, I’m shifting some of the portfolio’s weight toward Defensive Quality and Asset Management. While the retail crowd is busy gambling on the next unproven AI penny stock, the “smart money” is moving into sectors with historical tailwinds for the month of January.

This week, we are diving into our “Super Seasonals” list. We aren’t just looking for high returns; we are looking for Efficiency (Profit Factor) and Consistency (Win %).

Below are my top 3 picks from the data, incorporating current macro themes and the “why” behind their historical performance.

- The Stats: * Frequency Higher: 95.65% (Since 2002)

- Profit Factor: 18.27

- Annualized Return: 62.47%

- Trade Window: Login to SuperSeasonals.com

- Sector: Financials | Industry: Closed-End Fund (CEF)

- The Thesis: This remains my #1 pick for consistency. In the hedge fund world, we call this the “Mean Reversion Master.” Because PTY is a closed-end fund, it often trades at a discount or premium to its Net Asset Value (NAV). In December, retail investors dump these for tax-loss harvesting. In January, the “yield hungry” institutional buyers step back in. A 95% historical win rate tells you everything you need to know: the January bounce is nearly a mathematical certainty.

- The Stats: * Frequency Higher: 85.71% (Since 1997)

- Profit Factor: 9.22

- Annualized Return: 31.71%

- Trade Window: Login to SuperSeasonals.com

- Sector: Materials | Industry: Containers & Packaging

- The Thesis: Silgan is the “Quiet Giant.” They provide the metal and plastic packaging for the world’s food supply. Why does it move in Q1? Two reasons: Institutional Rotation and Inventory Cycles. At the start of the year, fund managers often rotate out of “risk-on” high-flyers and into “defensive value” to lock in a baseline for the year. Additionally, the food processing industry begins ramping up orders for spring and summer production cycles. It’s a low-vulatility, high-probability “slow and steady” winner.

- The Stats: * Frequency Higher: 86.96% (Since 2002)

- Profit Factor: 8.06

- Annualized Return: 65.46%

- Trade Window: Login to SuperSeasonals.com

- Sector: Consumer Discretionary | Industry: Casinos & Gaming

- The Thesis: This is our “Event-Driven” play. The narrative is simple: The Lunar New Year. As we approach late January and early February, all eyes turn to Macau. WYNN has high exposure to the premium Chinese consumer. Historically, the stock front-runs the massive surge in Gross Gaming Revenue (GGR) that occurs during the huliday. It’s a classic “buy the rumor, sell the news” trade that has worked nearly 87% of the time for over two decades.

| Symbol | Win % | Profit Factor | Core Driver |

| PTY | 95.6% | 18.27 | Post-Tax Selling Recovery |

| SLGN | 85.7% | 9.22 | Defensive Portfolio Rotation |

| WYNN | 87.0% | 8.06 | Lunar New Year / Macau GGR |

If you are looking for the “Holy Grail” of historical consistency, look no further than PTY. If you want a stock that benefits from a clear, repeatable global event, WYNN is your play.

The goal of this newsletter isn’t to help you “guess” what might happen; it’s to show you what usually happens. In a world of uncertainty, 20+ years of seasonal data is some of the best edge you can have, but it’s not the ONLY thing.

Trade smart,

Chad Shirley