Week of Feb 2, 2026 — 3 Seasonal Setups With a Real-World “Why”

If you’ve ever looked at a seasonal chart and thought, “Okay… but WHY does it do that?” — you’re not alone.

Most traders stop at the pattern.

Pros ask: What force keeps pushing price in that direction year after year?

Earnings cycles? Industry budgets? Consumer behavior? Commodity inputs? Fund flows?

That’s what we’re doing today: three seasonal trades + the story underneath the data.

Quick market temperature check (so you’re not trading in a vacuum)

Heading into February, the tape is sending a pretty clear message:

- Large caps are wobbling: SPY is down on the day (risk appetite a bit soft).

- Tech is weaker than the broader market: QQQ is down more than SPY (classic “rates sensitivity” behavior).

- Small caps aren’t leading either: IWM is also red (risk-on isn’t roaring).

- Oil just popped hard: USO is up sharply — that can lift energy/industrial names, but it can also tighten the screws on consumers and inflation expectations.

- Long bonds are slightly down: TLT slipping suggests yields are not collapsing (another reason high-multiple tech can feel heavy).

- Gold firm: GLD is green (a small “hedge bid” still present).

Translation for traders: we’re not in a clean “everything up” regime. That makes seasonality even more valuable — because it gives you specific lanes to drive in, instead of guessing the whole highway.

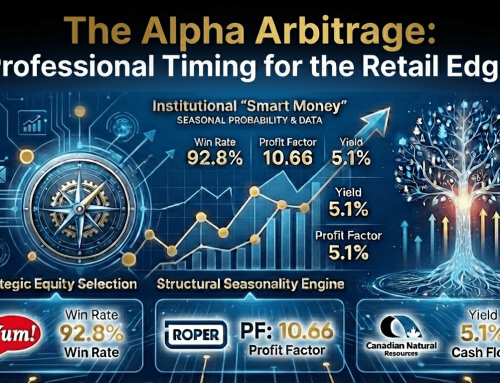

This week’s Top 3 seasonal stocks (from my ‘filtered’ SuperSeasonal list)

I ranked these based on a blend of win rate (“Frequency Higher”) + profit factor + return profile + tradability. Stats below reflect the SuperSeasonal dataset.

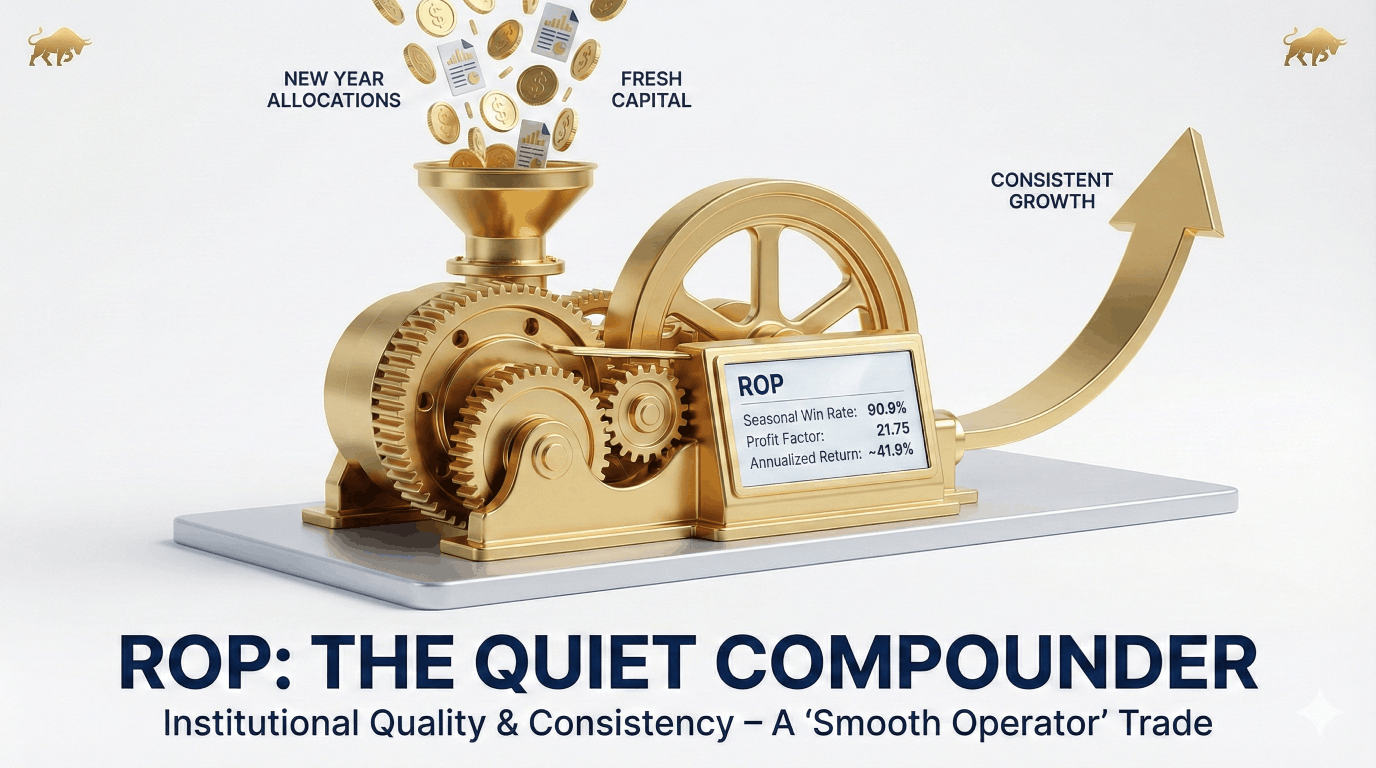

Seasonal edge: Win rate ~90.9% Since 1992 | Profit factor 21.75 | Annualized return ~41.8%

The “why” behind the pattern

ROP is one of those “quiet compounders” institutions love — steady business lines, recurring revenue, and the type of stock that tends to attract fresh allocations after the calendar flips.

Early February often stacks multiple tailwinds for this kind of name:

- New-year portfolio repositioning: money rotates out of “last year’s winners/losers” and into high-quality, durable growers.

- Pre-earnings drift: a lot of steady compounders get a “benefit-of-the-doubt bid” into earnings season as managers look for lower drama than high-beta tech.

- Industrial/quality tilt: with Industrials showing relative strength lately, this is the kind of name that can catch sponsorship.

How to treat it as a beginner

This is a “smooth operator” trade — you’re not hunting fireworks. You’re hunting consistency.

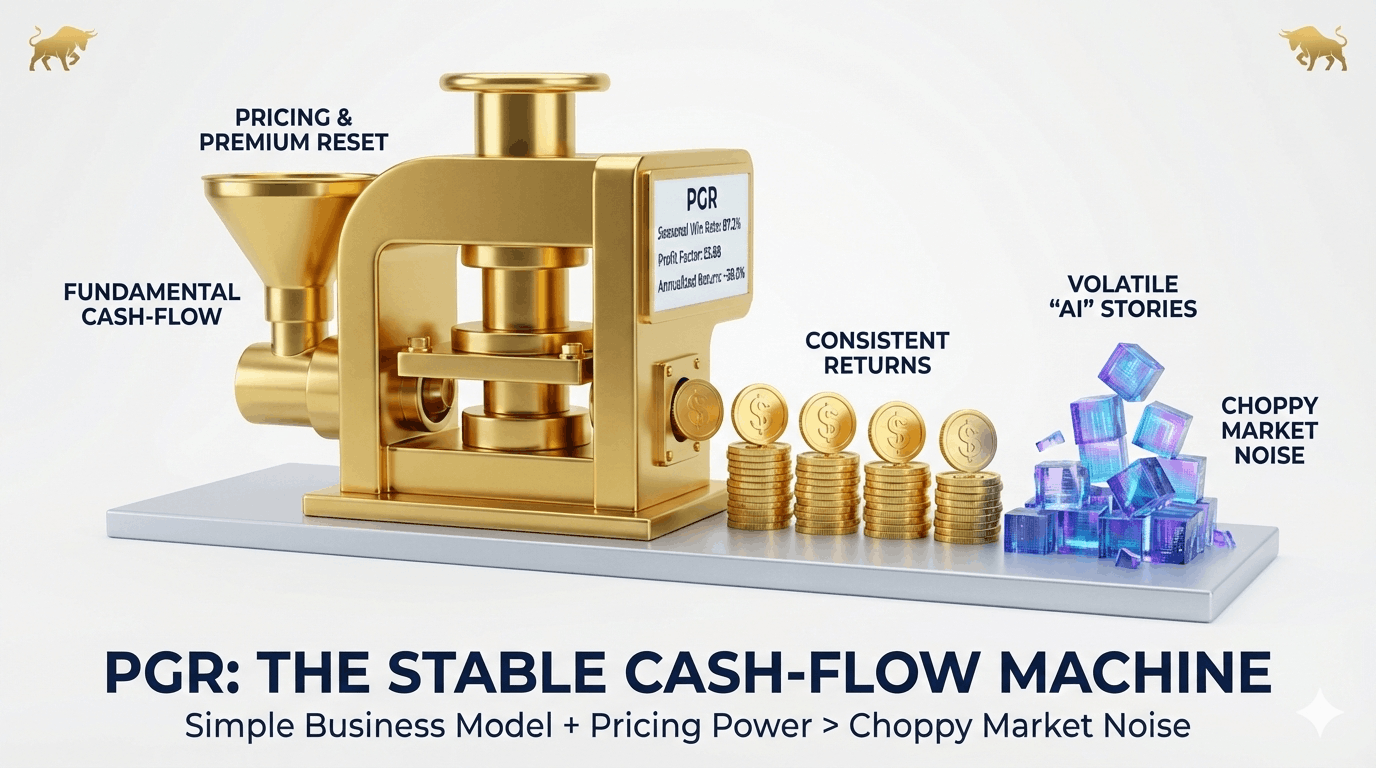

Seasonal edge: Win rate ~87.2% Since 1986 | Profit factor 25.88 | Annualized return ~38.0%

The “why” behind the pattern

Insurance is one of the most misunderstood “trader sectors” — people think it’s boring, then it quietly trends while everyone watches flashy tickers.

Seasonally, early-year tends to support insurers because:

- Pricing and premium narratives reset early in the year: rate actions, renewal cycles, and forward guidance often become clearer.

- Earnings-season setup: insurers can get a steady bid when traders want fundamental cash-flow stories rather than “AI multiple stories.”

- Financials aren’t breaking down: XLF is holding up better than tech — that relative stability matters.

Beginner-friendly takeaway

When the overall market gets choppy, simple business models + visible pricing power can outperform. PGR often behaves like that.

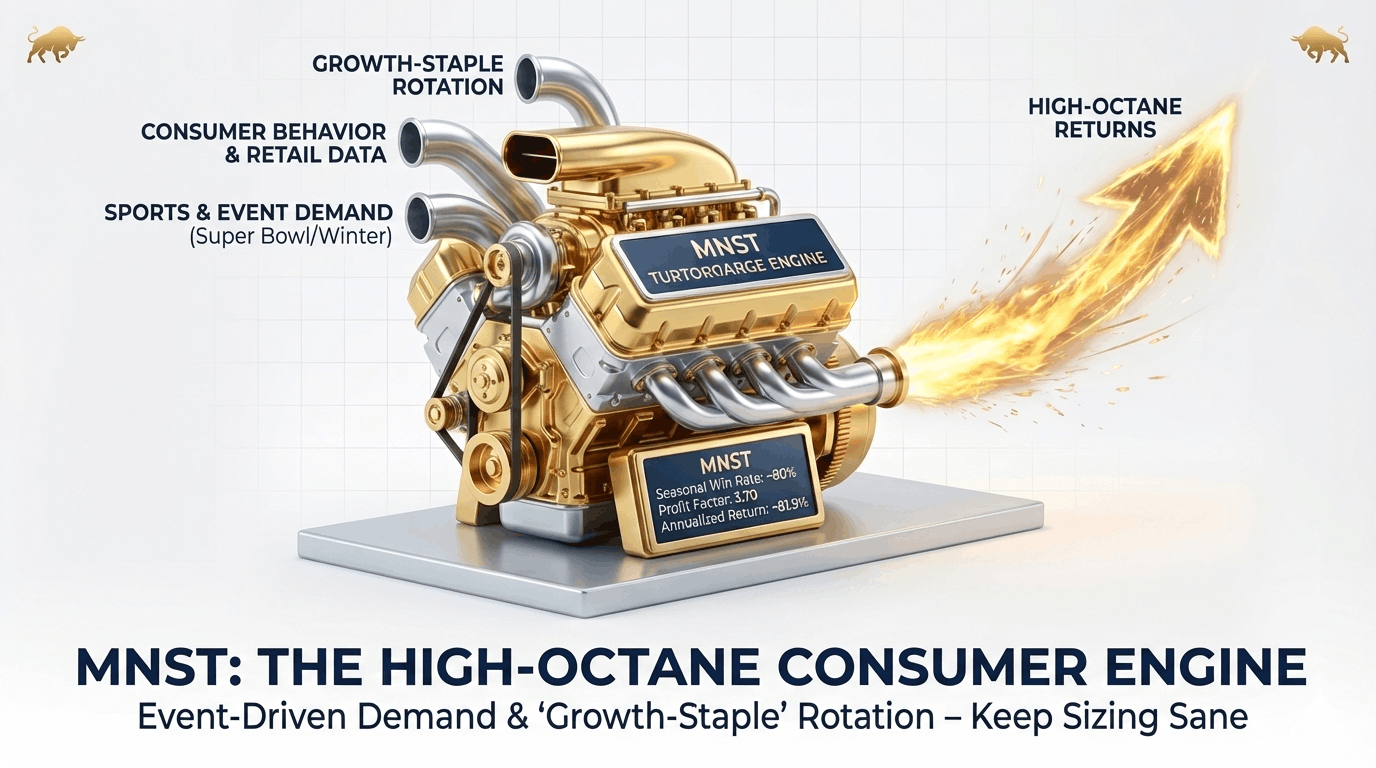

Seasonal edge: Win rate ~80% Since 1995 | Profit factor 3.70 | Annualized return ~81.9%

The “why” behind the pattern

MNST has a different “engine” than the first two: it’s tied to consumer behavior + distribution + event-driven demand pockets.

Early February tends to align with:

- Sports + event demand cycles: the Super Bowl and winter sports period can boost energy drink visibility and consumption.

- Retail/consumer data cadence: post-holiday, companies start guiding the street on Q1 demand realities.

- A “growth-staple” rotation: when tech is heavy (QQQ weak), traders often look for growth that isn’t purely multiple-driven — branded consumers can be a landing spot.

The real risk

MNST can move fast when sentiment shifts. Treat this like the “high-octane” idea of the week — keep sizing sane.

How to actually trade this (without blowing yourself up)

A seasonal edge is not magic. It’s a probability tilt.

Three simple rules I’d drill into any retail trader:

- Plan risk first, entry second.

Know what price level proves you wrong before you click buy. - Don’t marry the trade.

Seasonality is a window, not a belief system. - Avoid “all-in syndrome.”

Even an 88–91% historical win rate still loses sometimes. Size accordingly.

Want the exact trade window and timing?

I’m intentionally not publishing exit timing here.

If you want the full trade plan — including the historical seasonal window, exit date logic, and more in-depth data and research customization — log in to SuperSeasonals.com and pull up each ticker for the current week.

That’s where the real edge gets more practical.

Trade well,

Chad Shirley