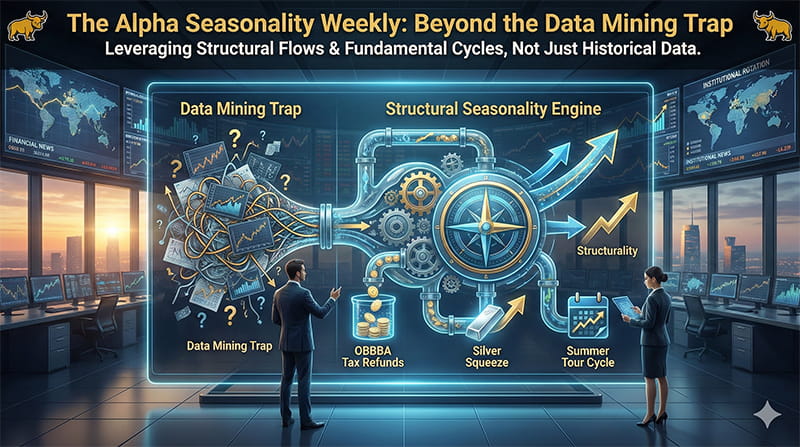

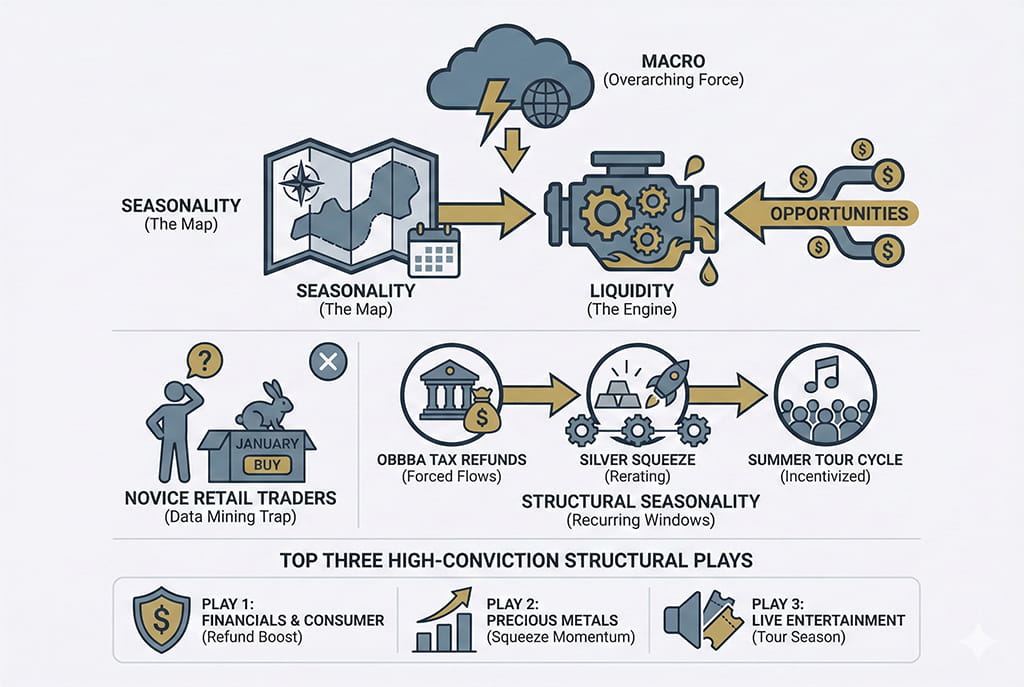

In the institutional world, we had a saying: “The calendar is a map, but liquidity is the engine.” What this means simply, is that seasonality tells you where the opportunities should be, but liquidity determines whether those opportunities actually materialize. It’s a reminder that macro trumps seasonality, and that the “Alpha Basket” of seasonal stocks play best when the liquidity engine is running smoothly.

Many ‘novice’ retail traders treat seasonality as a magic trick—they see a stock has gone up 80 or 90% of the time in January and they blindly hit “buy.” That is highly likely a recipe for the Data Mining trap. To find truer alpha, you have to look for Structural Seasonality—recurring windows where capital flows are forced or incentivized by fundamental cycles.

This week, we are tracking a unique convergence: The “One Big Beautiful Bill Act” (OBBBA) tax refunds are hitting bank accounts, the Silver Squeeze is rerating the metals complex, and the Summer Tour Cycle is beginning.

Here are our top three high-conviction structural plays for the current seasonal window.

Frequency Higher: 96%, Since 2002 | Annualized Return: 90%

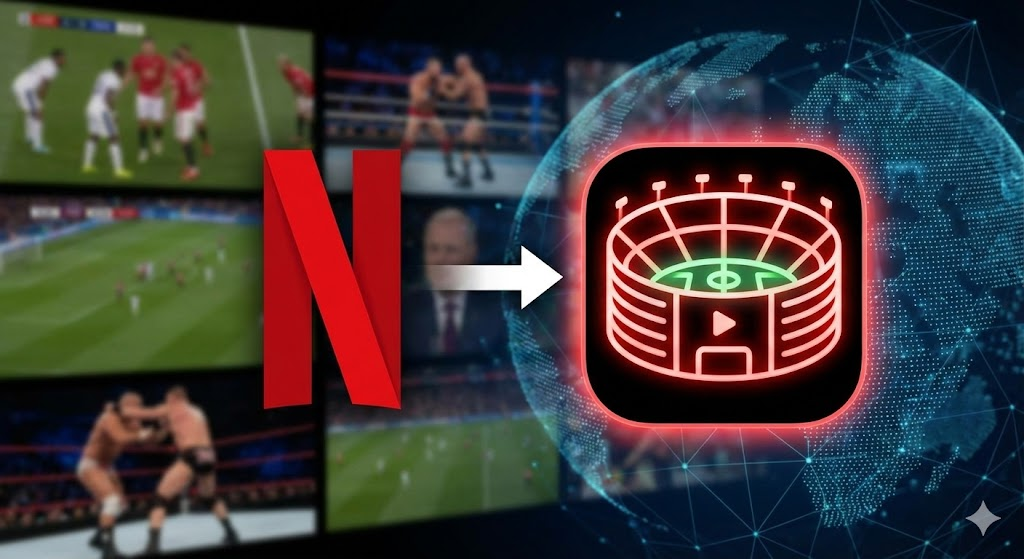

The Structural “Why”: A 96% historical win rate over the prior 23 years is an anomaly that demands respect. This strength likely isn’t random; it coincides with the Post-Holiday Retention Cycle. Institutions evaluate Netflix in Q1 based on how many holiday trial users converted to “sticky” paying subscribers.

The 2026 Narrative: We are witnessing the “Utility-fication” of Netflix – calling a company “utility‑fied” means it has evolved into something that behaves more like a stable, essential service than a cyclical, hit‑driven entertainment company. With the full integration of the WWE library and the success of the 2025 NFL Christmas broadcasts, NFLX has become a “Churn-Killer”– which means the company has evolved into a business that is exceptionally good at reducing subscriber churn, which is one of the most important drivers of valuation for subscription‑based platforms. In an environment where the OBBBA tax refunds are injecting liquidity into households, NFLX is the primary beneficiary of “stay-at-home” discretionary spending. It is no longer a speculative tech stock; it is a dominant consumer utility.

Frequency Higher: 80.00%, Since 2005 | Profit Factor: 11.14

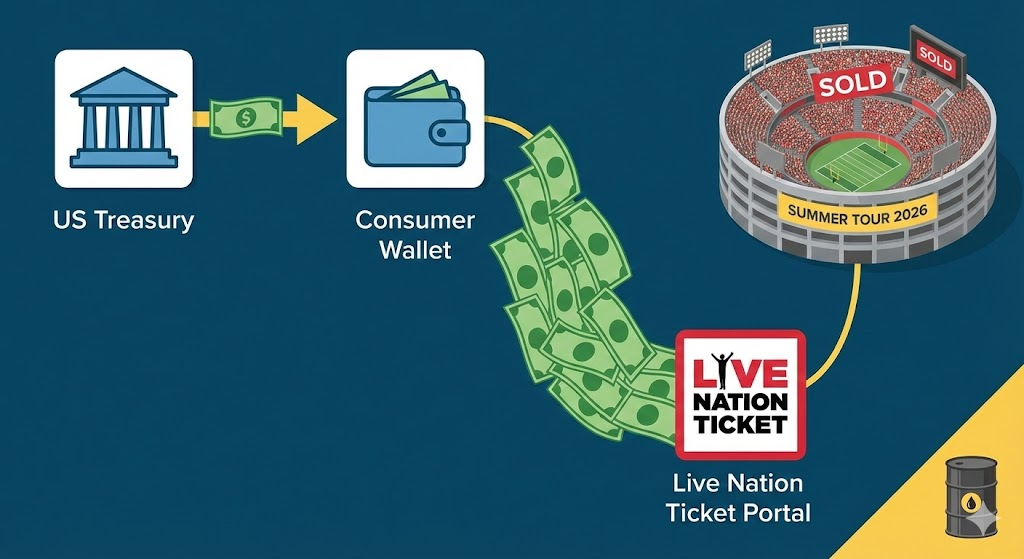

The Structural “Why”: Notice the Profit Factor of 11.14. This means historically, the gains in this window have been nearly 11x the size of the losses. This could be driven by a unique financial model: Negative Working Capital. LYV collects cash from summer tour ticket sales (like the upcoming record-breaking BTS world tour) months before they pay the artists or venues.

The 2026 Narrative: The macro environment is perfectly aligned for LYV. Crude Oil (WTI) is currently stabilized in the $55–$57 range, which lowers the logistical “tax” on massive global tours, protecting margins. As consumers receive their larger-than-average tax refunds this week, we expect a massive surge in front-loaded ticket sales, creating a “cash float” that institutions are currently front-running.

Frequency Higher: 80.00%, Since 2005 | Profit Factor: 5.15

The Structural “Why”: Precious metals historically see a “January Bid” due to Chinese New Year demand and global currency rebalancing. However, we choose WPM because of its Streaming and Royalty model. Unlike traditional miners, WPM has no labor or fuel inflation risk; they simply take a “cut” of the production.

The 2026 Narrative: This is a pure Intermarket Play. With Silver hitting historic highs of $92/oz and the US Dollar (DXY) showing vulnerability due to shifting Fed policies, WPM acts as the “Institutional Escape Hatch.” It provides the torque of a commodity breakout with the balance sheet of a tech company. If the Silver Squeeze continues, WPM is the cleanest vehicle for capture.

The Strategist’s Second-Order Thinking: Risk vs. Noise

As a research analyst, I must emphasize: Seasonality is a headwind or a tailwind, never the captain of the ship. The biggest risk to this “Alpha Basket” is a sudden spike in Real Rates (TIPS). If inflation data comes in “hotter” than expected this week, it could create a liquidity vacuum that overrides historical trends. We don’t “buy and hope”; we look for technical confirmation that the market is respecting these historical norms.

The Edge is in the Execution. Most traders fail because they have a map but no compass. They know where they want to go, but they don’t know when the probability of success is at its mathematical peak.

To see the exact historical entry dates, exit windows, and the full research data of these stocks and 1000’s of other stocks, sectors and industries in the 2026 market, you’ll need professional-grade data. Unlock the full data set at SuperSeasonals.com.

Trade well,

Chad Shirley