In today’s Super Seasonals: Trade of the Week we will look at Tapestry Inc. (TPR).

Tapestry, Inc. engages in the provision of luxury accessories and lifestyle brands. It operates through the following segments: Coach, Kate Spade, and Stuart Weitzman. The Coach segment consists of global sales of Coach brand products to customers through Coach operated stores, including the internet and concession shop-in-shops, and sales to wholesale customers, and through independent third-party distributors. The Kate Spade segment focuses on Kate Spade New York brand products to customers through Kate Spade operated stores, including the Internet, sales to wholesale customers, through concession shop-in-shops and through independent third-party distributors. The Stuart Weitzman segment includes Stuart Weitzman brand products primarily through Stuart Weitzman operated stores.

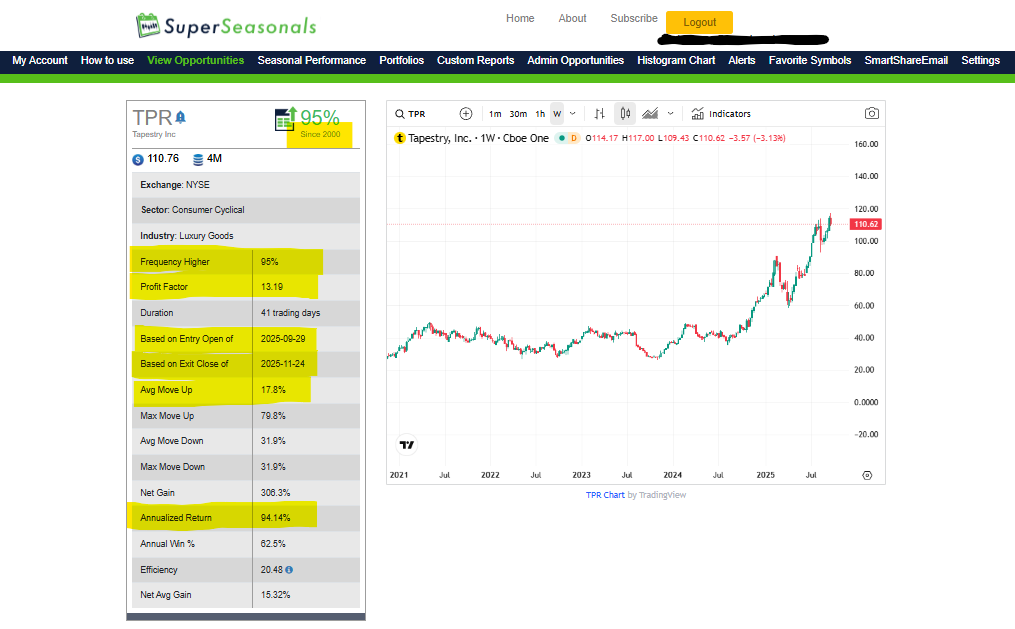

Below is a look at the stats of the seasonal patterns that the software uncovered over the next couple of months of trading…

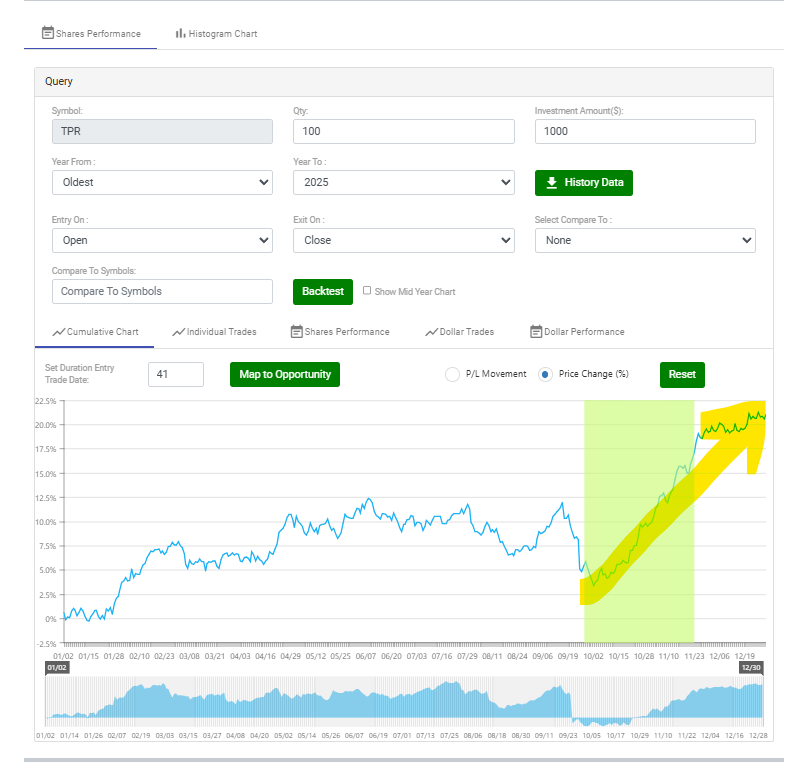

Below is a look at the past 5-10 years of data…there might be an outlier in 2020, so be cognizant of that…

Below is a Cumulative Chart of the average move. The stock has a tendency to finish strong into the year-end…

If I were thinking of buying shares in Tapestry Inc, then I might want to ponder what is the general market sentiment on the stock through year end? In doing so I engineered some prompts into an Ai model, and this is how the discussion essentially ended…please note, Ai can make mistakes and is not a predictor of the future…

Potential Path Through Year-End & Sentiment Summary

Putting together the positives and negatives, here’s how I see things playing out through year-end (3–4 months out):

- The near-term sentiment is mildly positive / cautiously optimistic. Momentum from recent beats and raised guidance offers support.

- I expect the stock may trade in a relatively narrow band, with upside constrained by cost/tariff risks. A move modestly higher is plausible if the macro environment remains benign.

- If further tariff or consumer weakness surprises emerge, downside risk is non-trivial.

In short: the sentiment skews slightly bullish, but with important caveats.

As a last bit of insight, I ran a quantitative probability model (e.g. implied volatility, options-based sentiment) for the stock through year-end to get a more data-driven view…this is a long conversation, but the bottom line is…

Into year-end, options point to a ~10–19% expected range around today’s price, with positioning leaning mildly bullish and vol not stretched. That aligns with a cautiously positive sentiment backdrop—but with an earnings catalyst in early November that could shift the tone.

One might consider a couple of trade frameworks (e.g., covered calls for income or a limited-risk call spread) sized to that ±$11–$21 implied range.

In closing, as you likely know, there are literally dozens of solid ways to approach trading Tapestry Inc. (TPR) with a bullish bias.

The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties.

Please remember to fully understand the risk before trading anything.

It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley