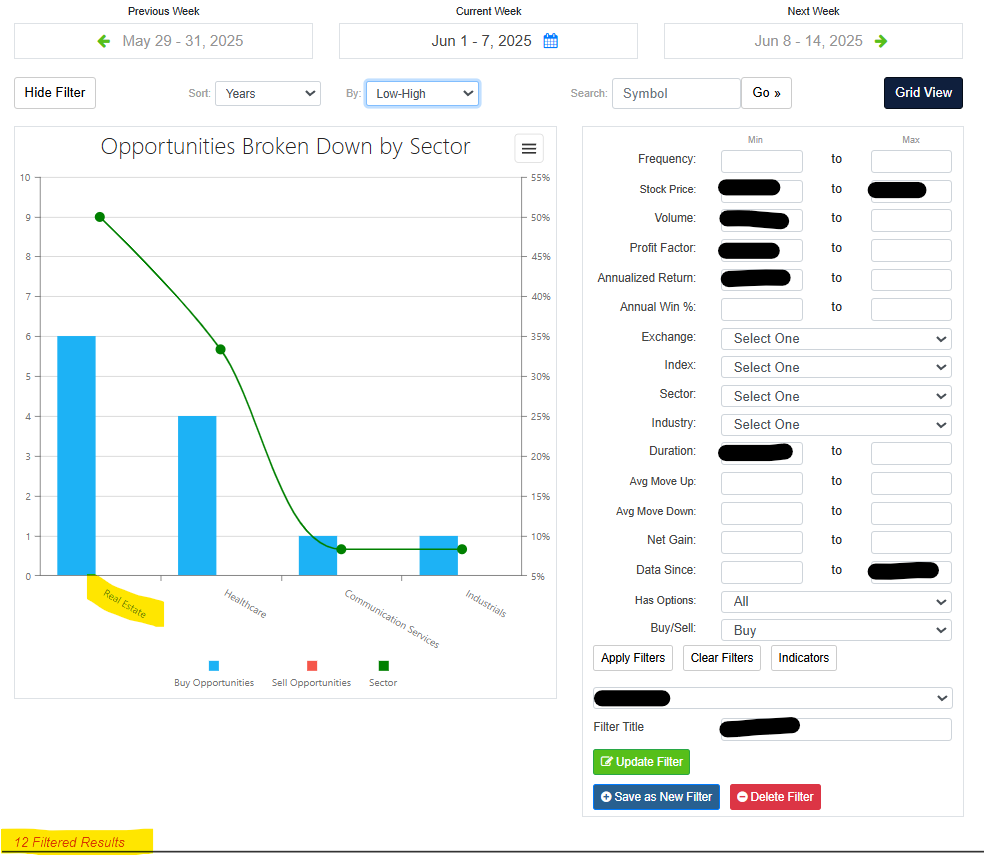

In today’s Super Seasonals: Trade of the Week we will key in on the Real Estate market sub-sector. I use a filter that drills down on the potentially best stock candidates, and you can see below that the majority of seasonal opportunities appeared in the Real Estate sub-sector.

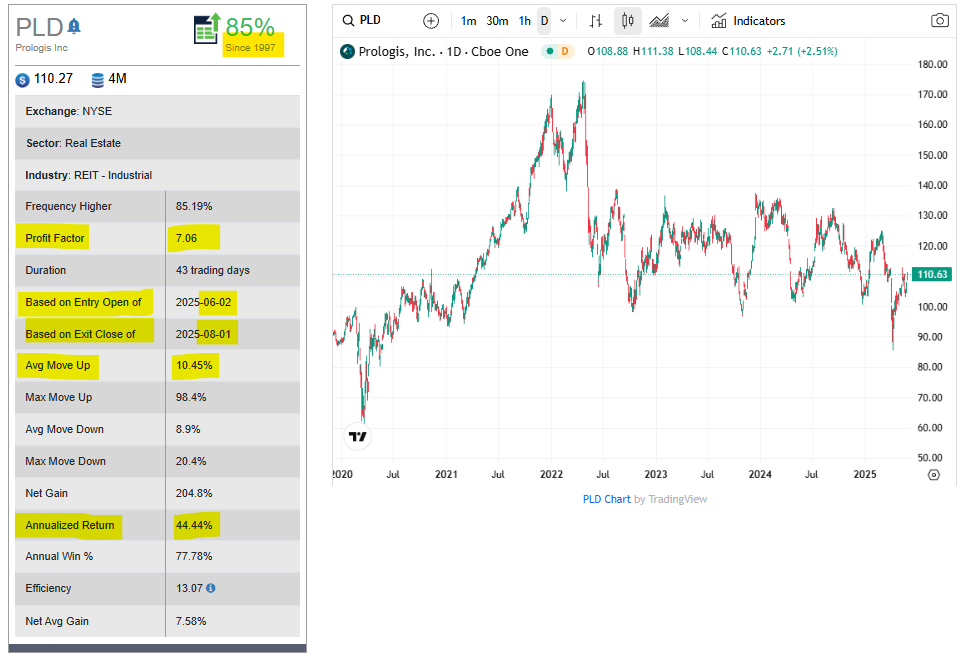

The stock that we will look at today is Prologis, Inc. (PLD). Prologis, Inc. engages in providing logistics solutions and services. It operates in the Real Estate and Strategic Capital segments. The Real Estate segment represents the ownership and development of operating properties and is the largest component of revenue and earnings. The Strategic Capital segment refers to the management of co-investment ventures and other unconsolidated entities.

Below are the seasonal patterns the software has uncovered since 1997… +10.45% Average Move UP over the next 2 months…+44.44% Annualized Return.

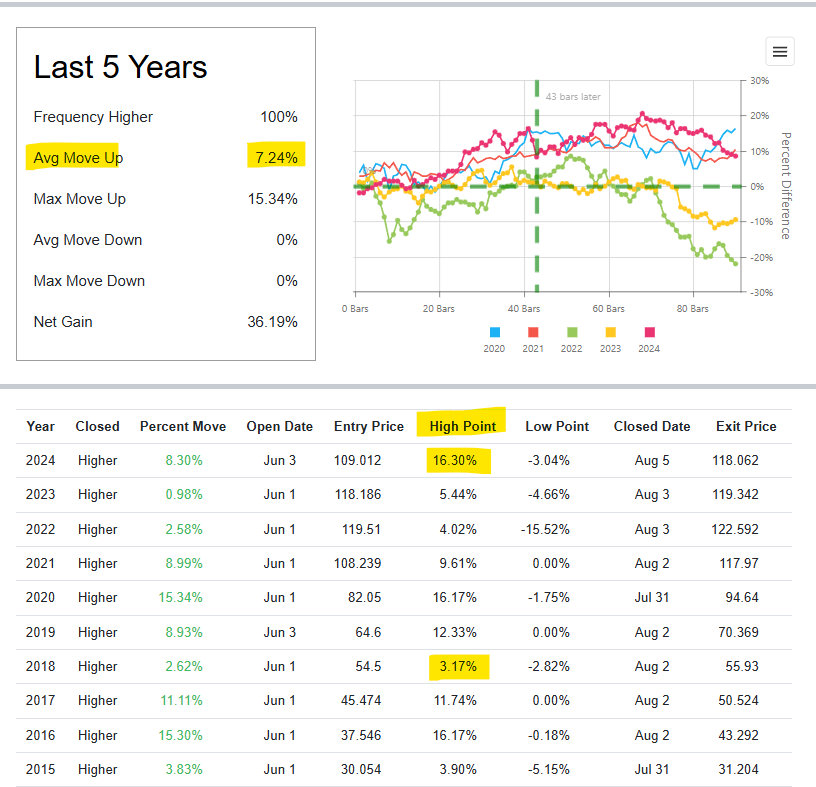

Below is a look at the past 5 years, with an Average Move UP of 7.24% over the next 2 months of trading. Additionally, if we look at the past 10 years, the “Mean/Mid” High Point is +9.74%.

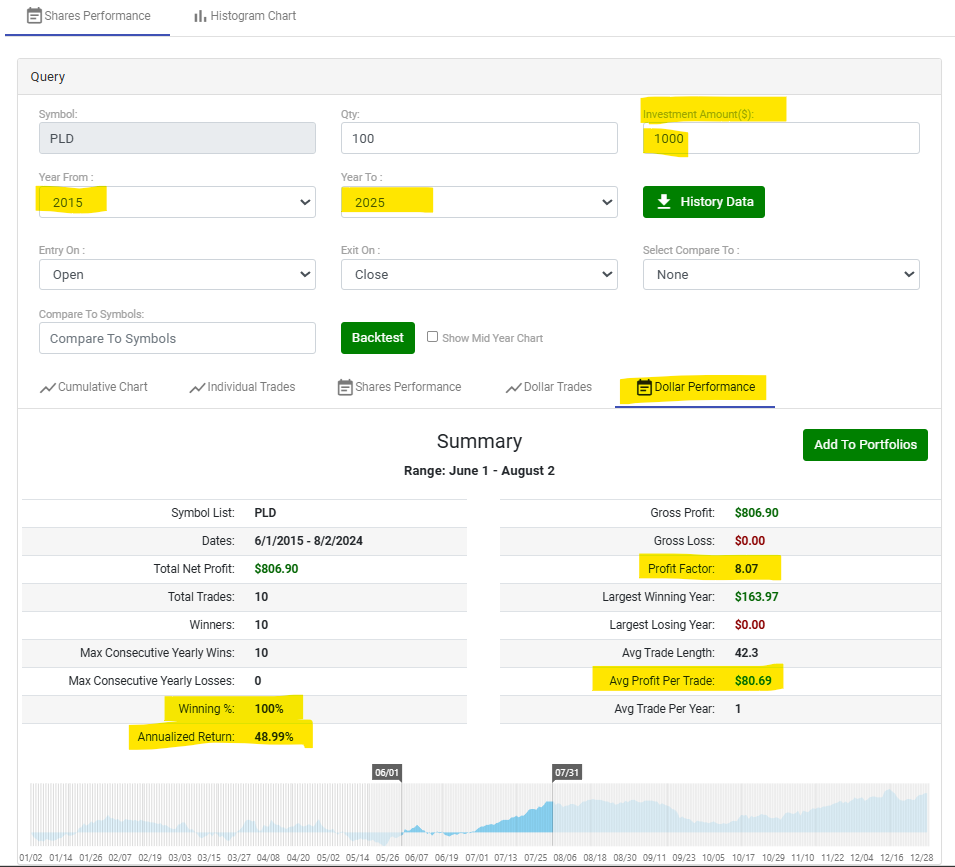

Looking at a 10 year backtest, $1,000 invested to buy/sell shares at the given seasonal dates would have averaged an +8.07% profit per year… 48.99% Annualized Return.

As you likely know, there are literally dozens of solid ways to approach trading Prologis, Inc. (PLD) with a bullish bias.

The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties.

Please remember to fully understand the risk before trading anything.

It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley