Hey Traders,

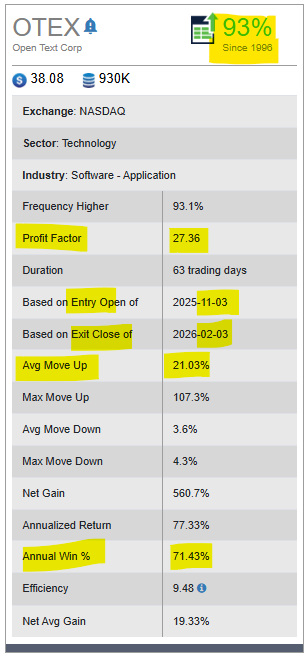

Welcome to your weekly Super Seasonal edge—simple setups for busy folks like you. This week: Open Text (OTEX), a steady tech play in enterprise software. It’s pulling back in an uptrend, setting up for a classic seasonal bounce. We’ll keep it to the basics: why now, how to trade it, and what to watch. No fluff, just actionable steps. (Current price at the time of this writing: ~$38 as of Oct 30, 2025—check live quotes.). Seasonal pattern stats:

- Big Picture: Up 24% YTD from $26 lows. Trading above key averages (50-day ~$37, 200-day ~$33)—bullish backbone intact.

- Right Now: Healthy dip after hitting $40 highs. Volume spiked on the selloff (stop-hunting vibes), but it’s stabilizing. Perfect dip-buy spot for swings.

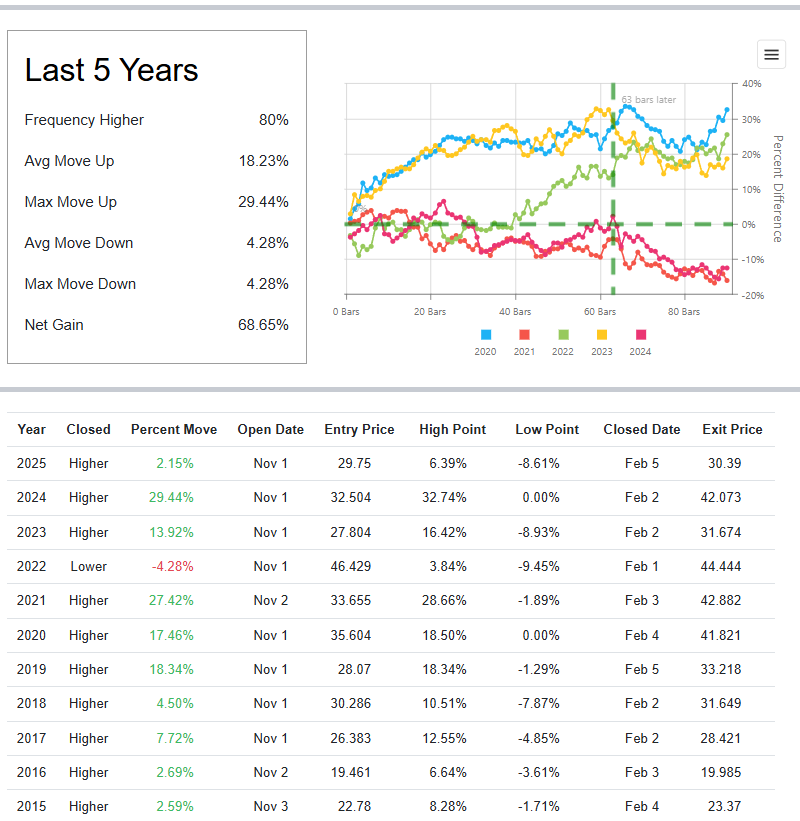

History doesn’t lie: OTEX loves Q4-Q1. Over 10 years:

- Past 5 years, 4 out of 5 of Nov-Feb periods end higher (9/10 green years).

- Avg Gain: +18% (max +29% in strong years).

- Downside Capped: Avg -4%, rarely deeper than -9%.

Why might this pattern be happening? Year-end tech budgets flow in, plus market calm post-holidays. Enter sometime next week (Nov 1 open)—could run to Feb +20% if it follows script. (Past outlier: 2022 dip on Fed fears—rare.)

Aim for 1-3 month hold, potentially. Risk small (1 % of your account—e.g., $500- on a $50k portfolio). Use limit orders to avoid chase.

| Step | Action | Details |

| Buy Zone | “Enter on dip” | $37.40-$37.70 (recent lows + Fib support). Wait for the green candle + volume >500k shares. Start with half position; add if it dips to $36.80. |

| Stop Loss | “Protect downside” | $36.80 (below support—~1% risk from entry). Trail to breakeven after +$1 gain. (Market makers hunt here—don’t panic-sell wicks.) |

| Take Profits | “Lock gains” | – Quick Win (50%): $39.50 (~1:2 reward/risk).

– Big Ride (Rest): Trail to $43-$44.50 (seasonal target). Sell if stalls at $40. |

| Exit Rule | “When to bail” | Full out by Feb 5 if no momentum, or if breaks $36.80 early. |

- Why Buy Here? The uptrend is intact (higher lows since July $33 bottom), and this pullback aligns with support confluence. OTEX’s enterprise software moat supports fundamentals, but we’re trading price action—wait for confirmation like a hammer/doji at $37.50 or bullish divergence on RSI (currently neutral post-selloff).

- Stop Hunting Awareness: Market Makers raided below $38 on Oct 29 to harvest liquidity; expect a similar probe below $37.40 on low volume before flipping. If it gaps down, sit out—don’t average down blindly.

- Position Sizing: For a $50k account, risk $500-1,000 (1-2%). At $37.50 entry, that’s ~400-800 shares ($36.50 stop = ~$400-800 risk).

- Exit Triggers: Cut if it breaks $36.50 decisively (trend flip). Scale out at targets; hold core if daily volume surges >1.2M on green candles.

- Timeframe: Swing hold 5-15 days. Monitor for earnings/news catalysts—OTEX reports soon, which could spike vol.

- Distance: From $37.50 entry, that’s ~$0.70 (1.9% risk)—snug, but OTEX’s avg daily range lately is 2-3% ($0.75-$1.20 wiggle). It won’t get flicked out on noise.

- Why It Holds: Sits just below the EMA50 (~$36.76) and Oct 23 low ($36.40 buffer). Historical vol (ATR ~$1.10) says Market Maker’s probe ~$0.50 below support before bouncing—your stop dodges that.

- Edge Over Loose Stops: Tight = smaller losses (key for compounding). If it breaks? Trend’s toast anyway—cut fast, live to trade another dip.

- Tweak if Nervous: Widen to $36.50 for 3% buffer (+$0.30 more risk)

Our goal is to find low-risk opportunities to buy strong stocks. Right now, OpenText (OTEX) is on our radar for a potential “buy the dip” play.

Here’s the simple breakdown.

Likely, the best chance to get into OTEX is on a pullback — two key areas where buyers have historically stepped in.

- Ideal Buy Zone: ~$36.70 – $37.00. This is our primary target. It’s a key technical level that has previously acted as support. It’s like a “sale price” on a quality stock.

- Secondary Buy Zone: ~$34.20 – $34.50. If the market pulls back a bit more, this is our “backup sale price.” It’s an even stronger support level, making it a high-confidence area to buy.

Strategy: Patiently wait and set limit orders to buy in these zones.

This is the most important part of the plan. Before we even think about profit, we decide how much we are willing to risk.

- If we buy in the ~$36.70 zone, we will set our stop-loss at $33.90. $2.80 risk per share.

- Why so far away? This gives our trade room to breathe and avoids getting “shaken out” by a temporary dip designed to trigger tight stop-losses. It ensures we only exit if the overall uptrend is truly breaking down.

We will take profits in two stages:

- First Profit Target: ~$40.50. We’ll sell half our position here to lock in gains.

- Letting Winners Run: ~$43.50+. We’ll trail the remaining half of our position with a looser stop to see if we can capture a bigger move.

- What to Do: Wait patiently. Set a limit order to buy in the $36.70 – $37.00 range.

- What NOT to Do: Do not chase the stock higher. Do not buy without setting a stop-loss.

Remember: In trading, discipline is more important than being right on every pick. We have a plan, and we will stick to it.

I would stay away from breakout trades at the moment. Here’s the straightforward reasoning, framed for a swing trader’s perspective, and why breakouts are risky here:

You’re Buying at the Top of the Range: The current price (~$38.28) is sitting between key support and resistance. Buying a breakout above $40 means you’re buying after a significant move has already happened, with no clear support nearby. Your risk is immediately high.

- Poor Risk/Reward Ratio: Let’s do the quick math:

- Buy Entry on Breakout: ~$40.10 (waiting for a confirmed break above $40)

- Logical Stop-Loss: ~$36.70 (back below the 50-day EMA, which must hold as support for the breakout to be valid).

- That’s a risk of ~$3.40 per share.

- To have a decent 2:1 Reward-to-Risk, you’d need a profit target of ~$46.80. While possible, that’s far away and requires a massive, uninterrupted rally. The setup is asymmetrical; you’re risking a lot for a gain that isn’t guaranteed.

- The “False Breakout” Trap: This is the biggest danger. Market makers are fully aware that $40 is a psychological and technical level. It’s very common to see a quick “poke” above $40 that triggers all the breakout orders, only for the price to immediately reverse and slam back down, stopping out all the new buyers before continuing its real journey. This is a classic liquidity grab.

As we discussed, the high-probability, high-reward play is to wait for a pullback to support ($36.70-$37.00 or $34.20-$34.50).

- Better Entry Price: You’re buying at a discount relative to the current price.

- Tighter Stops (Relative to Entry): While the stop in points may be wider, your entry price is so much better that your risk as a percentage of capital is similar, if not better.

- Superior Risk/Reward: Your stop is closer to key support levels, and your profit targets are much closer relative to your entry, creating a much more favorable 1:2 or 1:3 R/R setup.

The only scenario where I’d consider a “breakout” trade is on a daily close above $40.50 on strong volume, and then waiting for a retest of $40 as new support to enter. This is a “breakout and retest” play, which is much more reliable than chasing the initial spike.

For a swing trader, patience is a position. Chasing OTEX here is a low-probability game. The high-probability game is waiting for it to come to you. So, to answer directly: Yes, I would stay away from breakout trades on OTEX right now. The smart money is waiting for a pullback.

- Upside Catalysts: Earnings late Nov could spark; tech rally helps.

- Watch Outs: Macro wobbles (rates, recession talk) could mimic 2022’s -4% seasonal period stutter. No news? It grinds sideways.

- Beginner Pro Tip: Paper trade first. Track in a journal: “Did volume confirm? Did I stick to stops?”

In closing, as you likely know, there are literally dozens of solid ways to approach trading Open Text (OTEX) with a bullish bias.

The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties.

Please remember to fully understand the risk before trading anything.

It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade smart, sleep easy. Next Week: More seasonal gems. Stay tuned.

—Your Seasonal Swing Guide

Chad Shirley