In today’s Super Seasonals: Trade of the Week we will look at Lam Research Corp (LRCX).

Lam Research Corporation is an American supplier of wafer-fabrication equipment and related services to the semiconductor industry. Its products are used primarily in front-end wafer processing, which involves the steps that create the active components of semiconductor devices and their wiring.

This might be a run-up and post-earning move up, historically. Please keep in mind the upcoming earnings period on Wednesday October the 23rd.

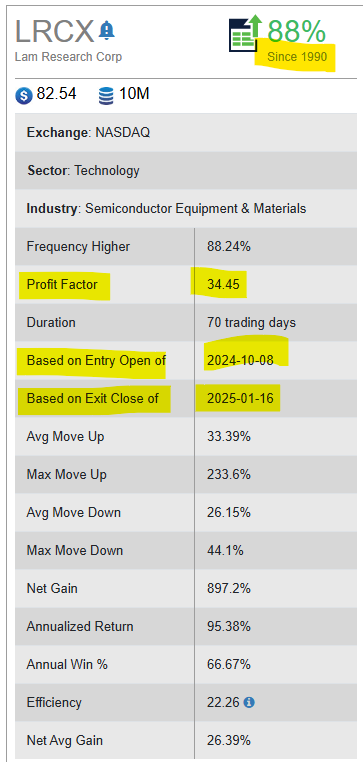

Below is a snippet of the seasonal period the software uncovered since 1990…

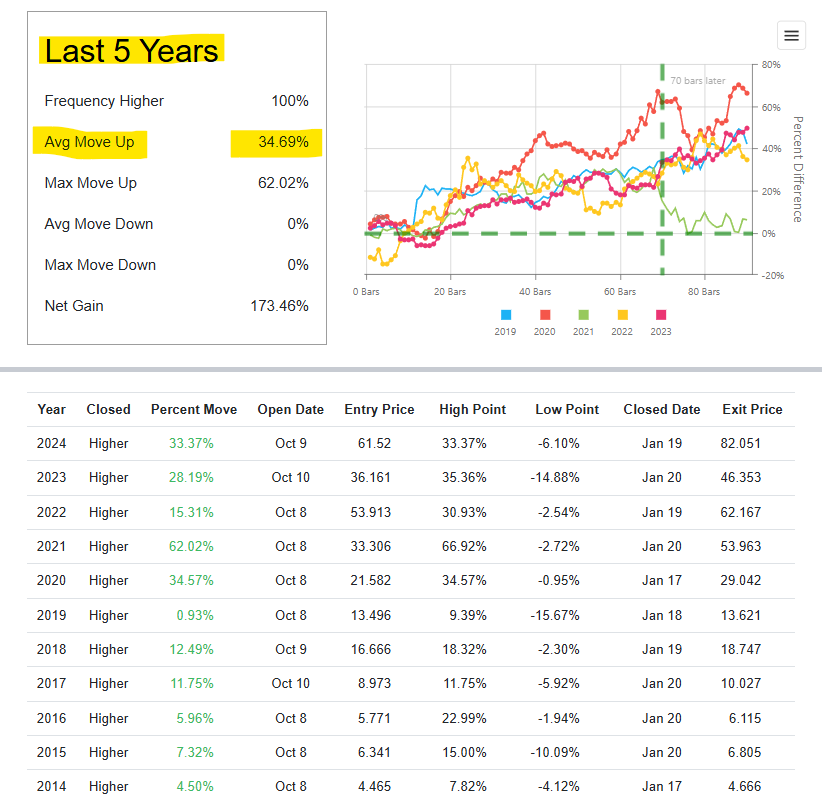

If we look at the past decade, particularly the past 5 years, the Average Move Up (+34.69) has been quite solid over the next 3 ½ months.

Possible stock play idea, with a favorable 2:1 reward to risk ratio. This is NOT a trade recommendation, rather a simple thought process if a reader was bullish now.

- Buy current market area ($82.50) at the time of this writing…

- Stop below the previous swing low (below $71.66)…

- Target to fill the potential upside gap in the $105-$106 region.

As you likely know, there are literally dozens of solid ways to approach trading Lam Research Corp (LRCX) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember to fully understand the risk before trading anything. It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley