In today’s Super Seasonals: Trade of the Week we will look at KKR & Co. (KKR).

KKR & Co., Inc. operates as an investment firm. Currently it has almost a $100 billion Market Capitalization. It offers alternative asset management as well as capital markets and insurance solutions. The firm’s business segments include Asset Management and Insurance Business. The Asset Management segment engages in providing private equity, real assets, credit and liquid strategies, capital markets, and principal activities. The Insurance Business segment offers retirement, life insurance and reinsurance solutions to clients across individual and institutional markets.

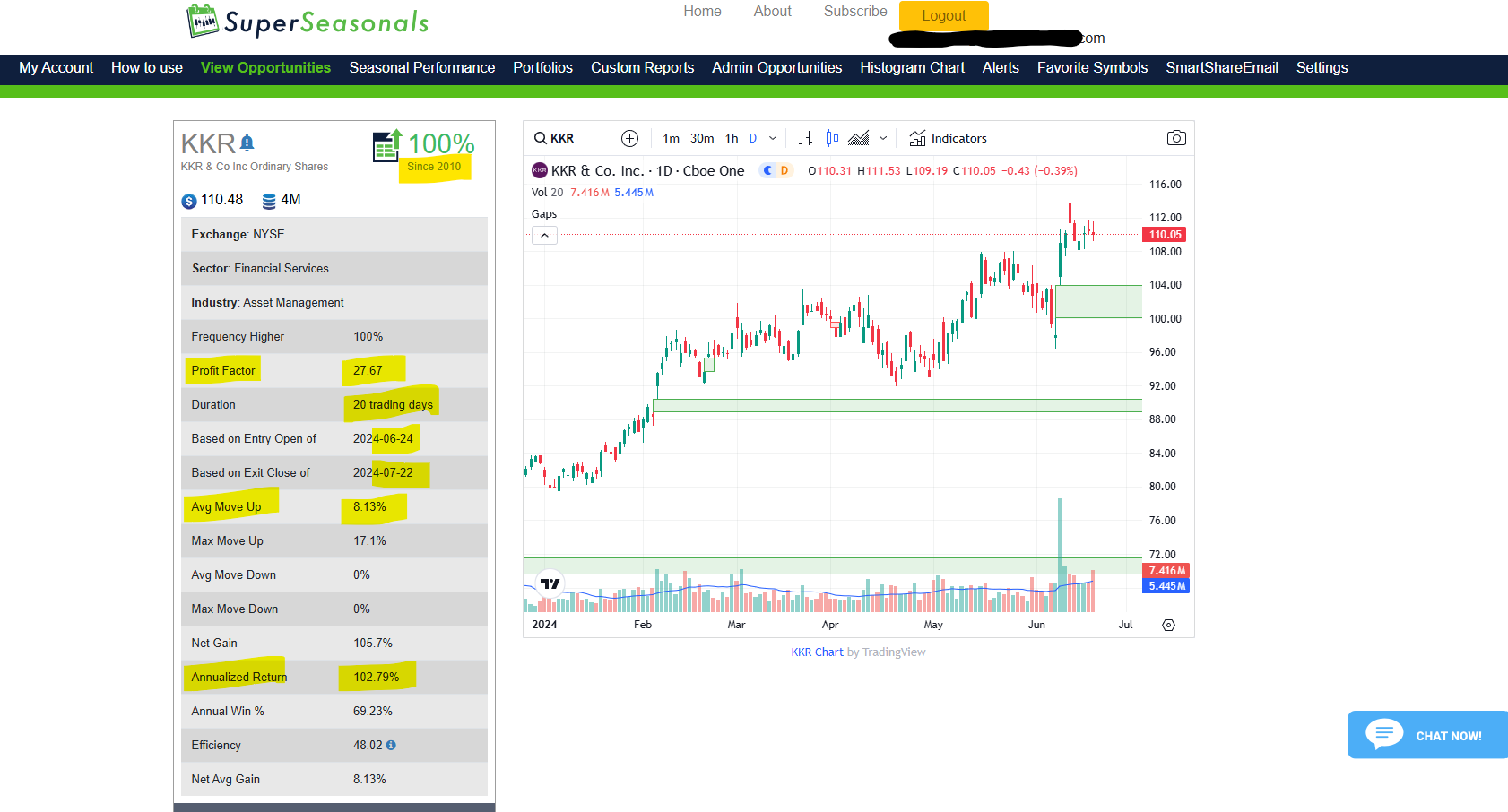

Below are snippets of the seasonal stats on the stock since 2010. The stock is bullish now, with a recent gap up from around $100/share. Will it fill that gap, or keep moving higher?

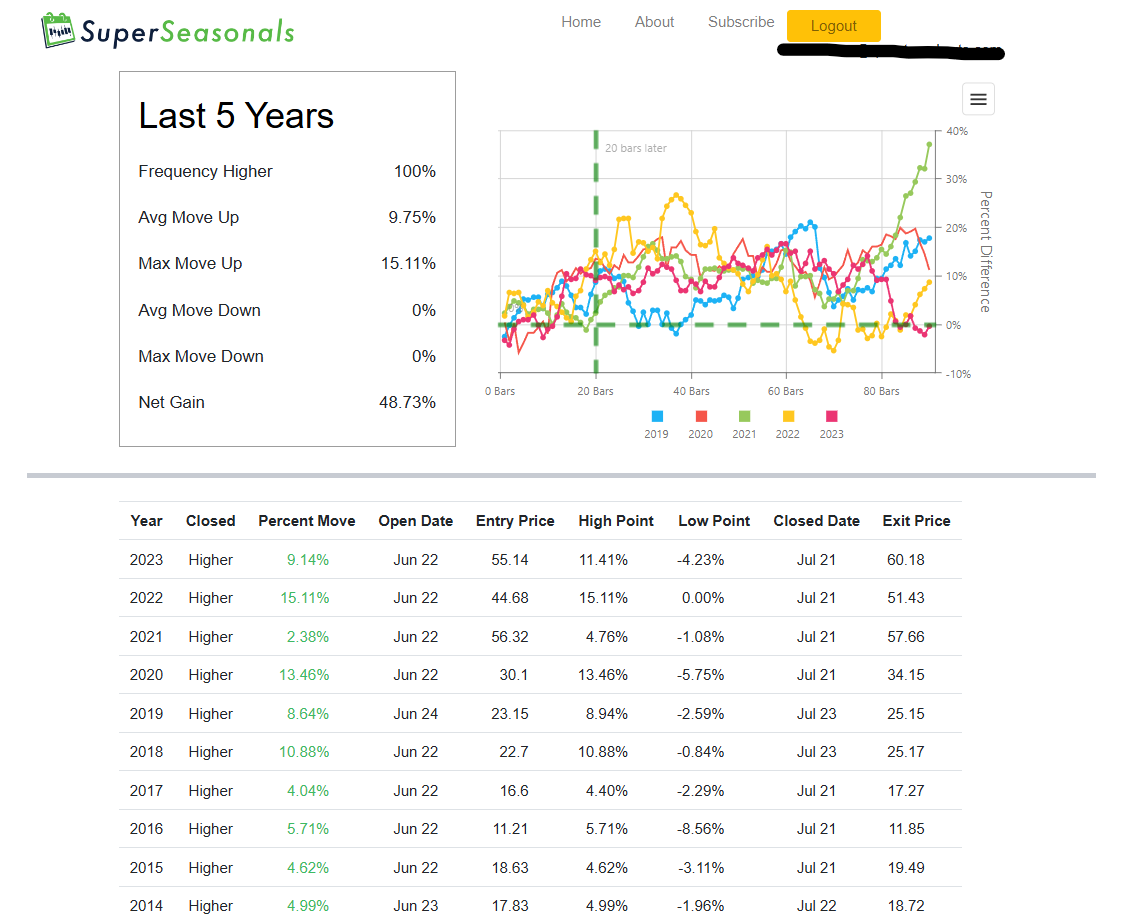

Below is a zoomed-in look at the seasonal stats over the past 5-10 years…

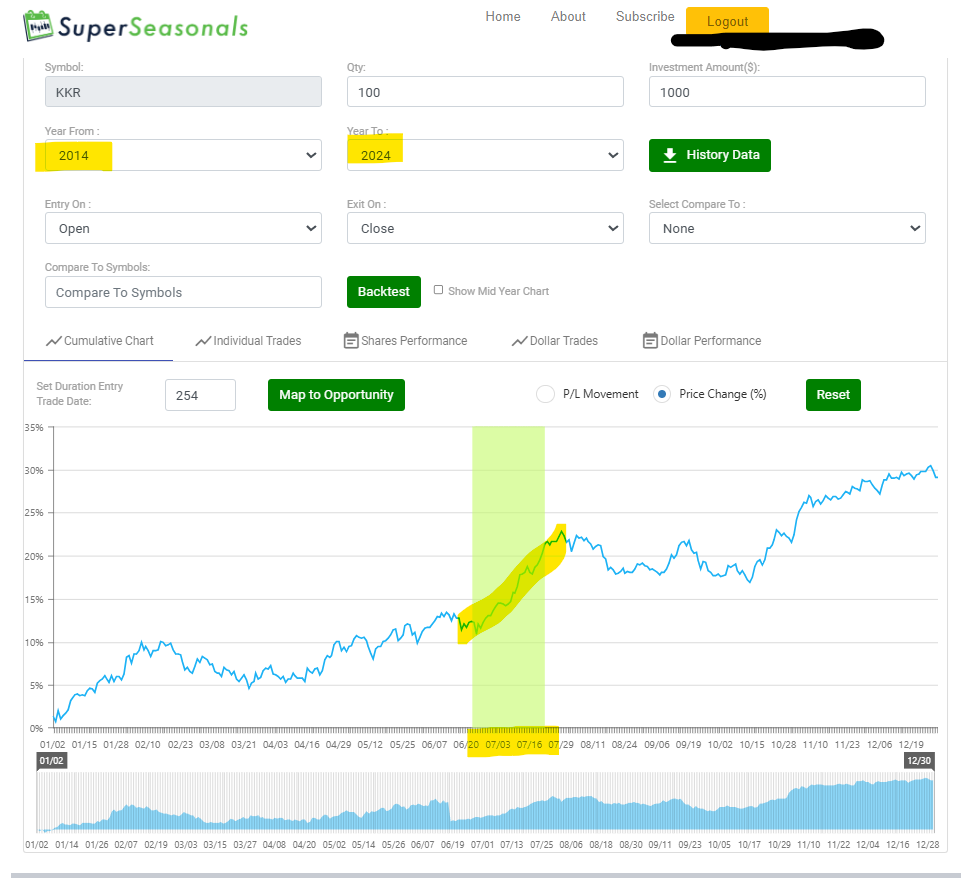

Below is a zoomed in look at the past 10 years of a Cumulative Chart, based on average % price change…

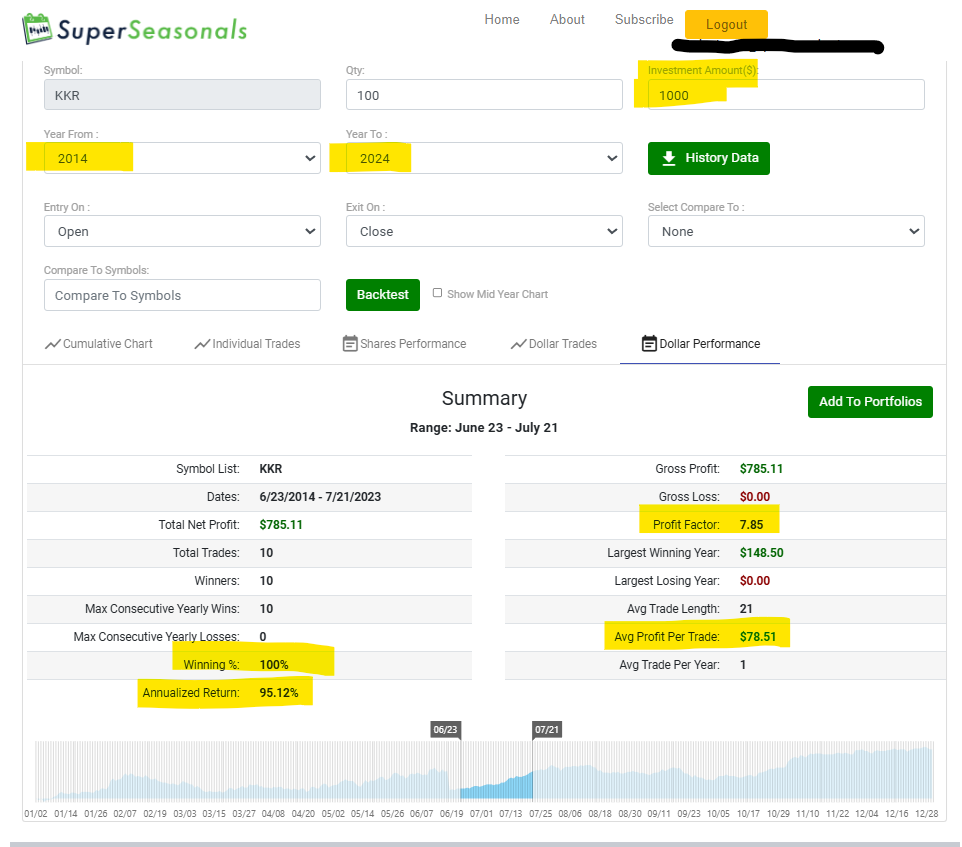

Below is a Backtest of what the last 10 years would look like if someone invested $1,000 into buying shares of the stock…

As you likely know, there are literally dozens of solid ways to approach tradingKKR & Co. (KKR) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on KKR & Co. (KKR) and other solid seasonal opportunities click here SuperSeasonals.

Trade Smart,

Chad Shirley