In today’s Super Seasonal: Trade of the Week we will look at Halliburton Co. (HAL).

Halliburton Co. engages in the provision of services and products to the energy industry related to the exploration, development, and production of oil and natural gas.

The industry and sector have been in a medium-term downtrend. The market has a tendency to rotate, so hopefully in the near future the industry and sector start to attract more bullish believers.

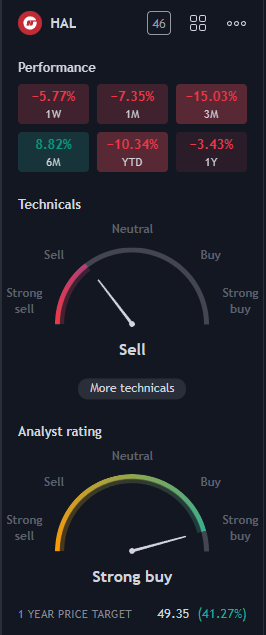

Technically the stock is in sell mode, the analysts have it as a strong buy.

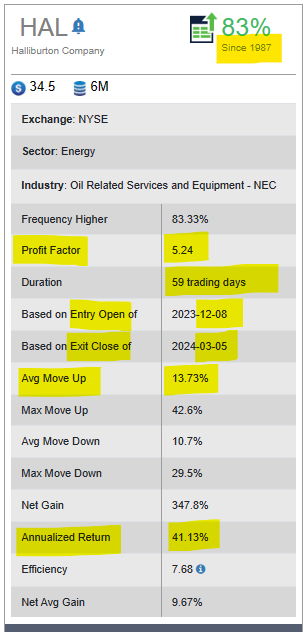

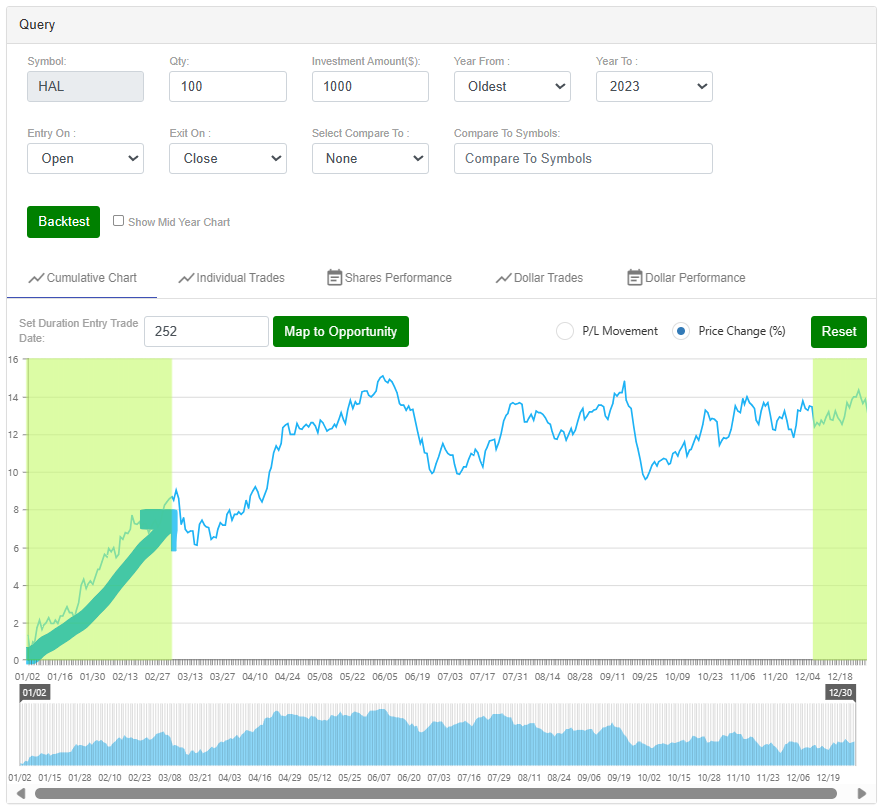

Below are the seasonal statistics on Halliburton. Over the next 3 months the seasonal tendencies look pretty good.

Halliburton has a tendency to be a little choppy in December, but at the start of the year it really has a tendency to push up.

There’s multiple strong pivot support areas where the stock is currently trading now. Can these levels hold?

Here’s a possible bullish reversal breakout play to consider. This is simply an idea that might make logical sense from a risk/reward perspective if you believe the stock is at strong support, is oversold and might try to push back to the $40 level or so.

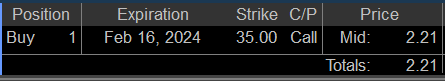

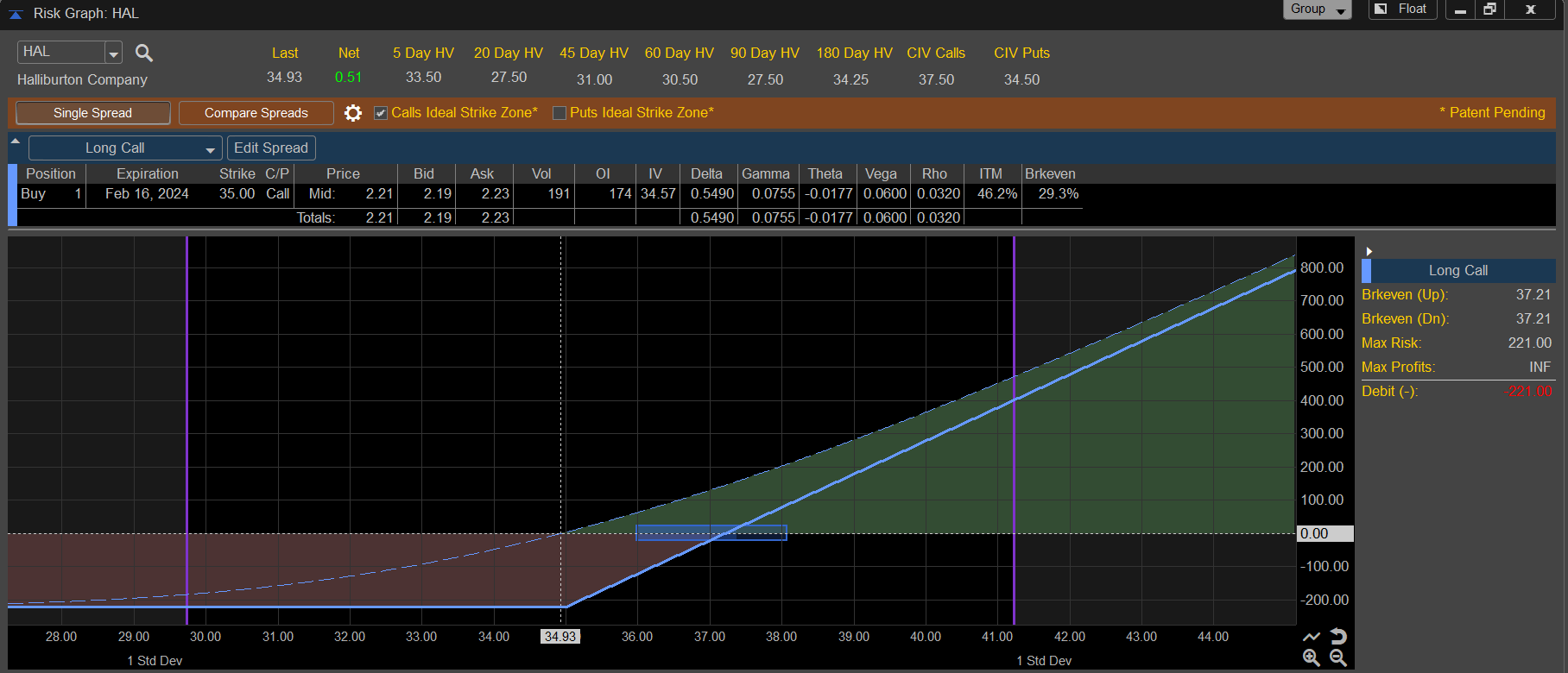

If a reader is bullish now, here’s a potential Call to consider buying:

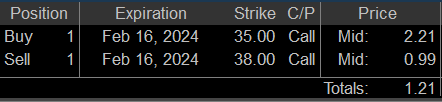

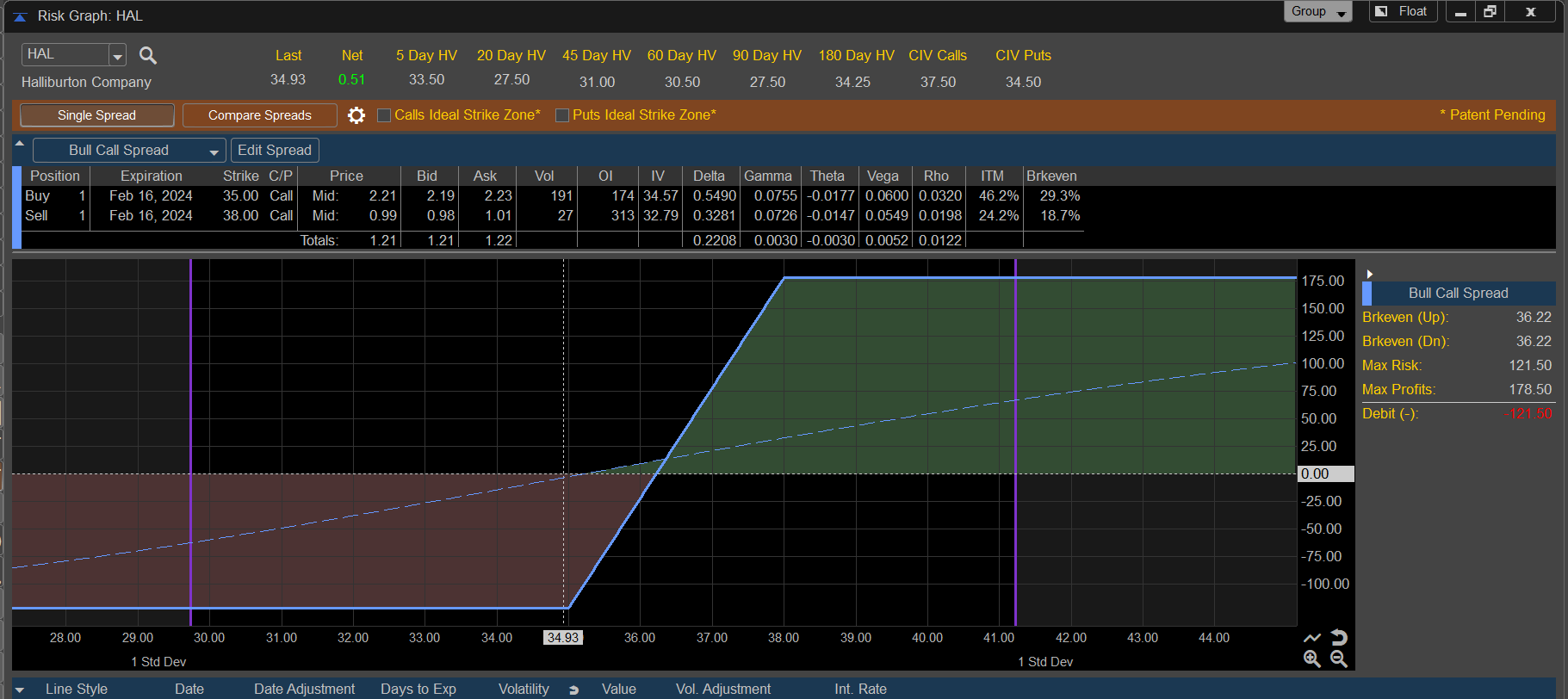

If a reader is bullish now, here is a potential Bull Call Debit Spread to consider buying:

As you likely know, there are literally dozens of solid ways to approach trading Halliburton Co. (HAL) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Hopefully this information has proved worth your time. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Halliburton Co. (HAL) and other solid seasonal opportunities click here SuperSeasonals . For other seasonal opportunities, please click on the link below to access the Super Seasonals software:

CLICK HERE FOR 50% OFF SUPER SEASONAL SCANNER