In today’s Super Seasonal Trade of the Week we will look at Extreme Networks (EXTR).

Extreme Networks, Inc. engages in the provision of software driven networking solutions for enterprise, data center, and service provider customers.

A couple of weeks ago a selloff of Extreme Networks shares created an attractive opportunity to buy, partially because of insiders selling their stakes that have surged this year. But customer spending on enterprise networking is holding steady despite slower tech spending and higher inventories, and the company is still gaining share on larger rival Cisco.

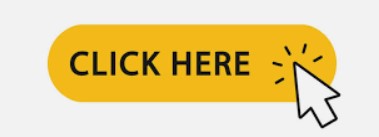

The stock has had a wonderful past 12 months. Currently the daily composite of technicals are Neutral. And the Analysts have a consensus Buy rating on the stock.

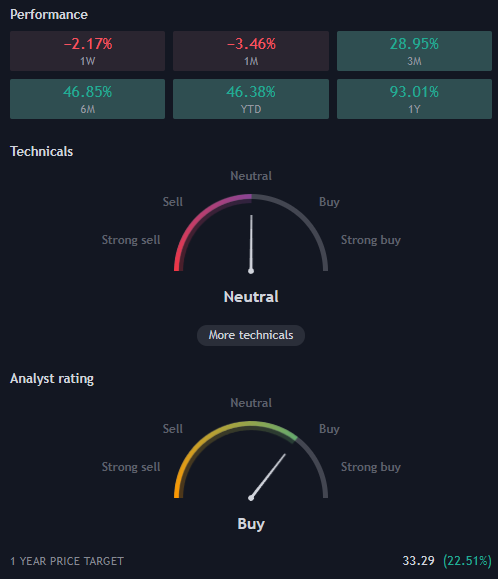

Below are the seasonal stats on the stock. They have looked very good over the past 2 decades. Also you will see a Daily stock chart. There are a couple of high volume nodes that I circled on the chart. One happened in the $24 area on June 28th. The recent pullback a few days ago reversed at that level. Now we are currently at a high volume node level ($27 area) from August 1st. Will this level hold and break out to the upside? Breakout traders might try to push the stock if it trades to $28 in the coming days.

If we look at a simple Weekly chart, and analyze volume. What do we see? We see significant buying volume come into the stock between 24-28 on the week of June 26th, the prior week, the bears tried to sell it off. But an unusually large amount of volume came in the following week. That level held, after a recent sell off. From a weekly standpoint, it’s currently in a 3 bar reversal pattern. A break above $28 might signal bulls trying to push the stock to the upside. That said, the $24-28 level seems to be a solid area of support to consider.

If someone likes that idea. Maybe they buy the stock at $28, put a stop below $24 and target a longer term upside move to $36 as a simple example of a solid risk/reward.

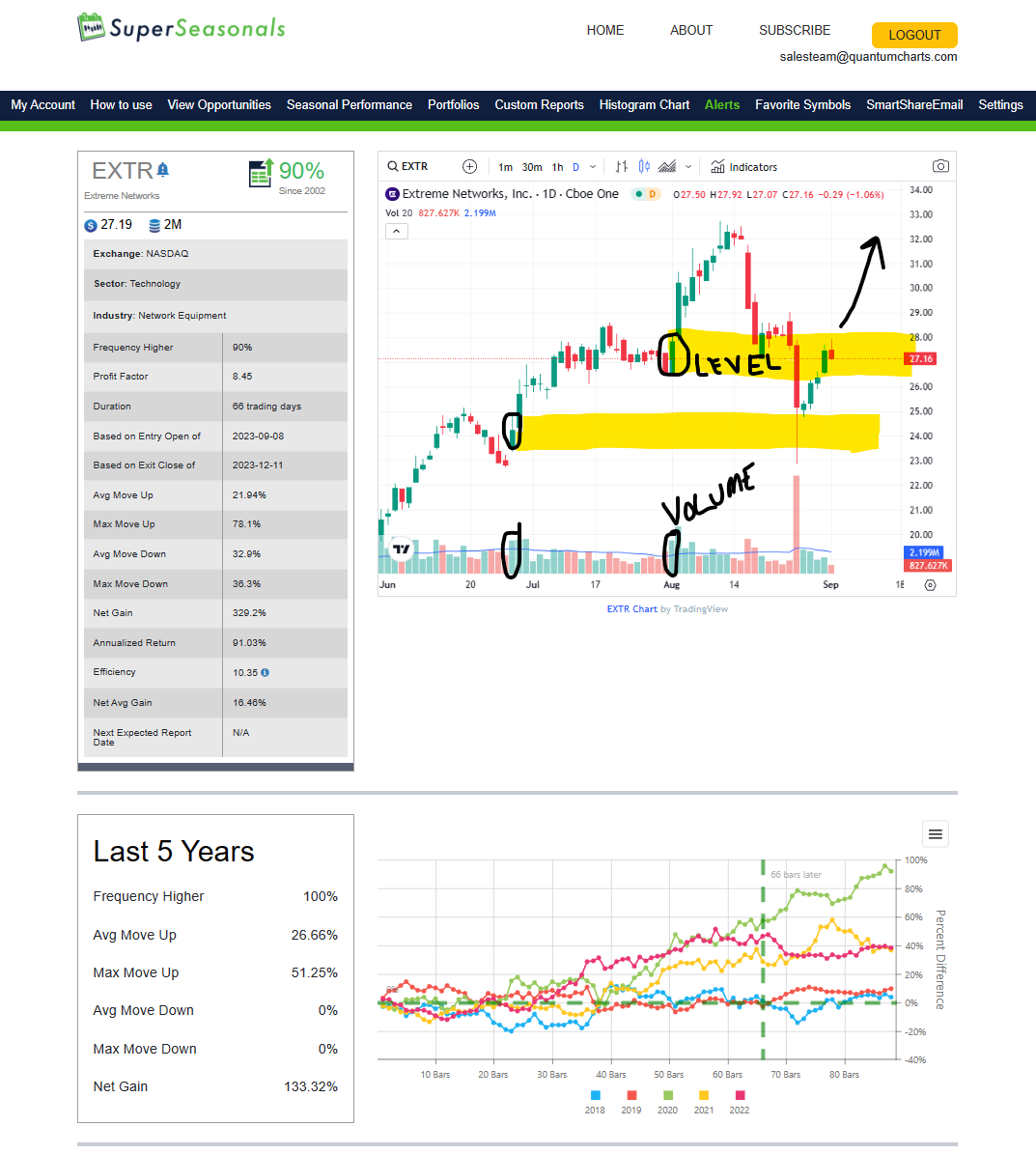

Looking below, the stock has a seasonal tendency to stay rather flat for a few weeks, then take off to the upside toward year end. Food for thought.

Glancing at the larger Weekly picture, the stock looks overbought and extended currently. Might the stock pull back to the $21 area? Certainly a plausible theory.

Drilling in on the Daily chart, the stock looks as if it’s come off a recent mean reversion level (yellow line) a few days ago. Current reversion area is in the $24 area if you are a pullback trader, also a bit further down toward the $22 area.

Maybe you wait for a pullback. Say to $25, then you buy the stock if you see favorable price action, momentum and volume for example. Maybe you target a move back up to $30, which would be a +20% move. From a stop perspective, maybe have it at $22.50 which is a 10% move against you.

If a reader is bullish now, here is a simple Call to consider buying.

Buy Oct 20, 23 Call. 25 Strike. Debit of $3.35 or better.

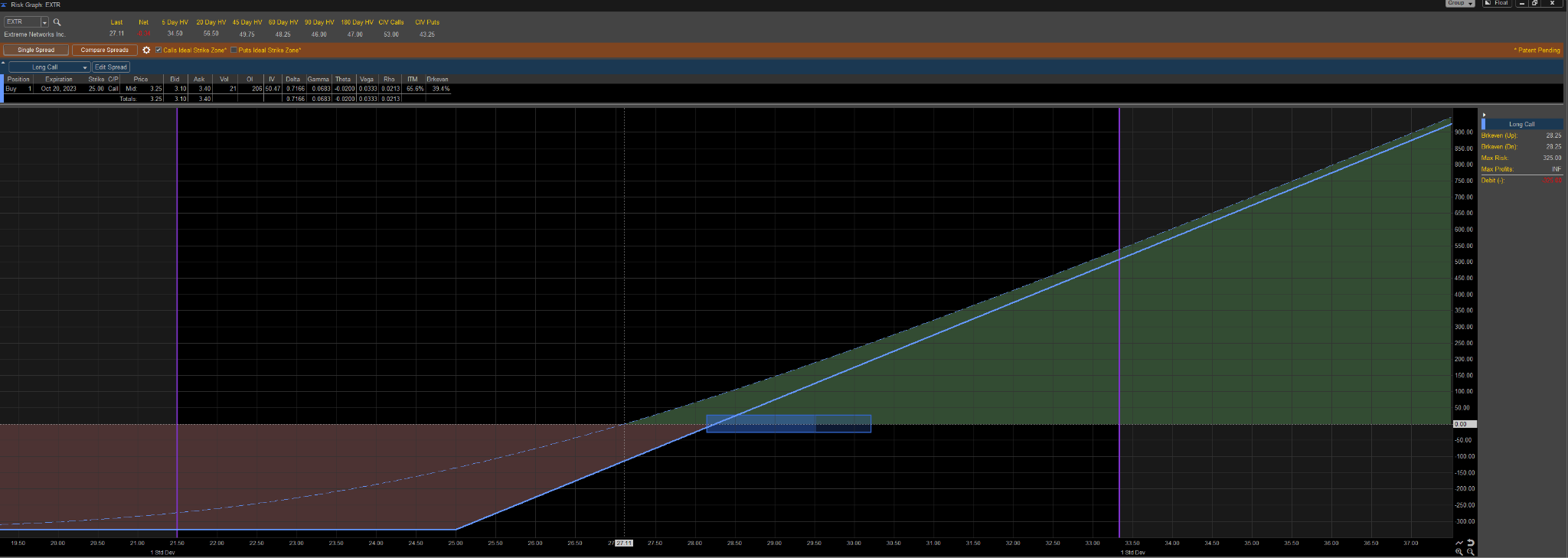

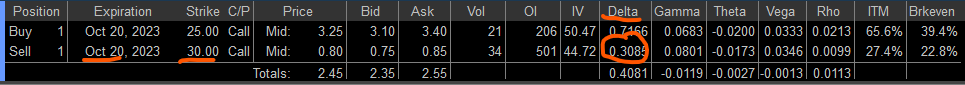

Here’s a potential debit spread (see image below), which I would not personally do, because the sell side doesn’t provide enough credit for my taste. I typically like to cut my Call debit risk in half, otherwise I simply stick with just buying a Call.

However, notice that the 30 strike call for the Oct 20 expiration has a delta of .30. If you double that, you get .60, which means there’s a 60% odds of touching 60 prior to expiration. Keep that in mind. So then you must ask yourself if buying the aforementioned call is worth the risk. Meaning would you risk $325 (call debit), with a 60% chance to make $200 (what risk graph says you might profit) at the $30 level. For some ‘yes’ it is worth the risk, for others ‘no’ it is not worth the risk. I do not love the risk, but there’s very limited choices for a directional pick on the board.

As you likely know, there are literally dozens of solid ways to approach trading Extreme Networks (EXTR) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Hopefully this information has proved worth your time. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Extreme Networks (EXTR) and other solid seasonal opportunities click here SuperSeasonals. For other seasonal opportunities, please click on the link below to access the Super Seasonals software:

CLICK HERE FOR 50% OFF SUPER SEASONAL SCANNER