In today’s Super Seasonals: Trade of the Week we will look at Dr. Reddy’s Laboratories Ltd. (RDY).

Dr. Reddy’s Laboratories Ltd. engages in the manufacture and marketing of pharmaceutical products. It operates through the following segments: Global Generics, Pharmaceutical Services and Active Ingredients, and Others. The Global Generics segment consists of manufacturing and marketing of prescription and over-the-counter finished pharmaceutical products ready for consumption by the patient, marketed under a brand name or as generic finished dosages with therapeutic equivalence to branded formulations. The Pharmaceutical Services and Active Ingredients segment focuses on manufacturing and marketing of active pharmaceutical ingredients and intermediates, also known as API, which are the principal ingredients for finished pharmaceutical products. The Others segment includes the operations of the subsidiary of the company. The company was founded by Kallam Anji Reddy on February 24, 1984 and is headquartered in Hyderabad, India.

Recent headlines…

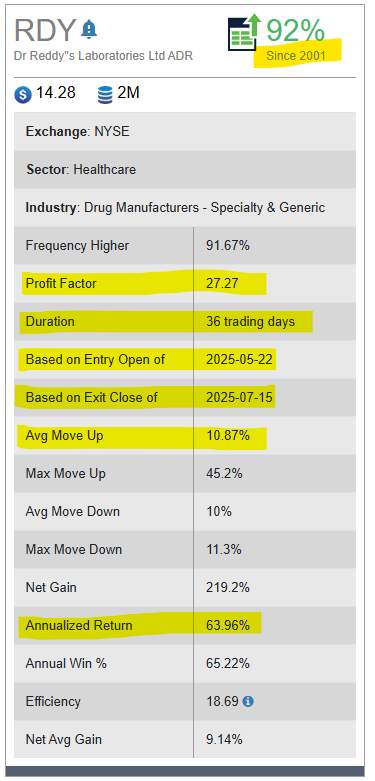

Below is the seasonal pattern that the software uncovered …+ 63.96% Annualized Return.

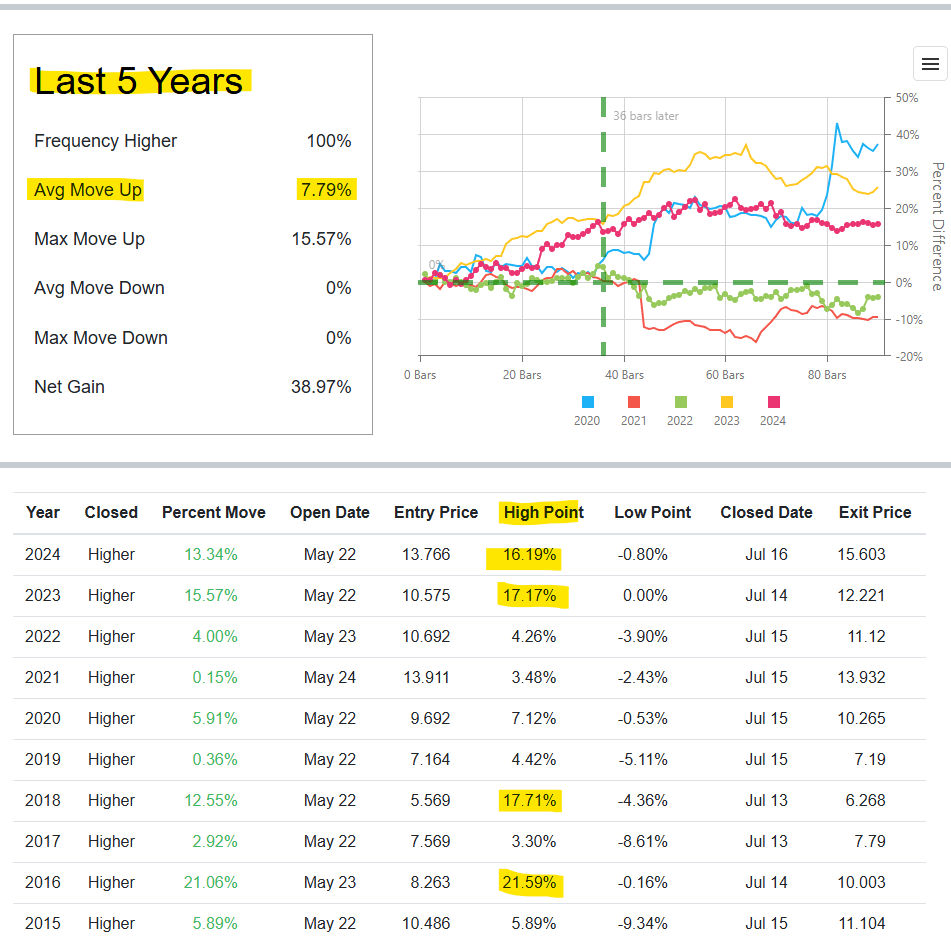

Over the next 7 trading weeks, the pattern has shown an +7.79% Avg Move Up in the past 5 years….and an +12.5% average ‘median’ High Point in the past 10 years.

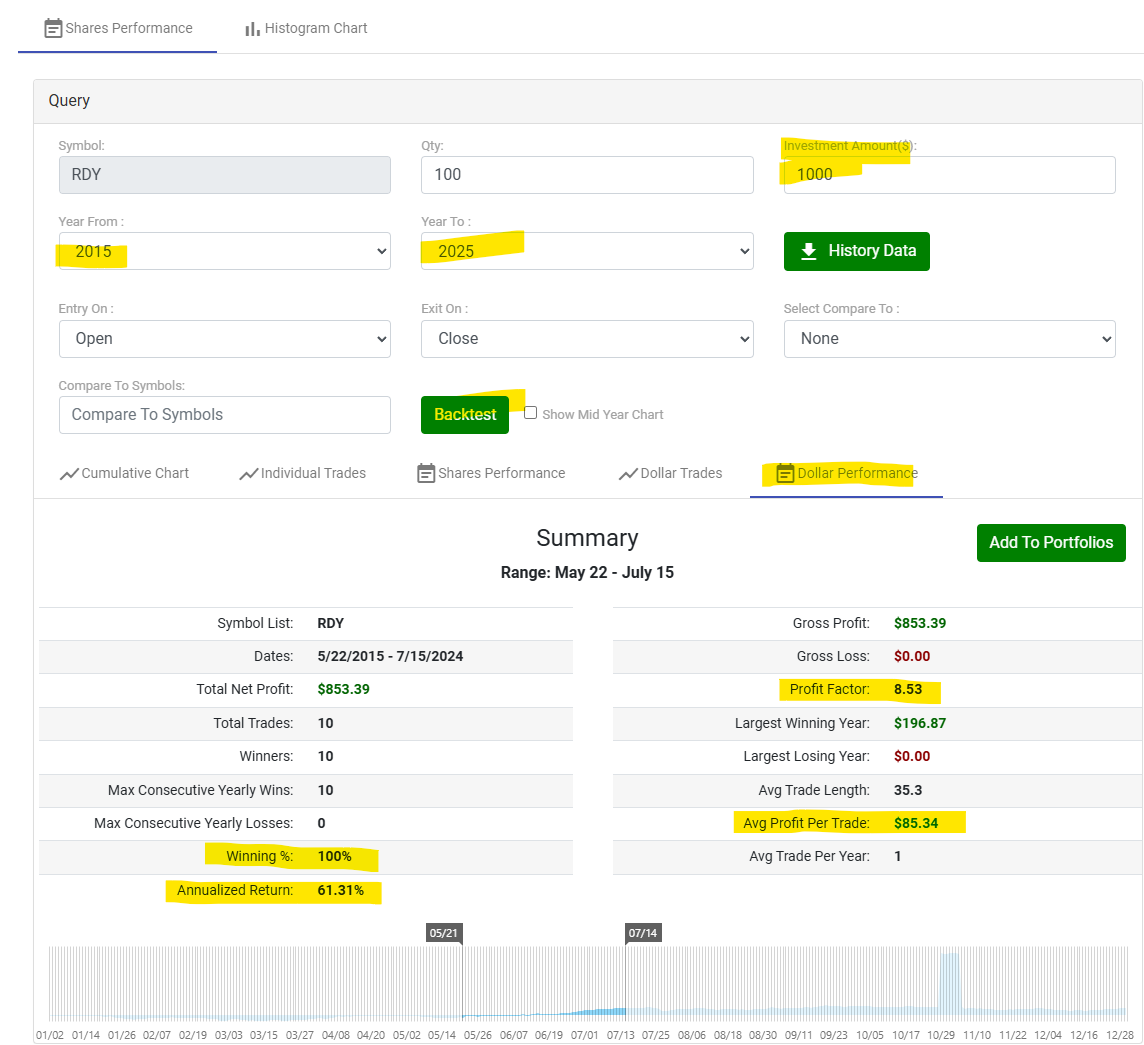

Below is a 10-year backtest of investing $1,000 to buy/sell during the previous pattern dates. Average profit per trade is +8.53%, which equated to an Annualized Return of 61.31%.

As you likely know, there are literally dozens of solid ways to approach trading Dr. Reddy’s Laboratories Ltd. (RDY) with a bullish bias.

The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties.

Please remember to fully understand the risk before trading anything.

It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley