In today’s Super Seasonals: Trade of the Week we will look at Dollar Tree, Inc (DLTR).

Dollar Tree, Inc. owns and operates discount variety stores offering merchandise at fixed prices.

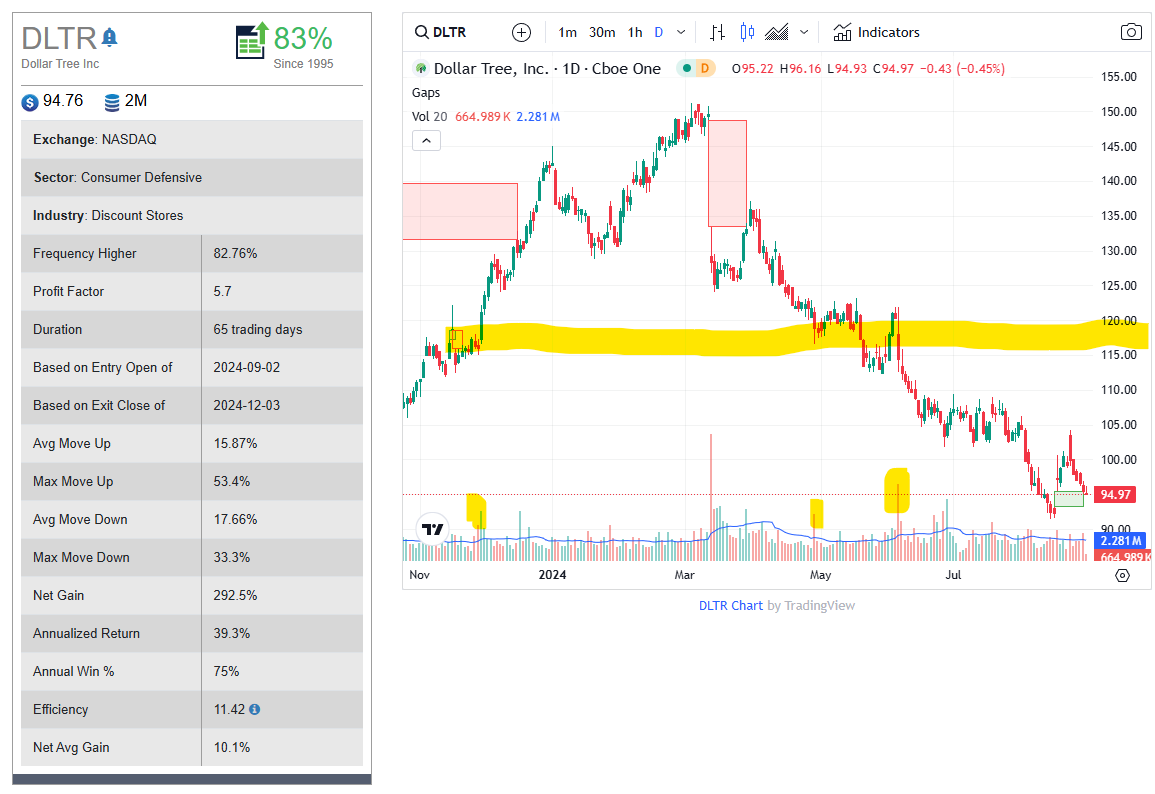

Below are the seasonal statistics of the stock (Since 1995) over the next 3 months or so. Additionally, the stock has sold off in the past few months, possibly the stock is oversold and it might find buyers entering in this seasonally sound time period. Glancing at the chart, there’s a small price gap and areas of high volume in the 115-118 areas. That might potentially be a price area to target if you are a directional stock trader.

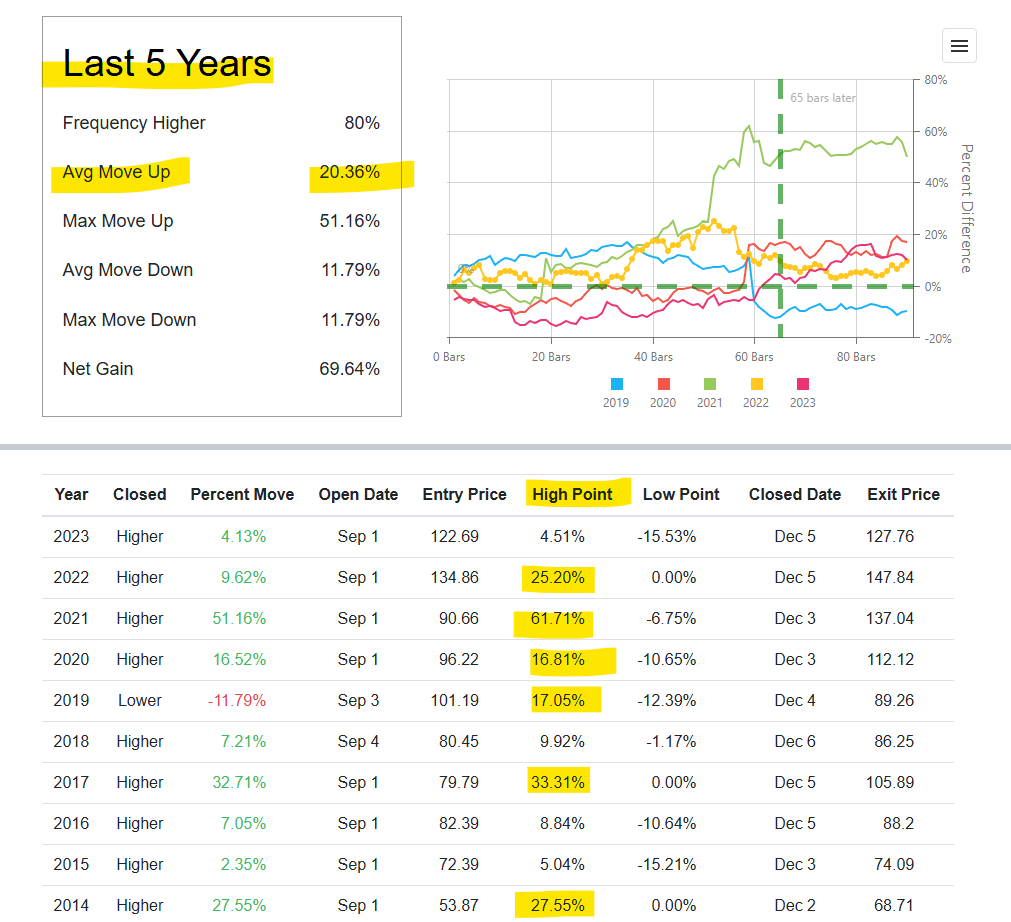

Below is a look at the past 5-10 years that gives us a recency bias in the more recent seasonal periods. The 5 year Avg Move Up looks good, and the past 10 year High Points have some really good peaks in them as well.

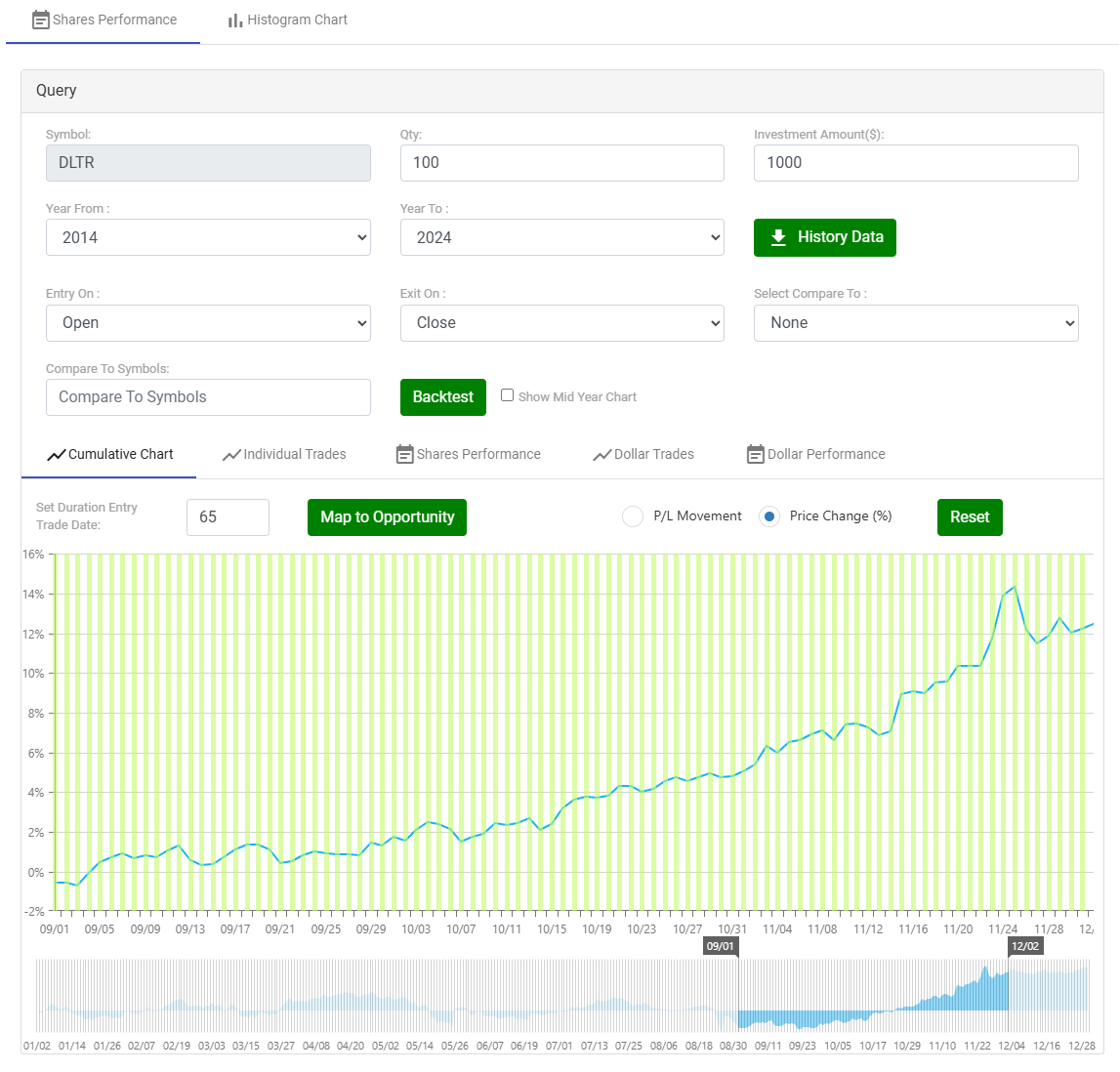

Below is a Backtest of a Cumulative Chart over the past 10 years…

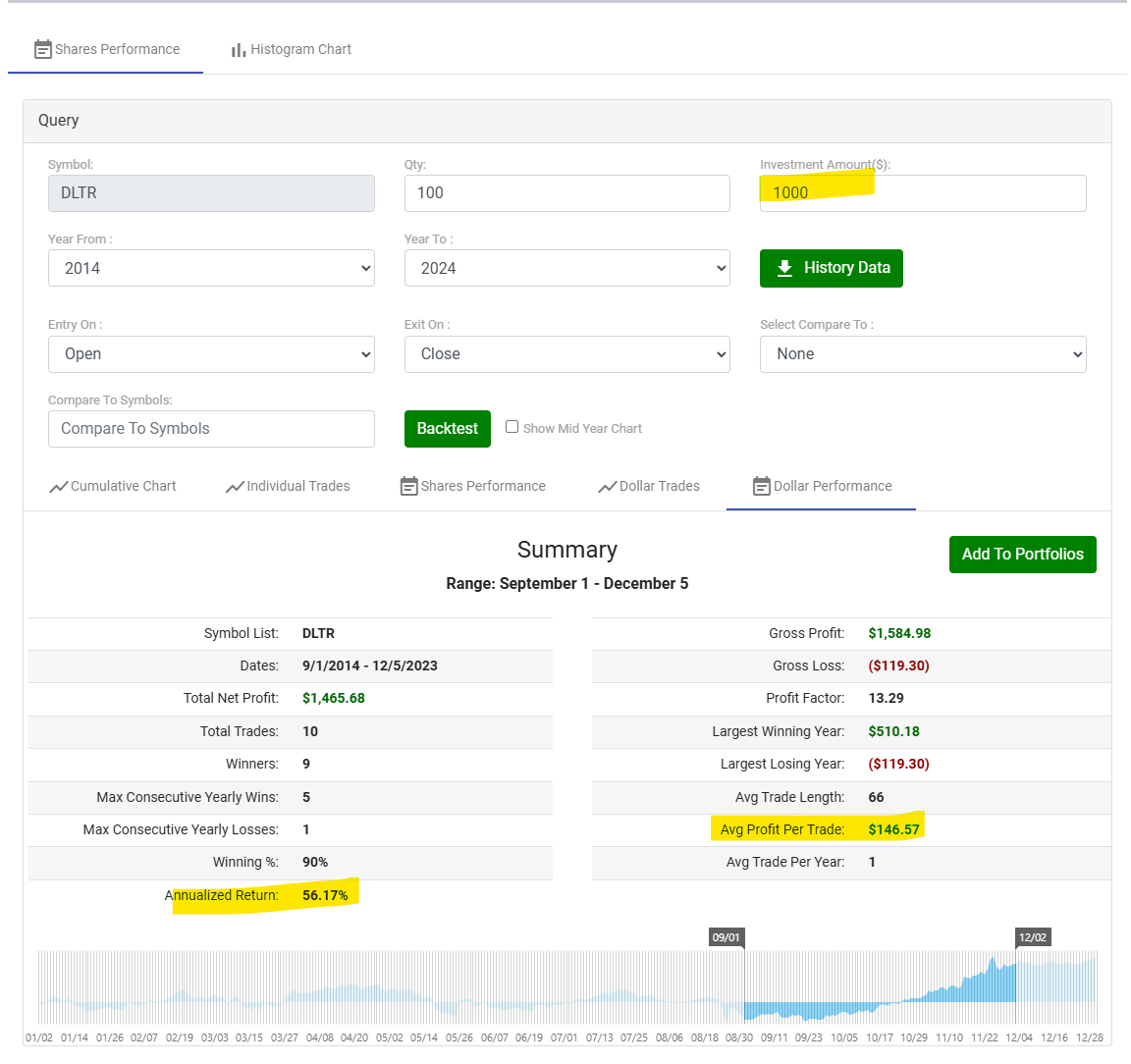

Below is a Backtest if an investor bought $1,000 of stock during this seasonal time period…

As you likely know, there are literally dozens of solid ways to approach trading Dollar Tree, Inc (DLTR) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember to fully understand the risk before trading anything. It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals .

Trade Smart,

Chad Shirley