In today’s Super Seasonals: Trade of the Week…we will look at Copart Inc. (CPRT).

As a reminder, this is just ONE opportunity, there are literally dozens of solid opportunities every week to consider via the Super Seasonals website.

Founded in 1982, Copart, Inc. engages in the provision of online auctions and vehicle remarketing services. It provides vehicle sellers with a full range of services to process and sell vehicles primarily over the internet through Virtual Bidding Third Generation Internet auction-style sales technology. The firm sells the vehicles principally to licensed vehicle dismantlers, rebuilders, repair licensees, used vehicle dealers, and exporters and at certain locations, as well as to the general public. The company’s services include online seller access, salvage estimation services, estimating services, end-of-life vehicle processing, virtual insured exchange, transportation services, vehicle inspection stations, on-demand reporting, DMV processing, and vehicle processing programs. It operates through the United States and International segments.

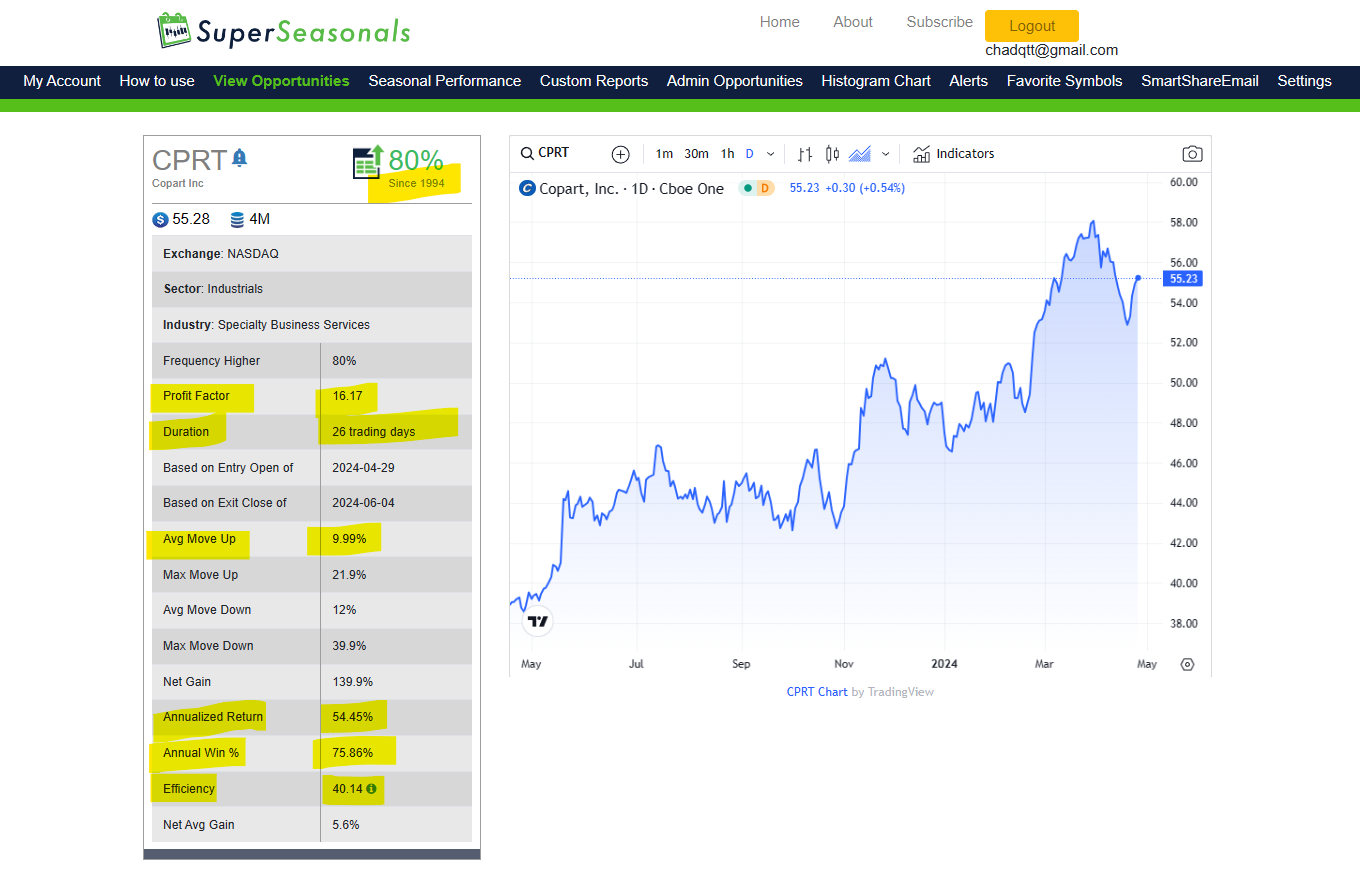

From a seasonality perspective…Below is a snippet from the Super Seasonals website, and the seasonal statistics for Copart Inc.(CPRT) since 1994. Over the next 26 trading days, or roughly the next 5 weeks, the stock has gone Up 80% of the time over the past 3 decades. That’s a pretty solid statistic. The Annualized Return is 54%, which is very solid as well. The average move up is about 10%, which is a very solid bullish tendency move over the coming weeks.

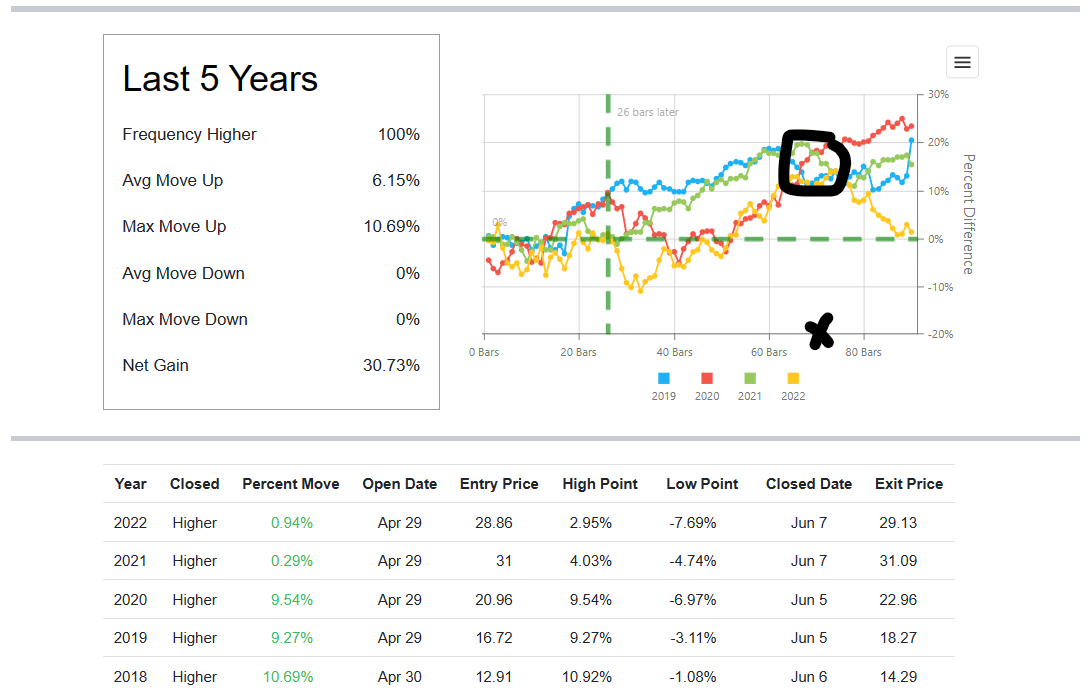

If we zoom in on the past 5 years, from a recency bias standpoint. For those who are unaware of the concept, recency bias is the tendency to overemphasize an event that occurred in the recent past, while placing less importance on events that occurred in the more distant past. That said, there may be something going on here seasonally that might infer it could continue to remain bullish over the coming weeks.

Below you will notice that about 70 ‘trading’ days out, the stock appears to see an interesting peak in ALL 5 years. Historically speaking, this could be mere coincidence, or maybe something else.

Over the past 10-years, which falls into the recency bias theory, in my opinion…the next few months look okay seasonally, and start to fall off in August, historically. My point, one could consider holding longer, or waiting for an optimized entry that might better suit their risk profile.

As you likely know, there are literally dozens of solid ways to approach trading Copart Inc. (CPRT) with a bearish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Copart Inc. (CPRT) and other solid seasonal opportunities click here SuperSeasonals .

Trade Smart,

Chad Shirley