In today’s Super Seasonals: Trade of the Week we will look at Canadian National Railway Co. (CNI).

Canadian National Railway Co. engages in rail and related transportation business. Its services include rail, intermodal, trucking, supply chain services, business development, and maps & network. It offers their services in automotive, coal, fertilizer, food & beverages, forest products, dimensional loads, grain, metals & minerals, and petroleum & chemicals industries. The company was founded on June 6, 1919 and is headquartered in Montreal, Canada.

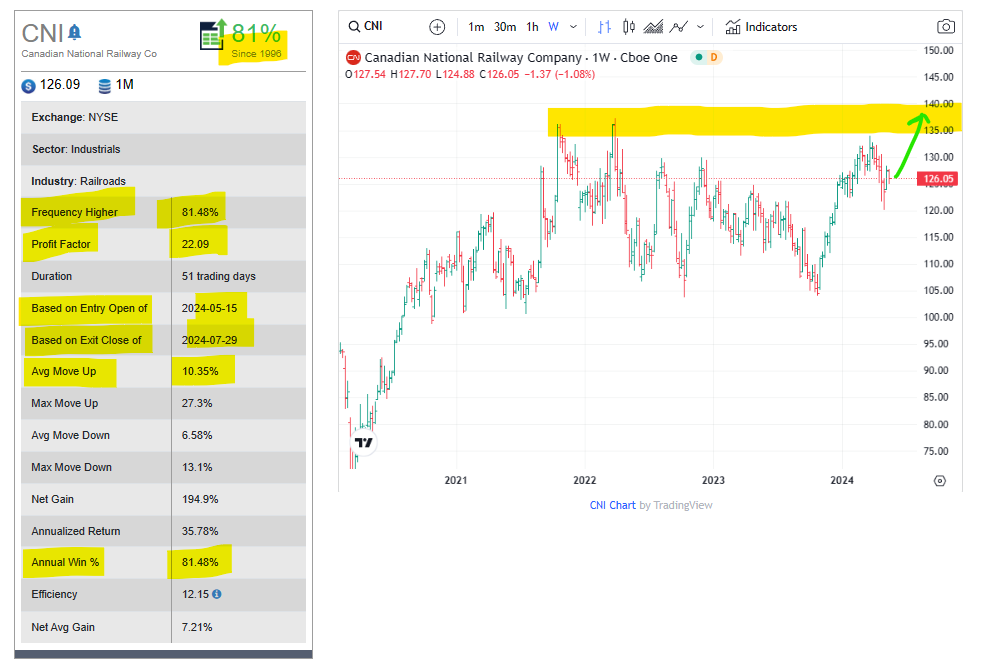

Below is the seasonal snapshot since 1996. Also, a Weekly chart shows price might attempt to test the 2021 and 2022 highs, if the seasonal tendencies happen to play out.

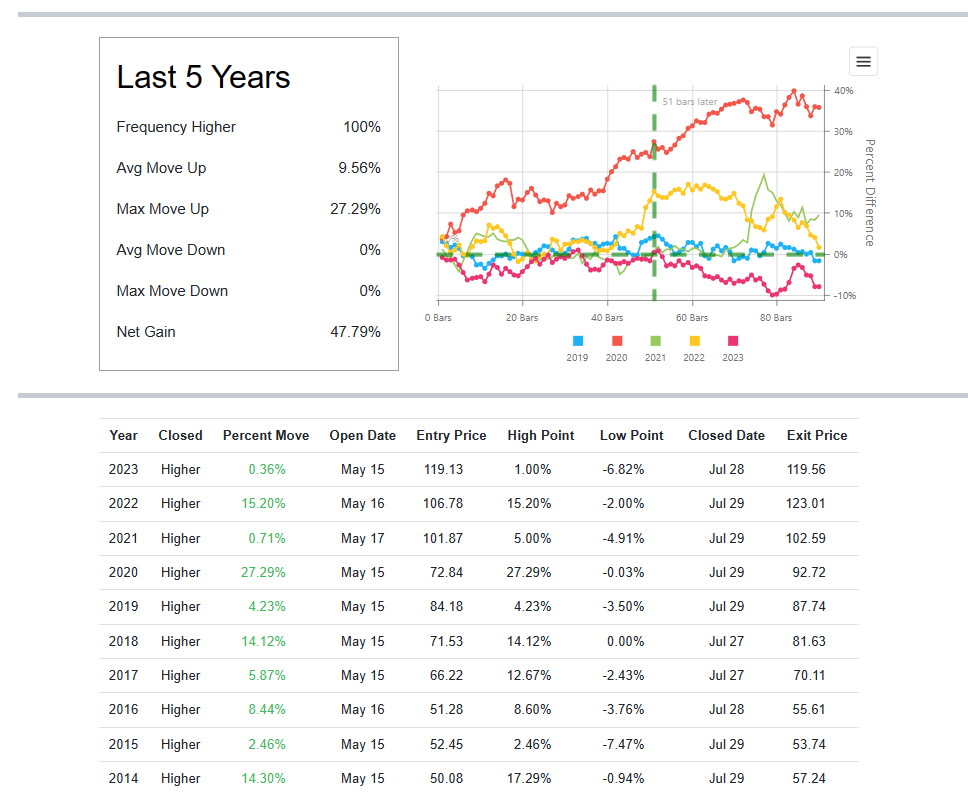

From a recency bias standpoint over the past 5-10 years, the seasonal tendency appears to be a valid consideration in a bullish trading approach.

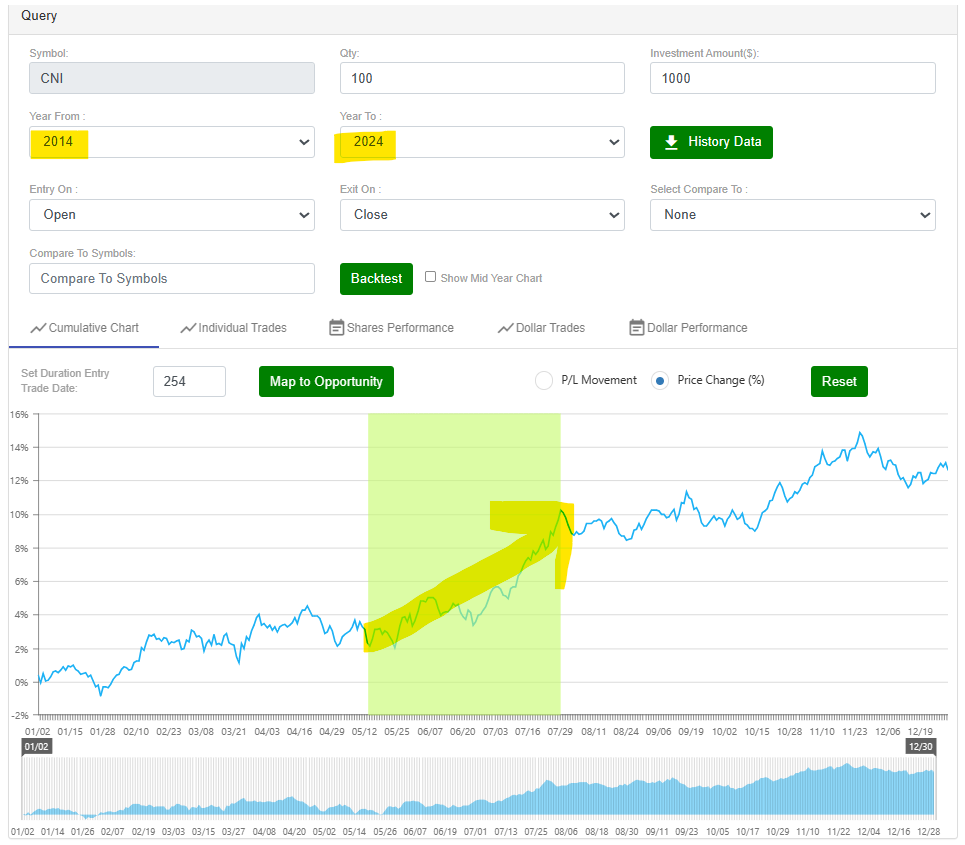

Below is an image of a Cumulative Chart over the past 10 years, we can clearly see that a bullish seasonal tendency is quite recognizable.

Below is a Histogram Chart for CNI…as you can see July is a very good month, so positioning in prior to that could be a way to approach it.

As you likely know, there are literally dozens of solid ways to approach trading Canadian National Railway Co. (CNI) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Canadian National Railway Co. (CNI) and other solid seasonal opportunities click here SuperSeasonals.

Trade Smart,

Chad Shirley