In today’s Super Seasonals: Trade of the Week we will look at Buckle, Inc. (BKE).

The Buckle, Inc. engages in the business of retailing medium to better-priced casual apparel, footwear, and accessories for fashion-conscious young men and women. The firm is also involved in the provision of customer services such as free hemming, free gift-packaging, easy layaways, private label credit card, and guest loyalty program. The company was founded by David Hirschfeld in 1948 and is headquartered in Kearney, NE.

Below are the seasonal statistics of an upcoming seasonal period in the stock over the past 2 decades. Additionally, the chart shows a potential upside gap fill at $49.02. That would be about a 15% move as of the writing of this report. Which is in-line with the Avg Move Up during this period.

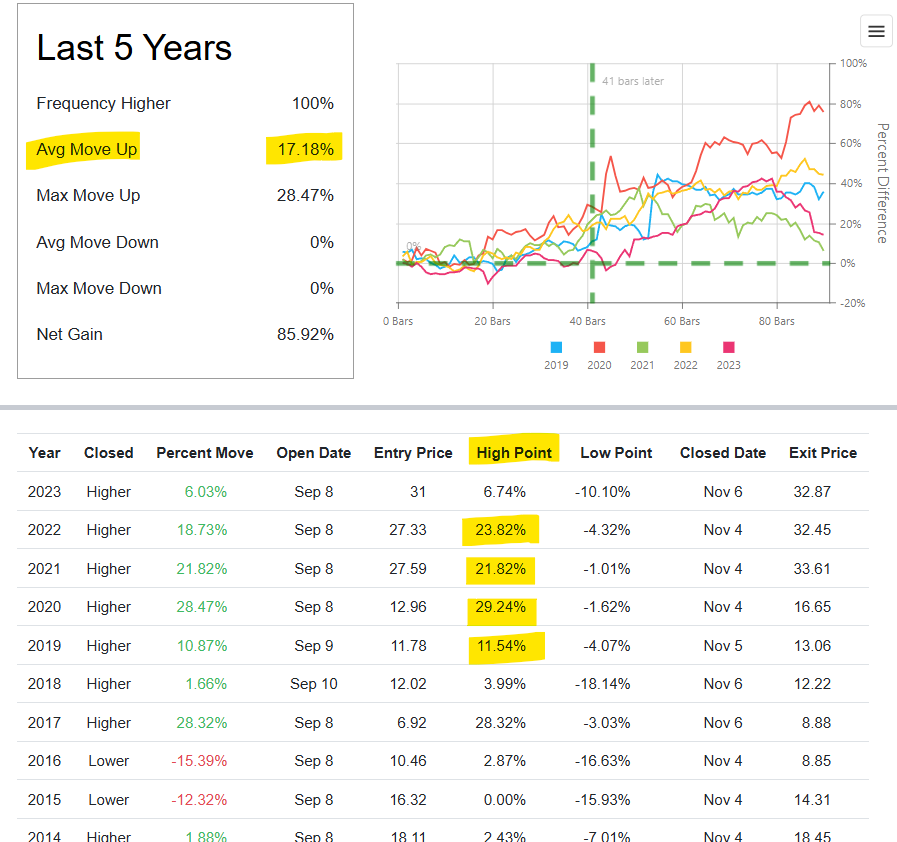

Below is a 5-10 year look at the more recent seasonal period. There have been some solid High Points in the past 5 years, with the Avg Move Up of +17%.

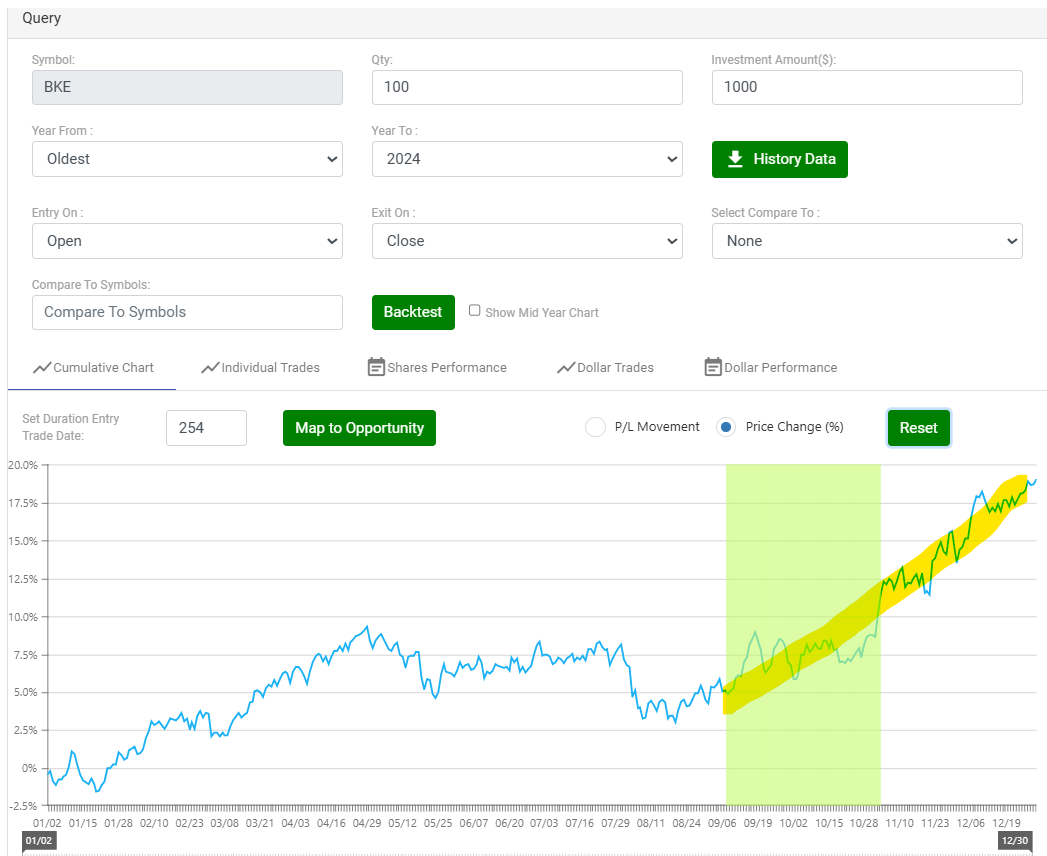

Below is a visual of a Cumulative Chart. It’s clearly noticeable that the stock has a tendency to move up through the year-end.

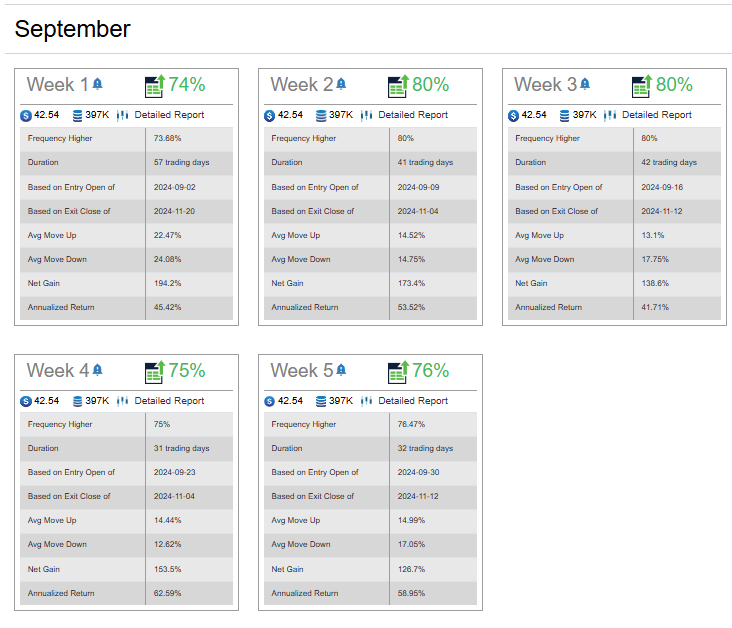

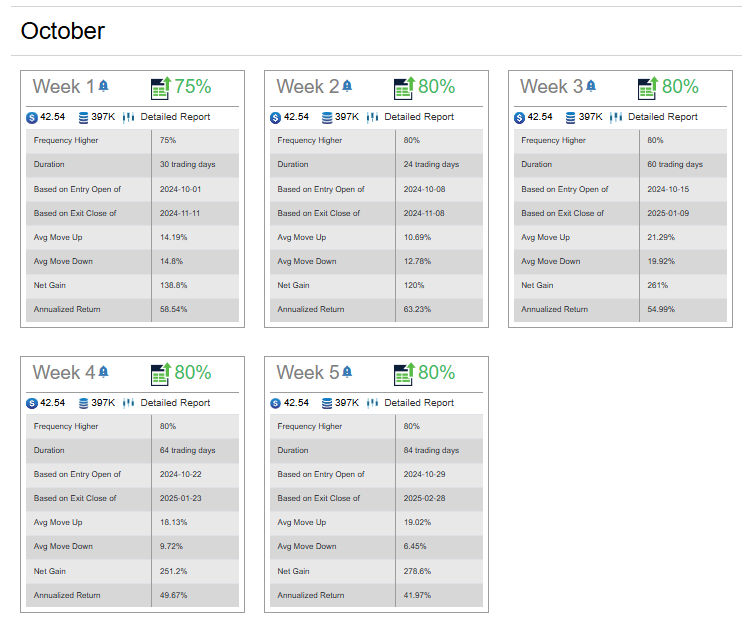

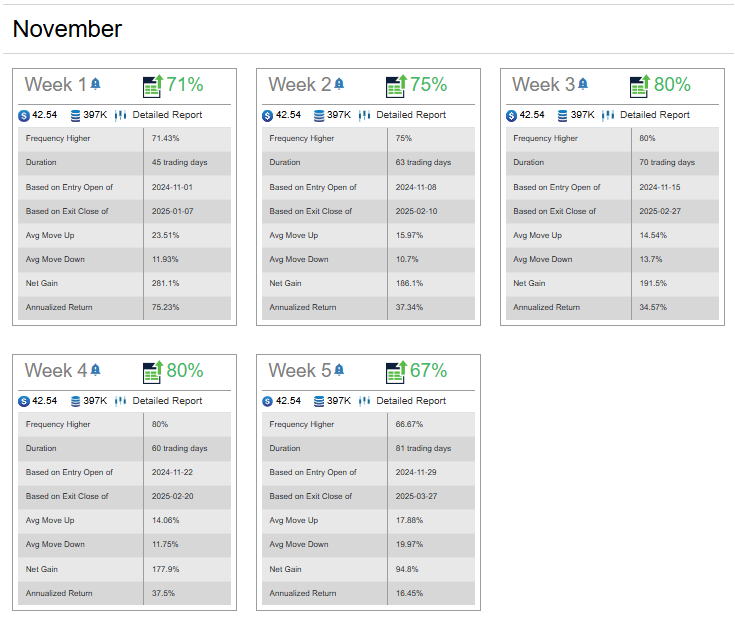

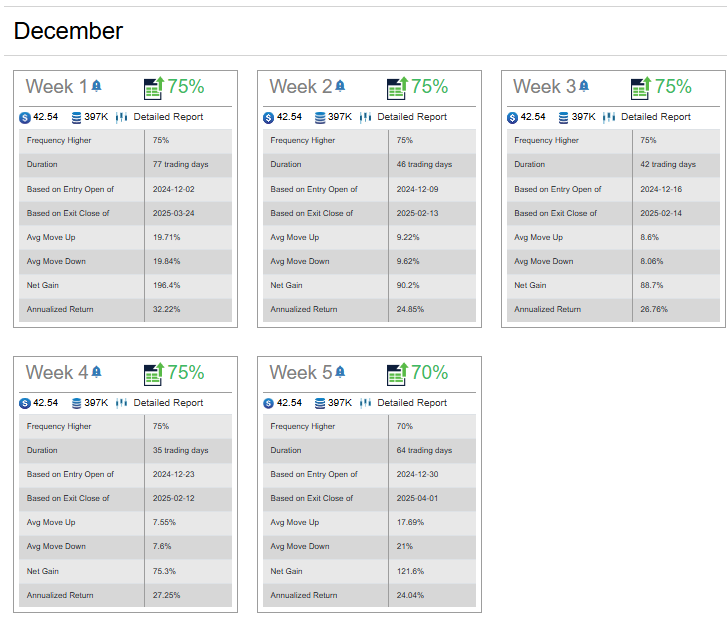

Below is a look at the Weekly, month by month glimpse over the next few months, which shows us that there is a fairly solid bullish tendency through the year-end.

As you likely know, there are literally dozens of solid ways to approach trading Buckle, Inc. (BKE) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember to fully understand the risk before trading anything. It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley