– 3 Stocks Institutions Quietly Accumulate Before Spring

Most retail traders look at charts.Cool, nothing wrong with that, I do as well.

Professionals look at positioning — Professionals don’t react to price — they anticipate capital flows. Seasonality is simply the statistical expression of those flows.

But the real edge?

Understanding why money tends to move when it does.

Seasonality isn’t magic. It’s the byproduct of:

- Institutional capital rotation

- Earnings and guidance cycles

- Commodity hedging flows

- Tax planning

- Pension and sovereign fund rebalancing

- And plain old human behavior

This week, we’re stepping into a historically strong seasonal window that has quietly produced some of the most consistent late-winter opportunities in the market.

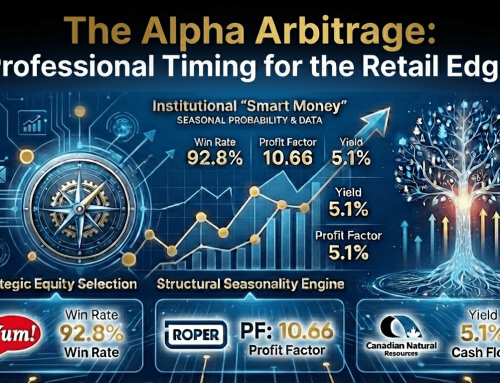

Below are my top three setups from the SuperSeasonal scan — not just because the numbers are attractive, but because the macro backdrop aligns with the seasonal tailwinds.

Seasonal Stats Snapshot:

- Frequency Higher: 84%

- Profit Factor: 20.22

- Data history back to 1987

- Average volume: 10M shares

That profit factor is not a typo.

Now let’s talk about the why.

Late February through spring is a classic repositioning window in natural gas equities. Here’s what’s typically happening behind the curtain:

- Utilities and industrial buyers hedge forward exposure.

- Producers reset drilling and capex guidance.

- Institutional money rotates toward cyclicals ahead of Q2 demand expectations.

- Commodity desks reposition after winter volatility.

This year, we also have broader macro support:

- Energy stocks remain under-owned relative to cash flow.

- If inflation expectations tick higher, energy catches a bid.

- Geopolitical risk premiums tend to resurface in spring.

Retail traders often chase energy after it’s already extended. Seasonality suggests positioning before the rotation is widely discussed.

For specific entry/exit timing, log into SuperSeasonals.com.

Seasonal Stats Snapshot:

- Frequency Higher: 92%

- Profit Factor: 9.76

- History since 1998

- Consistent institutional volume

This is the kind of stock most retail traders ignore because it’s “boring.”

Institutions love boring.

Late winter into spring is historically strong for waste management names. Why?

- Municipal contract renewals often reset early in the year.

- Pricing adjustments kick in.

- Infrastructure and construction activity begins to ramp.

- Defensive money rotates back into steady cash-flow names after early-year volatility.

Intermarket note:

When Treasury yields stabilize and volatility compresses, defensive compounders like WCN often outperform quietly.

This isn’t a momentum trade. It’s a capital preservation with upside bias setup — and the data has been remarkably consistent.

Again, exact timing windows are available inside SuperSeasonals.com.

Seasonal Stats Snapshot:

- Frequency Higher: 93%

- Profit Factor: 3.37

- Data history back to 1997

Nearly 93% positive frequency. That’s institutional-level consistency.

Here’s the behavioral driver:

- February is peak pessimism for consumer discretionary after post-holiday spending data.

- By March, analysts begin adjusting models toward spring traffic trends.

- Franchise operators provide early guidance.

- Fund managers rotate into consumer names ahead of Q1 earnings season.

Fast food and franchise-heavy models like YUM tend to benefit from:

- Stable pricing power

- International growth narratives

- Defensive consumer spending

If broader markets remain constructive, consumer brand leaders often see steady inflows.

And if markets wobble?

High-quality franchises still attract defensive capital.

It’s a “heads I win, tails I don’t lose much” type of setup.

Timing details remain inside the SuperSeasonals platform.

Broad Market Context

We’re entering a seasonal window where:

- Small and mid-cap energy tends to strengthen.

- Defensive compounders catch steady inflows.

- Consumer names see pre-earnings positioning.

Intermarket dynamics to monitor this week:

- Crude oil and natural gas futures positioning

- 10-year Treasury yield stability

- Dollar strength vs. commodities

- Volatility compression (VIX trends)

If volatility contracts and commodities stabilize, the odds increase that these seasonal patterns express themselves cleanly.

If volatility expands aggressively, tighten risk and reduce position sizing.

Seasonality gives you a statistical edge.

It does not remove risk.

Final Thoughts

Most traders lose because they trade randomly.

Seasonal traders operate with structure:

- Defined windows

- Historical probability

- Sector rotation awareness

- Risk control

You don’t need to predict the market.

You need to align yourself with when money historically moves.

This week, energy, defensive infrastructure, and consumer franchises are showing that alignment.

For full statistical breakdowns and precise timing windows, log into SuperSeasonals.com.

Prepare well.

Plan entries.

Define risk before the open.

Trade well. See you next Sunday.

Chad Shirley

Disclaimer

This newsletter is for educational and informational purposes only and should not be considered personalized investment advice. All trading involves risk, including the potential loss of principal. Past seasonal performance does not guarantee future results. Always conduct your own due diligence and consult with a licensed financial professional before making investment decisions.