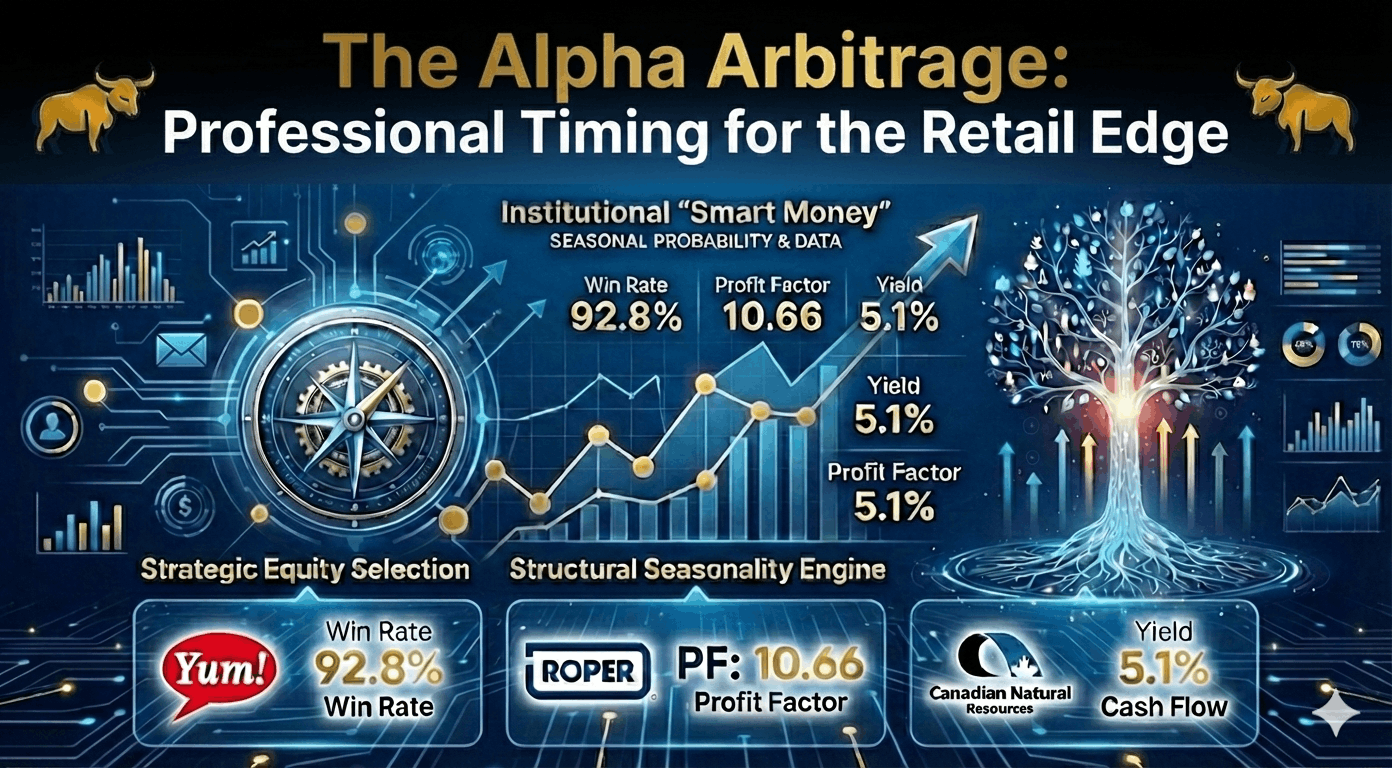

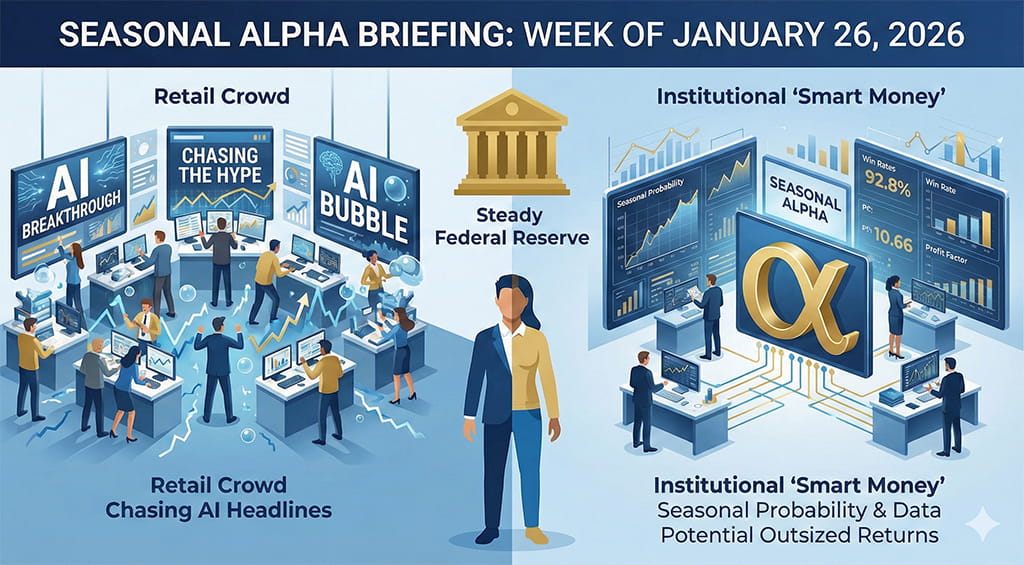

Welcome to this week’s Seasonal Alpha briefing. My goal is to peel back the curtain on how institutional “smart money” uses the very data sitting in the Super Seasonals platform to potentially earn outsized returns.

We are currently looking into the Week of January 26, 2026. The macro environment is characterized by a “bifurcated consumer” and a steady Federal Reserve. While the retail crowd chases the latest AI headlines, institutions are looking at Seasonal Probability and their underlying statistics to potentially provide an edge.

- Seasonal Edge: 92.8% Frequency Higher .

- Trade Window: Entry Jan 22 | Exit, login to SuperSeasonals.com

- Institutional Logic: Historically, Q1 is the period where “Value-Growth” names like YUM see a massive inflow of passive 401k capital.

The “Why” Behind the Drive:

The data shows a 92.8% win rate over nearly 30 years. Why does this happen? Institutions front-run the Q1 earnings (late Feb) where YUM typically showcases its international “scaling” efficiency.

- 2026 Fundamentals: Recent analyst upgrades from Gordon Haskett (Jan 8, 2026) moved YUM to a “Buy” with a price target of $167.59. Live data shows it currently hovering around $153.02 at the time of this writing, offering a rare “discounted” entry before the seasonal window takes hold.

Sentiment: With the “Greenland Tariff” row causing market jitters this week, institutions are rotating into “Defensive Discretionary” like YUM, which benefits from its high-margin digital ordering (Taco Bell/KFC).

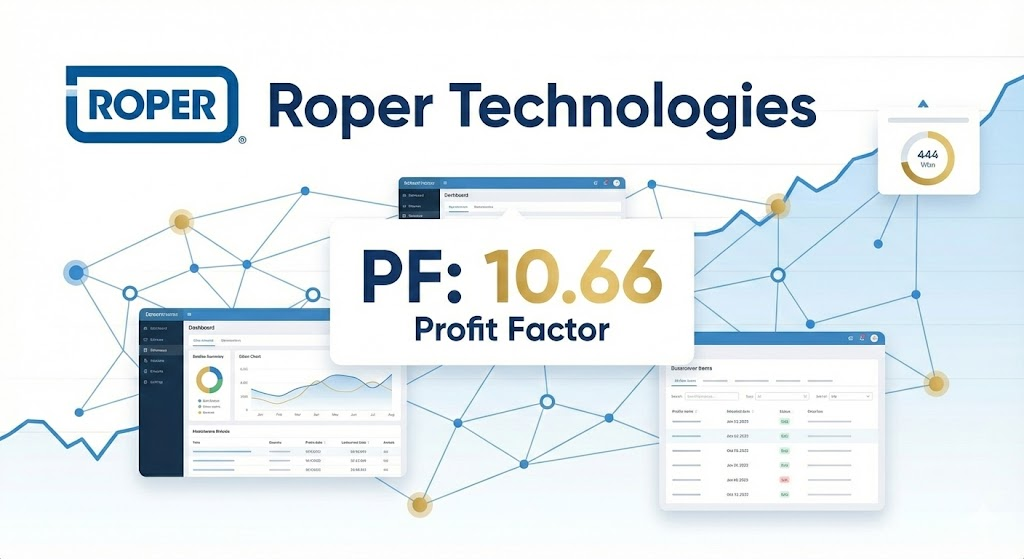

- Seasonal Edge: 84.8% Frequency Higher | Profit Factor: 10.66.

- Trade Window: Entry Jan 22 | Exit, login to SuperSeasonals.com

- Institutional Logic: A Profit Factor of 10.66 is a statistical anomaly that hedge fund algos dream of. It means for every dollar lost on this trade historically, $10.66 was gained.

The “Why” Behind the Drive:

- Fundamental Pivot: Roper has successfully completed its transformation into a vertical SaaS (Software as a Service) powerhouse. As of Jan 2026, the company is trading at a significant discount to its intrinsic DCF (Discounted Cash Flow) value of $715, currently priced near $416.14.

- 2026 Sentiment: In a “risk-off” environment (ahead of the Davos summit), ROP’s 69% gross margins and recurring revenue model provide a “quality floor.” The Super Seasonals data notes a potential Annualized Return of 41%, which aligns with the institutional “Buy the Dip” sentiment we are seeing in the software-industrial complex this month.

- Seasonal Edge: 84.0% Frequency Higher | Profit Factor: 3.05.

- Trade Window: Entry Jan 22 | Exit, login to SuperSeasonals.com

- Institutional Logic: This is a classic “Cycle Shift” play. Energy stocks traditionally outperform in late Q1 as refinery maintenance ends and global travel demand projections for summer are released.

The “Why” Behind the Drive:

- 2026 Budget Catalyst: On Dec 16, 2025, CNQ announced a disciplined $6.3 billion budget for 2026 with a 3% production growth target. They are now entering the “Execution Phase” where results start hitting the tape.

- Dividend Aristocrat: CNQ has raised dividends for 25 consecutive years. In 2026, with a 5.1% yield, it serves as a “carry trade” for institutions waiting out market volatility.

Live Data Cross-Reference: While a previous close of $35.63 at the time of this writing, live Jan 2026 data shows Energy is currently the top-performing S&P sector (up 2.3% on Wednesday alone). This indicates the seasonal trend is already “igniting.

Second-Order Effects & Strategic Risks

As a strategist, I must highlight what most retail traders miss: The “Correlation Collision.”

- Macro-Political Friction: The ongoing “Tariff Row” (Jan 2026) could disrupt the global supply chains of YUM and CNQ. If trade tensions escalate, the “Defensive” nature of YUM becomes even more valuable.

- Liquidity Concentration: Note that ROP and YUM have pretty good daily volume, while CNQ is much higher. For larger retail positions, CNQ offers superior liquidity to exit if the trade goes against the seasonal pattern.

- The “Hidden” Opportunity: Worth noting, DKS (Dick’s Sporting Goods) has an 82% win rate but a much shorter window (ends Feb 27). This is a “Tactical Sprint” rather than a “Strategic Hold.” If you need quick capital turnover, DKS is the hidden gem on the list

Summary Table for Execution

| Symbol | Strategy | Entry Date | Projected Exit | Key Driver for 2026 |

| YUM | Defensive Value | Jan 22 | Login to SS | Digital margin expansion |

| ROP | Quality Growth | Jan 22 | Login to SS | Vertical SaaS recurring revenue |

| CNQ | Yield/Rotation | Jan 22 | Login to SS | 25-yr dividend growth track |

.

Seasonality is not a crystal ball; it is a map of historical probability. When you see a 92.8% win rate on YUM or a 10.6 Profit Factor on ROP, you aren’t looking at a “sure thing.” You are looking at a mathematical edge that institutions use to tilt the playing field in their favor.

My Final Strategic Note for the Week: Watch the Entry @ Open on January 22 closely, or later on throughout the week. If the broader market (SPY/QQQ) opens with a massive gap up, don’t chase. The “Big Money” waits for liquidity to settle in the first 30 minutes of the session. Patience in execution is often the difference between a profitable seasonal trade and a “wash.”

What I’m Watching Next Week:

As we move deeper into the Q1 cycle, I’ll be dissecting the Credit-to-Equity rotation. If the 10-year Treasury yield remains anchored, the “Quality Value” names we discussed today will likely see even more aggressive institutional accumulation.

Stay disciplined. Trade the plan, not the P&L.

Best regards,

Chad Shirley

Disclosure: This newsletter is for informational and educational purposes only. While the data is sourced from institutional-grade historical feeds, past performance is never a guarantee of future results. Trading involves significant risk of loss. Always consult with a certified financial advisor before making significant capital allocations.