Over the years of analyzing market cycles, I’ve seen traders consistently discount or misjudge the “Santa Claus Rally.” They might buy too early (catching the Thanksgiving hangover) or too late (chasing the New Year gap-up). This is not a hard and fast rule, merely a tendency.

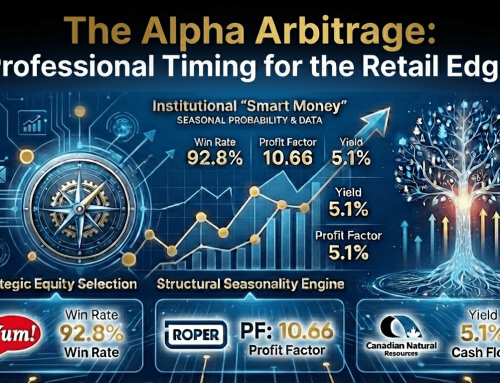

The data that I found in the Super Seasonals scanner isolates seasonal tendencies of the most potent entry window for certain stocks starting next week: December 8th.

Why this date? Fundamentally, by December 8th, the “Tax-Loss Selling” wave in late November has largely exhausted itself. We are also typically past the early-December Non-Farm Payrolls volatility. What often follows is a vacuum of selling pressure combined with institutional “window dressing”—where funds tend to buy winners to show them on their year-end books. Word of caution, this is imperfect logic, just my best assumption as to why. Not every year participates, but on balance, the winds tend to blow in that direction.

Based on the statistical anomalies in the data (specifically Win Rate and Profit Factor), I have isolated the potential Top 5 High-Probability Setups.

- The “Statistical Unicorn”

- Sector: Energy (Midstream/Pipelines)

- Win Rate: 96.3% (The highest on the board)

- Profit Factor: 13.33

- The Window: Login to SuperSeasonals.com to get Exit Date

Analysis:

A 96.3% win rate is statistically rare. It suggests this trade has failed only once or twice in decades.

- The Fundamental “Why”: This is a convergence of Physics and Finance.

- Physics: EPD transports Natural Gas Liquids (NGLs) and Propane. December/January is peak heating demand. Volumes surge.

- Finance (The MLP Bounce): EPD is a Master Limited Partnership. Investors hate the tax paperwork (K-1s), so they sell MLPs in November to clear their books. By Dec 8, selling is typically done. Smart money steps in to capture the distribution (dividend) before the Q1 payout. You are buying a “sold-out” market.

- The “Risk/Reward” King

- Sector: Technology (Semiconductors)

- Win Rate: 86%

- Profit Factor: 44.73 (The highest Risk/Reward ratio I have ever seen)

- The Window: Login to SuperSeasonal.com to get Exit Date

- Analysis:A profit factor of 44.73 means for every dollar lost on a losing year, the stock made $44.73 in winning years. This implies explosive upside.

- The Fundamental “Why”: The CES Run-Up.

- The Consumer Electronics Show (CES) happens every January in Las Vegas. It is the single biggest event for consumer tech. Apple, Nvidia, AMD—they all unveil new tech in Jan/Feb.

- TSM is the “arms dealer” for all of them. Institutional capital flows into TSM in mid-December to front-run the January product announcements. This is a classic “Buy the Rumor” trade leading into Q1 earnings.

- The Fundamental “Why”: The CES Run-Up.

- The “End-of-Year” Budget Flush

- Sector: Healthcare (Medical Devices)

- Win Rate: 86%

- Profit Factor: 25.77 (Elite Tier)

- The Window: Login to SuperSeasonals.com to get Exit Date

Analysis: Stryker makes robotic surgery assistants (Mako) and hospital equipment.- The Fundamental “Why”:

- The “Deductible Dash”: Stryker benefits from patients rushing to get surgeries done before insurance deductibles reset on Jan 1.

- The Capex Flush: Unlike pure implants, Stryker sells big capital equipment to hospitals. Hospital administrators have “Use-It-Or-Lose-It” capital expenditure (Capex) budgets. If they don’t spend their 2025 budget by Dec 31, they get less money in 2026. They rush to buy Stryker equipment in December, which shows up in the Q4 earnings print (released late Jan).

- The “Value Rotation” Play

- Sector: Energy (Midstream)

- Win Rate: 89%

- Profit Factor: 22.30

- The Window: Login to SuperSeasonals.com to get Exit Date

-

Analysis: Why pick PAA when we already have EPD? Because the data demands it. An 89% win rate with a 22.3 profit factor is technically superior to almost everything else on the list.

- The Fundamental “Why”: Yield Hunting.

- In January, the “January Effect” often sees investors rotate out of high-flying growth stocks and into “Dogs of the Dow” or high-yield value plays to set a safety baseline for the year.

- PAA offers a high yield. The Dec 8 entry gets you in ahead of the January “Safety Rotation.” It’s a lower-beta, high-certainty trade that complements the volatility of TSM.

- The “Yield Curve” Gamble

- Sector: Real Estate (Mortgage REIT)

- Win Rate: 86%

- Profit Factor: 4.21

- The Window: Login to SuperSeasonals.com to get Exit Date

-

Analysis: I chose NLY over other tech names to provide Portfolio Ballast (Stability).

- The Fundamental “Why”: Rate Repositioning.

- Bond traders typically reposition their portfolios in December/January. If the market anticipates the Fed will cut rates or hold steady in the new year, Mortgage REITs (which borrow short and lend long) become prime targets.

- NLY pays a massive dividend. Buying on Dec 8 allows you to capture the stock price appreciation as funds re-allocate to “Income” asset classes to start the fiscal year.

- The Anchor: EPD (96% reliability) provides the possible safety.

- The Rocket: TSM (44.73 Profit Factor) provides the potential alpha/growth.

- The Cyclical: SYK plays the hospital budget cycle.

As you likely know, there are literally dozens of solid ways to approach trading the aforementioned stocks with a bullish bias.

The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Seasonality is a tailwind, not the engine – fundamentals (earning, Fed path, etc..) drive the car. If seasonality is leaning in your favor, you don’t buy because of seasonality—you might buy when your risk/reward is good and seasonality is aligned with it.

Please remember to fully understand the risk before trading anything.

It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley