Thursday, November 6, 2025 | Super Seasonals: Trade of the Week

Traders, as we head into Q4’s cozy glow, the markets are whispering “upside” for cyclicals like homebuilders. PulteGroup (PHM) is our spotlight pick today—up ~19% YTD on housing rebound dreams, but with a fresh pullback to $119 that’s begging for a dip-buy. We’ve dissected the chart, seasons, options flow, and even those pesky stop hunts. Here’s the playbook to navigate November–January’s mild bullish breeze. (DYOR—markets love surprises!)

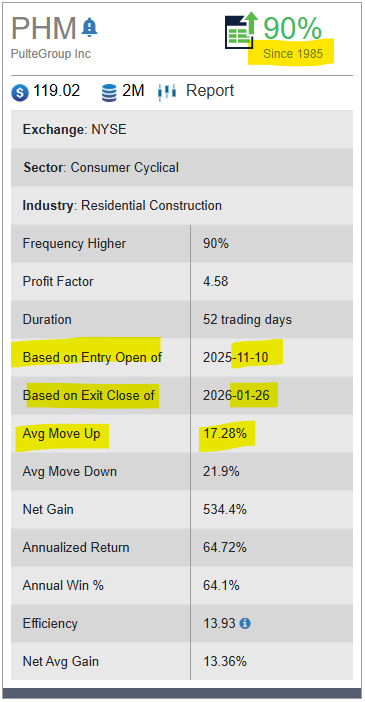

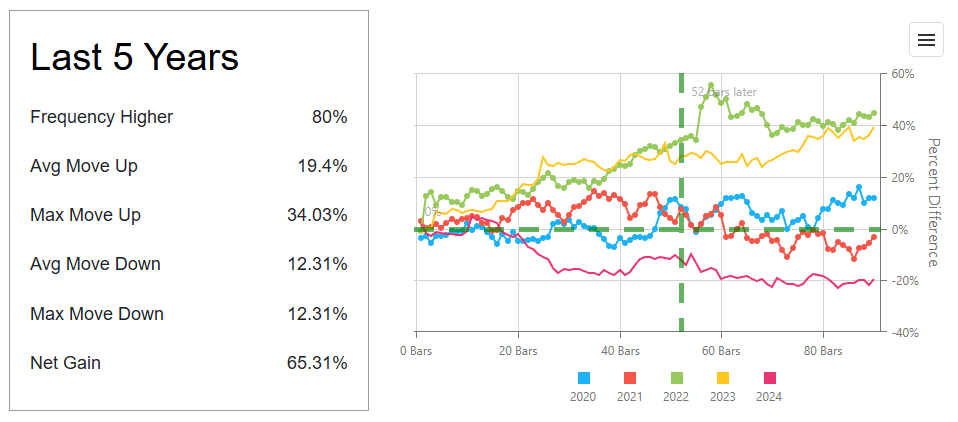

A look at the past 5-10 years…

History doesn’t lie—PHM loves November–January, with a net average gain of +13.36% over 40 years. Why the tailwind? Housing permits peak, “January effect” kicks in, and tax plays add froth. 90% of these stretches have ended positive.

PHM’s Trend at a Glance

PHM’s been a steady climber since March lows (~$100), hitting $140 in October before a healthy breather. It’s holding above the 50-day MA ($116).

Options Intel: Bulls Loading Up

The chain (Nov 15 exp) is call-skewed—PCR (Put/Call Ratio) at 0.77 screams optimism, with OI (Open Interest) clustering at $120 (max pain pin). GEX- gamma exposure levels (+$4.2M) keeps it chill at $116–$122, but watch Put walls at $115 for downside traps. IV’s low (35% rank), so options are cheap for directional plays. Upside Calls at $122? That’s where smart money’s stacking.

Options Quick Hits…

| Signal | Level | Insight |

| PCR | 0.77 | Bulls > bears; +2–5% setups ahead. |

| Top OI Strike | $120 | Price magnet—pin city. |

| GEX Hotspot | $118 | Support boost; fade dips. |

| Put Wall | $115 | Floor test—don’t freak. |

Trade Blueprint: Dip, Stop, Profit Momentum’s your friend—buy the pullback, scale out on strength. Risk 1–2% max; trail winners. Stop hunting? Real but rare here—recent wicks below $116 reversed a good portion of the time on low vol. Our levels buffer the noise.

Your Playbook Might Look Like This…

| Action | Price Zone | Why? | Risk/Reward |

| Entry | $116–$118 (primary dip) or $119.50–$120.50 (break) | Value + OI support; no chase above $122. | N/A |

| Stop Loss | $114.50 (tight) or $113.50 (paranoid buffer) | Below $115 puts—~1.5–2.5% risk, filters stop hunts. | 1:3+ |

| Targets | T1: $122 (+5%)

T2: $126 (+8%) T3: $132 (+14%) |

OI clusters + seasonal juice; scale 50% at T1. | Scale & trail |

Catalysts: Mid-Nov earnings or Fed hints. If it gaps up, pivot secondary ( a little trader lingo for switching to your backup plan). To clarify, if the stock gaps up (opens way higher, say at $120+ on good news like Fed chatter), you skip the dip and “pivot” to the secondary entry ($119.50–$120.50) instead. That way, you don’t miss the ride, but you’re still entering on confirmation (e.g., a quick green candle post-open).

Algos hunt liquidity at obvious spots ($115 rounded), but PHM’s GEX (gamma exposure) damps the drama—wicks are shallow (~0.5–1%). Our stops sit just outside the pile-up, with quick reversal odds high. Pro move: Half-size entry, add on confirm.

PHM’s primed for a festive finish—uptrend intact, seasons aligned, options bullish. But eyes on rates and data; one hot CPI could test $115. A “hot” reading means inflation comes in higher than expected (e.g., above the forecasted headline). That spooks markets because it signals the Fed might hold off on rate cuts, keeping borrowing costs high. Why it matters for PHM: As a homebuilder, PulteGroup thrives on cheap mortgages to juice demand. Hot inflation = delayed cuts = pricier loans (rates might stick >6.5%) = fewer homebuyers = stock dip. We’ve seen this play out before—PHM dropped ~5–7% on similar surprises in 2023/24. “Test $115”: That’s the next major support level (put wall from options OI, recent pullback low). A hot CPI could trigger selling, pushing price down to probe that floor. Not a crash, but a 3–4% shakeout—enough to flush weak hands before rebounding if it’s a one-off.

In short, it’s a reminder to watch data drops closely; they can override the bullish setup short-term. If CPI cools (as markets mildly expect), it could even catapult us toward $122+.

So that’s it. To learn more about seasonal information on other solid opportunities, click here SuperSeasonals. Stay nimble, trade small, and let’s ring in the gains. Enjoy the weekend—catch you next scoop!

Disclaimer: Educational vibes only. No financial advice—markets bite. Consult pros, risk what you can lose.

Cheers to seasonal wins!

Chad Shirley