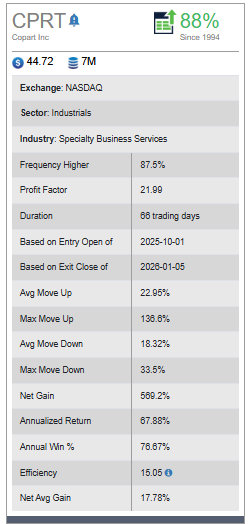

In today’s Super Seasonals: Trade of the Week we will look at Copart Inc. (CPRT).

Copart, Inc. engages in the provision of online auctions and vehicle remarketing services. The firm offers vehicle sellers a full range of services to process and sell vehicles primarily over the internet through Virtual Bidding Third Generation Internet auction-style sales technology. It sells vehicles principally to licensed vehicle dismantlers, rebuilders, repair licensees, used vehicle dealers, exporters and at certain locations, and the public.

Snapshot (as of Oct 2, 2025, NY time)

- Price: hovering in the mid-$40s after a multi-month slide from the $60s.

- Catalyst timing: FY25 Q4 call already held on Sep 4; no new dates posted yet on IR. Next update is likely the Q1 FY26 window (historically mid-Nov), but not posted on the site.

- Industry backdrop: Still viewed as a near-duopoly with strong cash generation and international expansion (bull case).

- Insurance total-loss frequency (a demand driver) has been elevated this year.

What the chart is saying

- It’s ~30% off its 52-week high (~$64) → plenty of overhead supply; breakouts can fail on first attempts.

Below are the seasonal patterns that the software uncovered…

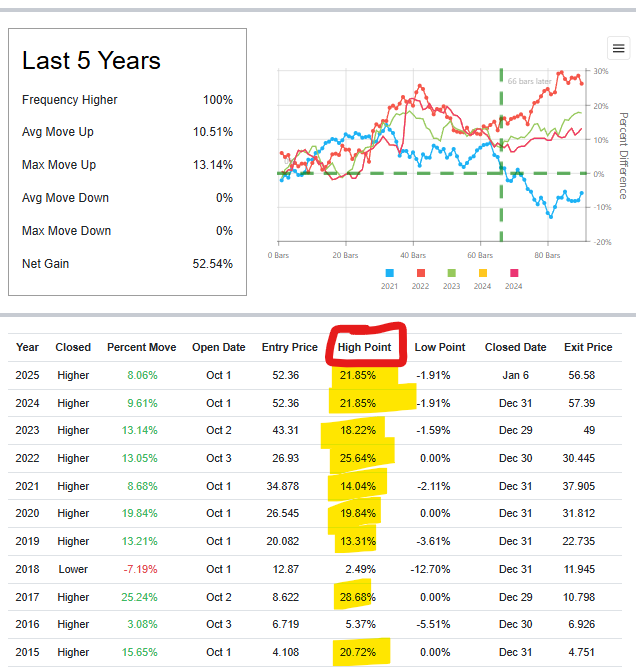

Below is a look at the past 5-10 years, there’s been some very solid High Point moves until the first week of January…

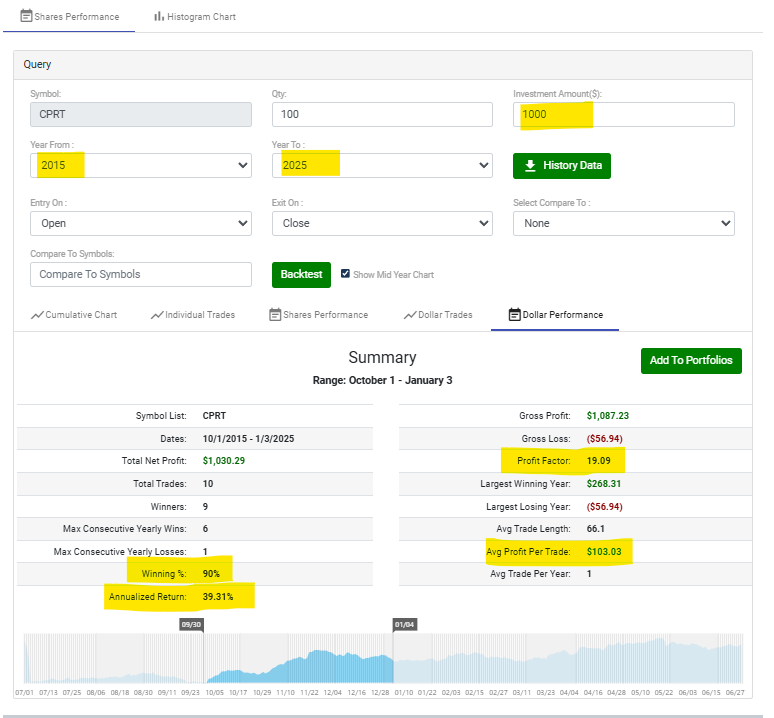

Below is a 10 year backtest, based on buying $1,000 worth of shares and selling during the given seasonal dates…

Seasonality and historical patterns can absolutely play into swing trade planning.

1. Historical Seasonality in CPRT

- End-of-year tendency: CPRT often rides higher into Q4 as insurance salvage volumes pick up (more accidents in winter months, elevated used-car demand around year-end).

- Market-wide seasonality: The broader equity market has a well-documented “year-end rally” (sometimes called the Santa Rally) that often boosts momentum stocks. CPRT tends to benefit when risk appetite rises in the last quarter.

2. How This Might Incorporate Into a Swing Plan

- Bias tilt: If I see CPRT setting up with a reclaim of a key moving average or a reversal base into late October/November, I’d lean more bullish with my position size (instead of staying very conservative).

- Profit target stretch: Normally, I might lock most gains at $52–53, but with seasonal tailwinds, I’d allow a runner toward $55–56 if the tape confirms.

- Trade management: Instead of selling out aggressively at first target, I’d scale 50% and keep 50% with a trailing stop to ride a possible “year-end drift.”

3. Risk Remains the Same

Even with seasonality, I don’t give the stock a free pass—price action and moving averages matter more for a technical trader. If CPRT can’t hold above $48, I won’t assume history will save the trade.

In practice: I’d use the historical strength as a bias enhancer, not as a standalone signal. If the technicals line up and we’re heading into the seasonal strong window, I’m more willing to let profits run beyond the first target.

How one could fold this into a swing plan

- Tilt bullish in October–December with more willingness to hold longer if the trade remains healthy.

- Stretch your target beyond the first resistance zones (e.g. 52–53) if momentum and volume confirm — maybe toward 55–56. There’s also a gap fill area in the $50-$60 area.

- Trail aggressively after breaking past major resistance (confluence zones) so you don’t give back gains if the seasonal push fades.

- Be more selective in weak years — if broad markets weaken or CPRT fails structure, don’t rely on seasonality to bail you out.

In closing, as you likely know, there are literally dozens of solid ways to approach trading Copart Inc. (CPRT) with a bullish bias.

The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties.

Please remember to fully understand the risk before trading anything.

It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley