Alphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services.

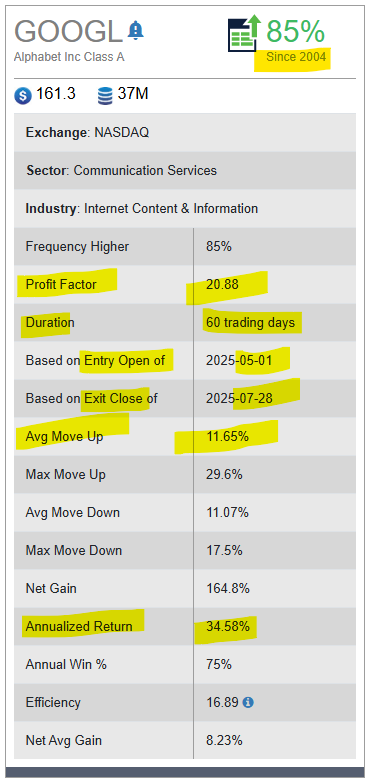

Price might try to push up to the 180-181 level, if the seasonal tendencies play out over the next 3 months…

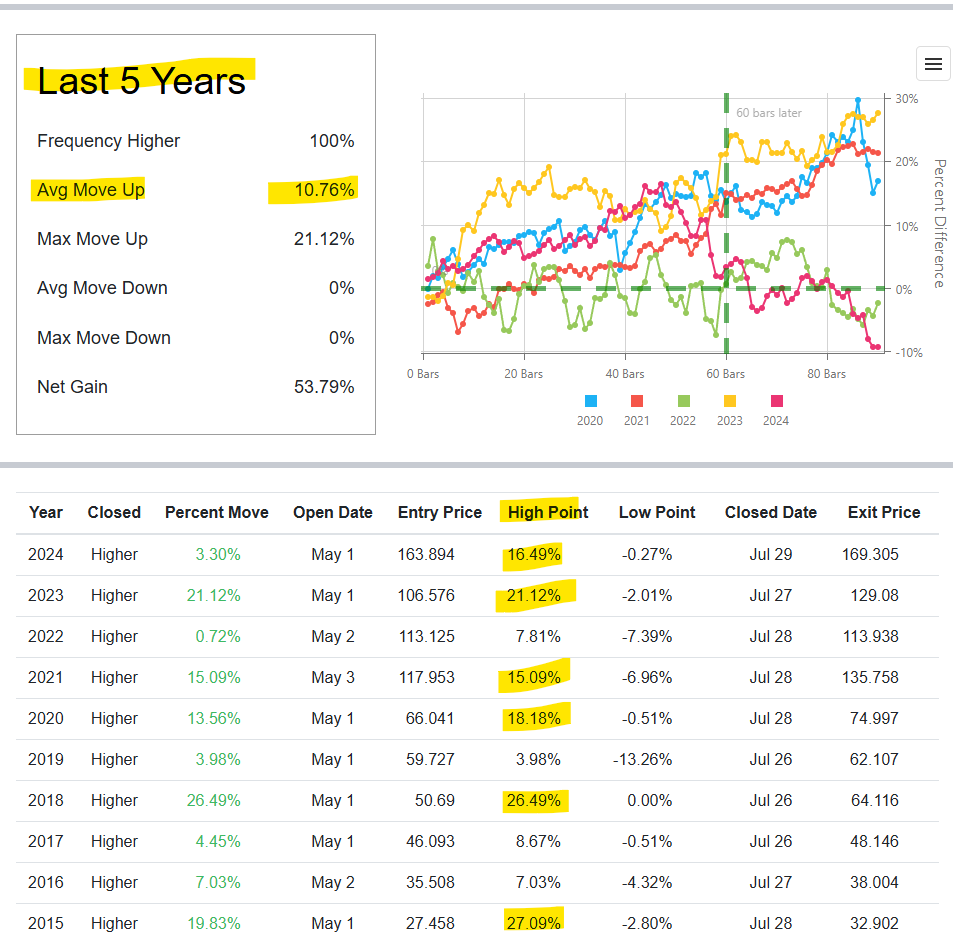

A look at the past 5-10 years…the 10-year High Point has a “mean” average of about +15-16%.

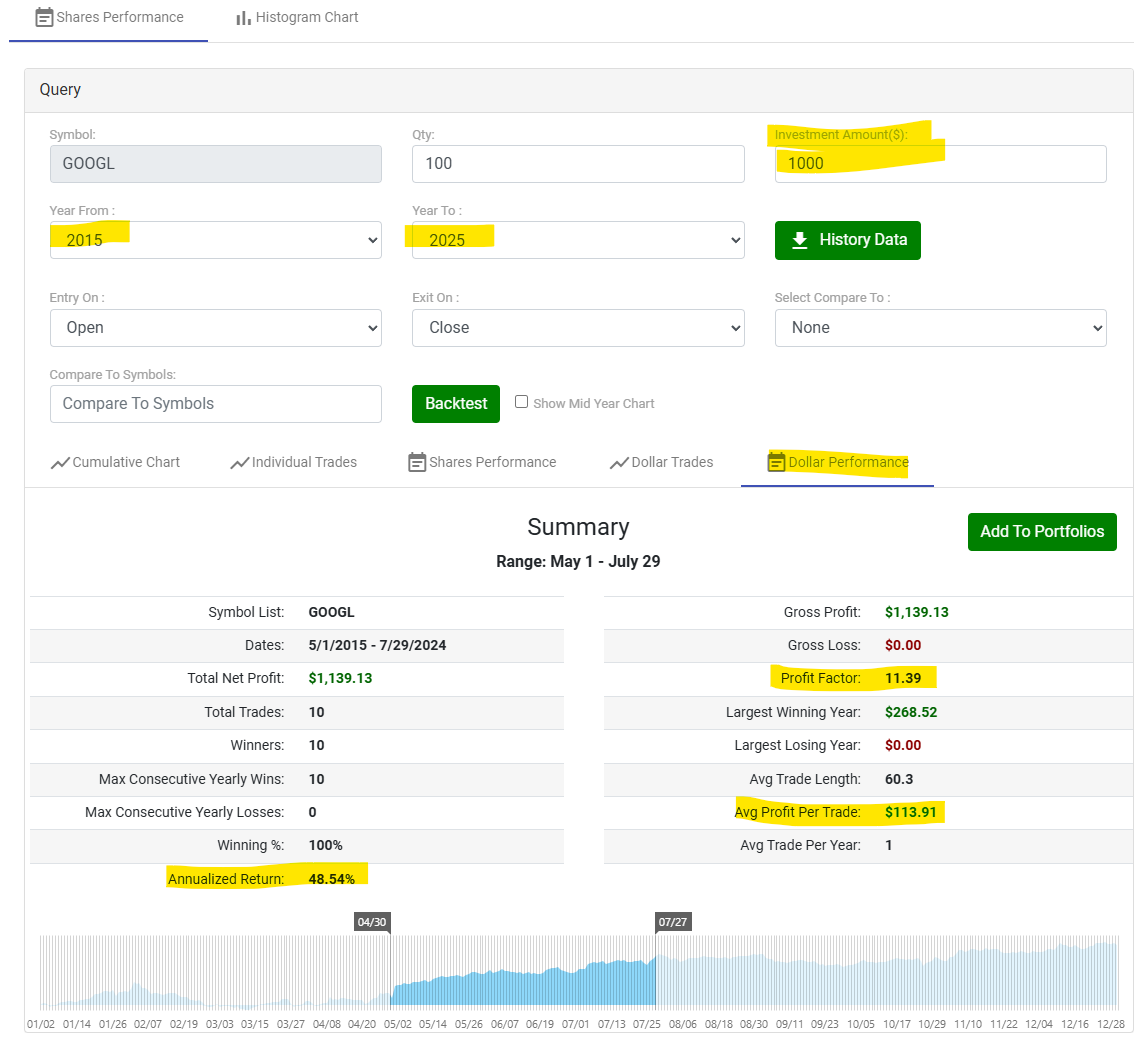

10 year backtest, if $1,000 in stock were bought, then sold in the seasonal period…

As you likely know, there are literally dozens of solid ways to approach trading Alphabet Inc Class A (GOOGL) with a bullish bias.

The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties.

Please remember to fully understand the risk before trading anything.

It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley