In today’s Super Seasonals: Trade of the Week we will look at The Cooper Companies Inc. (COO).

The Cooper Cos, Inc. operates as a medical device company. It operates through the Cooper Vision and Cooper Surgical segments. The Cooper Vision segment develops, manufactures, and markets products for contact lens wearers, which solves vision challenges such as astigmatism, presbyopia, myopia, ocular dryness, and eye fatigues. The Cooper Surgical segment focuses on the provision of advancement for the health of women, babies, and families through women’s health and fertility products and services.

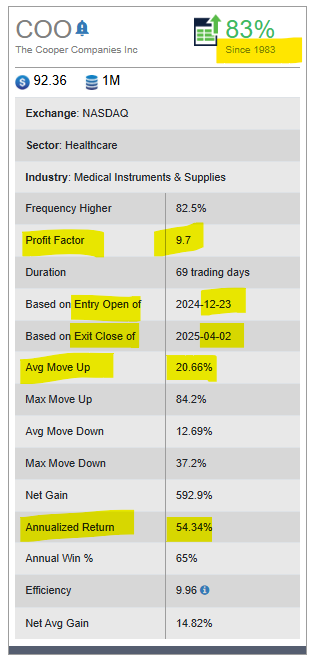

Below are the seasonal patterns that the software uncovered …

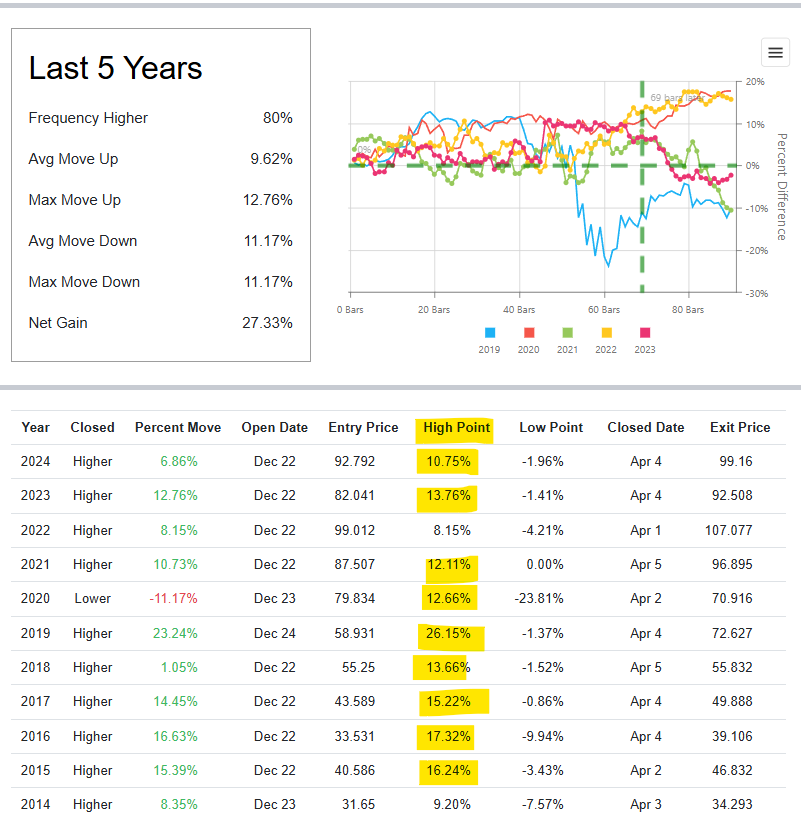

Below is a look at the past 5-10 years, fairly solid High Points…

Below is a look at the Past 20 Years, if $1,000 was invested to buy/sell shares of the stock at the given entry and exit dates…

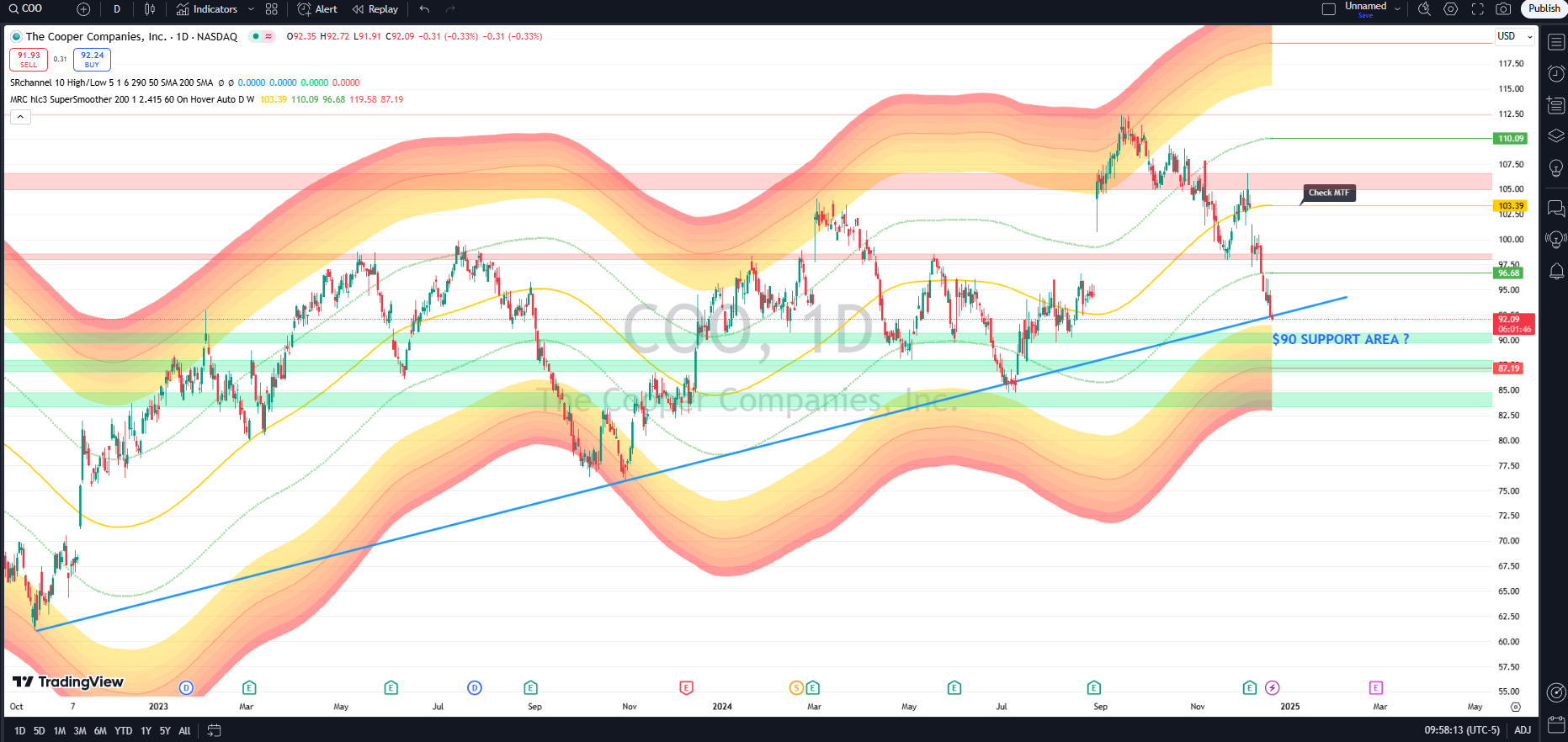

Looking at a Daily chart we see that price is headed toward an extended outer band (thick shaded yellow/red zone) of a potential mean reversion area support, also it is near a channel support zone (green shaded area) and at the bottom of an upward channel trend line (blue line). This might infer a potential technical bounce to the upside over the coming weeks.

From a bigger picture…Below is a Weekly chart, we are at a fair value area (yellow line), also at upward trend line support (blue line), and a channel support area (grey shade area).

As you likely know, there are literally dozens of solid ways to approach trading The Cooper Companies Inc. (COO) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember to fully understand the risk before trading anything. It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals.

Trade Smart,

Chad Shirley