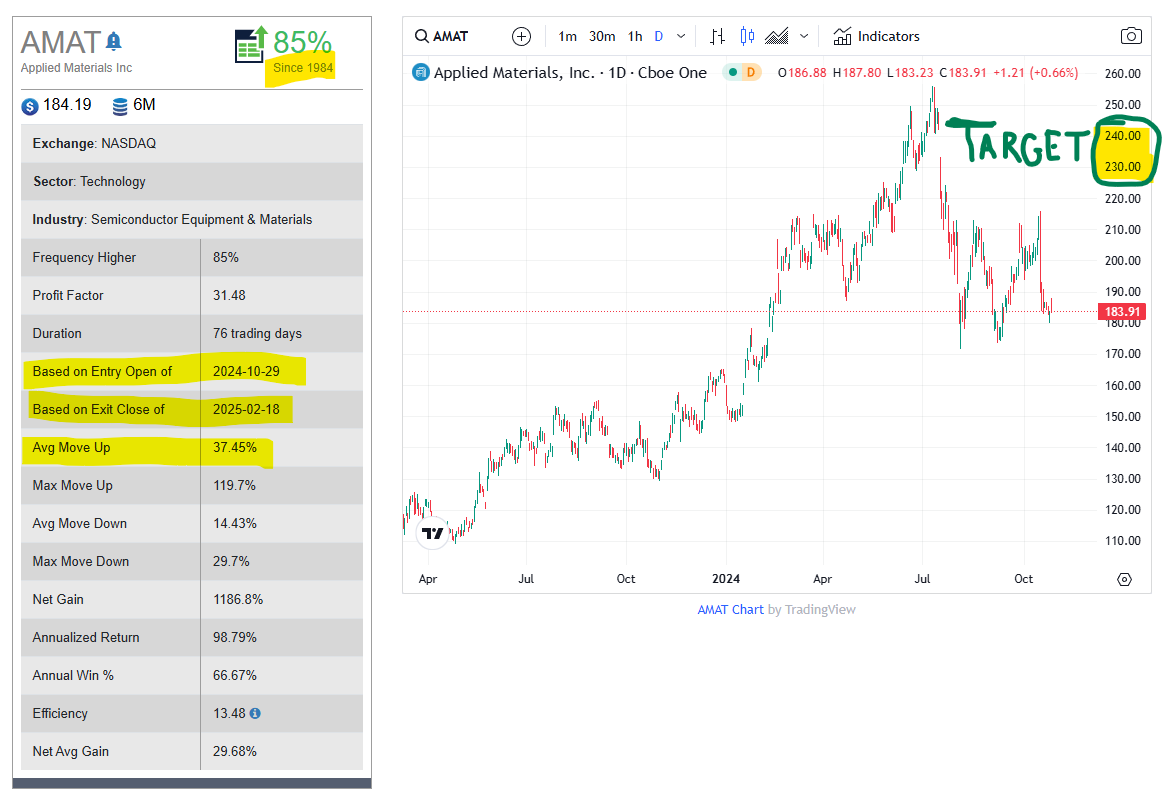

In today’s Super Seasonals: Trade of the Week we will look at Applied Materials Inc. (AMAT).

Applied Materials, Inc. is an American corporation that supplies equipment, services and software for the manufacture of semiconductor chips for electronics, flat panel displays for computers, smartphones, televisions, and solar products.

Below are some seasonal patterns that the algorithm has uncovered. Over the next 4 months of trading, the stock has averaged well over a +30% move in UP years, which has been 85% of the time since 1984.

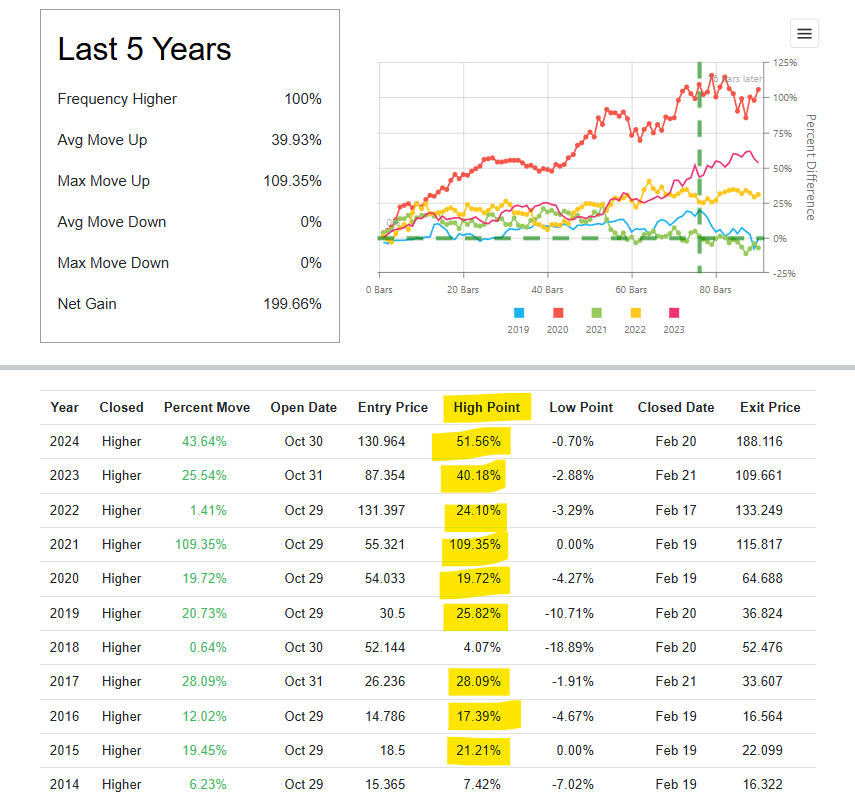

Zooming in on the past 5-10 years the bullish statistics do look positive for a bullish seasonal sentiment on the stock…

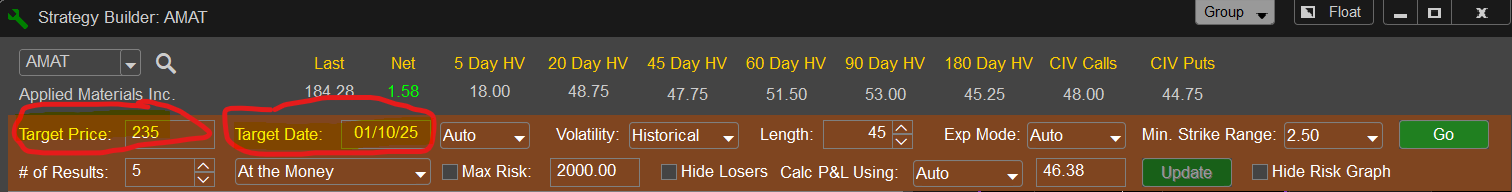

Say a reader is bullish today, and they believe that the stock could move up to $230-$240; let’s just split the difference and say $235. Based on that $235 target, option pricing markets say that as of today, if the market decides to move there it could do it mathematically by Jan, 10, 2025 target date. This could make sense, and align with historical data. Please know, these are not guarantees, merely what-if mathematical projections.

As you likely know, there are literally dozens of solid ways to approach trading Applied Materials Inc. (AMAT) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember to fully understand the risk before trading anything. It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals .

Trade Smart,

Chad Shirley