In today’s Super Seasonals: Trade of the Week we will look at Incyte Corp (INCY).

Incyte Corp. is a biopharmaceutical company, which engages in the discovery, development, and commercialization of proprietary therapeutics. It focuses on hematology and oncology, and inflammation and autoimmunity therapeutic areas.

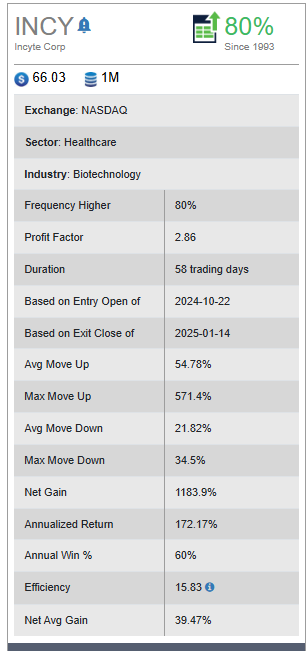

Below are the seasonal stats on the stock—

Below are the past 5-10 year seasonal snapshot. The High Points have been very good over the next 3 months of trading, historically speaking.

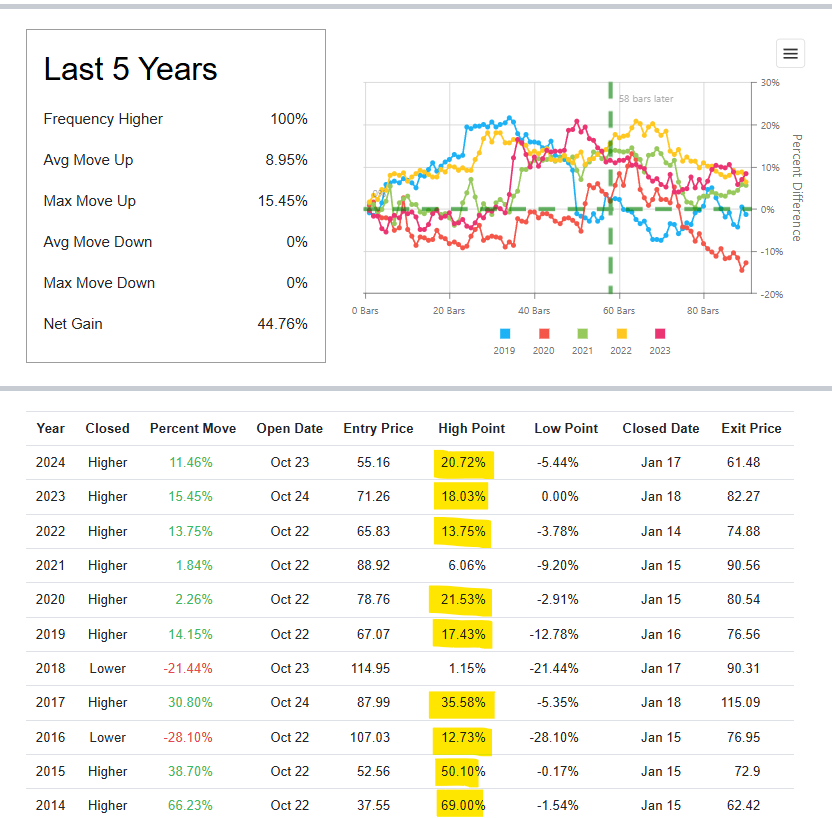

Below is a look at Competitor Seasonality, which has a tendency to be bullish as well.

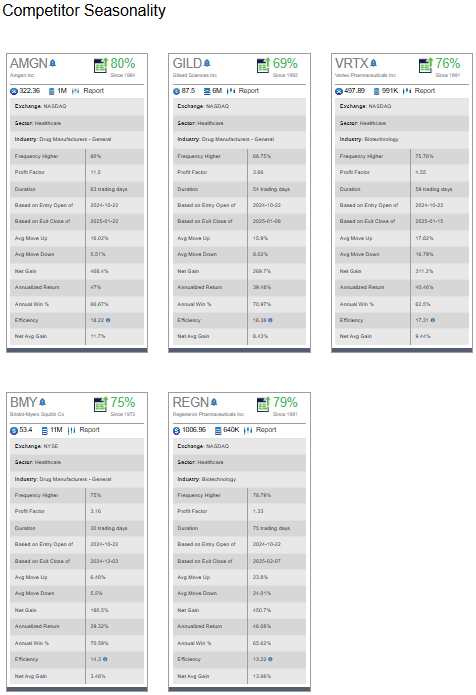

Below is a Daily chart of Incyte Corporation. It’s currently in a volatility squeeze situation. There is currently a bit of upside bullish momentum, technically. There is an upcoming Earnings announcement, so that is something to be aware of. This is just a thought, if price takes out this past Tuesday the 15th High of $67.06, then potentially look to buy shares of the stock— with a favorable reward to risk ratio that suits the reads risk profile and thesis on potential stock movements. Below is an example of a favorable 2:1 reward to risk ratio.

As you likely know, there are literally dozens of solid ways to approach trading Incyte Corp (INCY) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember to fully understand the risk before trading anything. It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals .

Trade Smart,

Chad Shirley