In today’s Super Seasonals: Trade of the Week we will look at General Motors Company (GM).

A glance at performance data over the past 12 months and year to date look good for the stock. In the past month the stock has sold off some. Technically, the consensus of indicators say the stock is in a Sell mode, but not strongly oversold. The analysts still have it as a Buy rating for the next 12 months, with the average price target at 54.91, or 23.53% upside from where we are at the time of this writing.

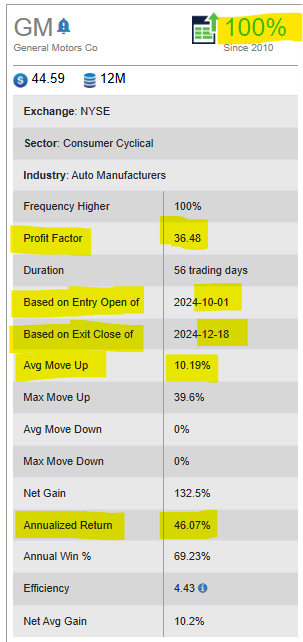

Below are the seasonal statistics for the upcoming seasonal period since 2010.

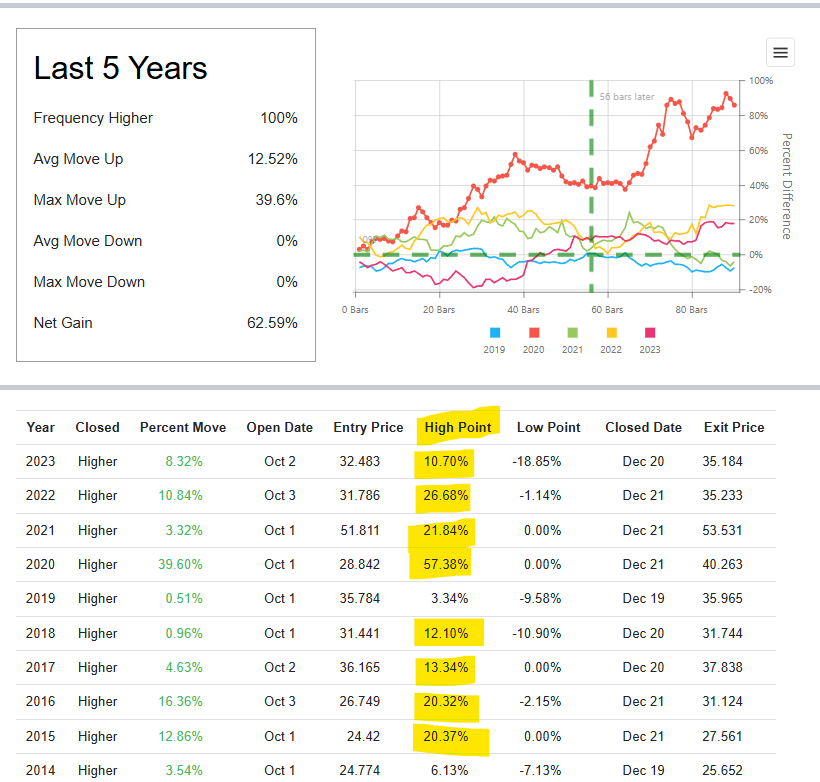

Below is a look at the past 5-10 years. There’s been some very solid % High Points…

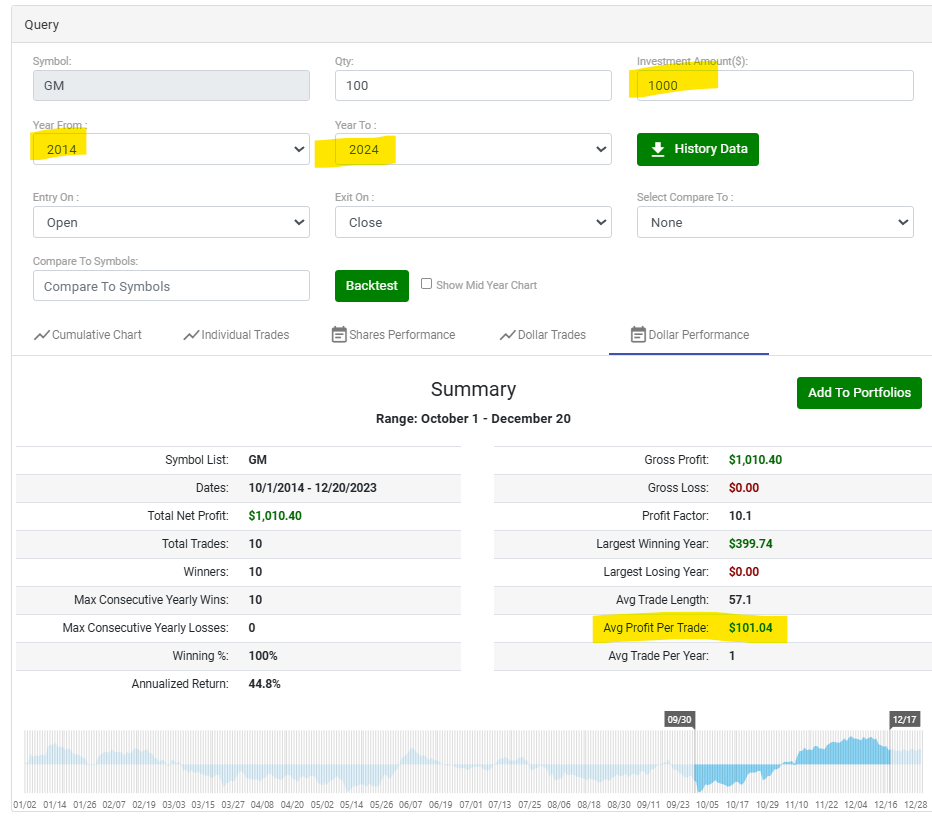

Below is a look at the past 10 years, if one were to buy $1,000 shares of the stock during the given seasonal entry/exit dates.

Below is just one possible trade idea, not a recommendation. Buy shares around the $42 area. Place a Stop below previous pivot lows in the $38.50 area. Take Profit toward upside resistance in the $49.00 area. This might be a feasible reward to risk ratio of 2:1, depending on an individual investor’s risk tolerance and personal outlook.

As you likely know, there are literally dozens of solid ways to approach trading General Motors Company (GM) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember to fully understand the risk before trading anything. It’s recommended to do your own research and consider consulting with a financial advisor before investing in any stock or options trade.

To learn more about seasonal information on other solid opportunities, click here SuperSeasonals .

Trade Smart,

Chad Shirley