In today’s Super Seasonals: Trade of the Week we will look at EQT Corp: EQT.

EQT Corp. is a natural gas production company, which engages in the supply, transmission, and distribution of natural gas. The company was founded in 1888 and is headquartered in Pittsburgh, PA.

Below are a snippet of the seasonal stats on the stock, as well as a Daily stock chart.

- Frequency Higher: 90.48%

- Profit Factor: 29.89

- Average Move Up: 20.57%

- Annualized Returns: 85.73%

- Efficiency 7.56 times more efficient than annual buy/hold

- Recent May Price Gap attempted to Fill around $32.55…could that level hold?

- Price Gap in August around $43…could price try to reach there?

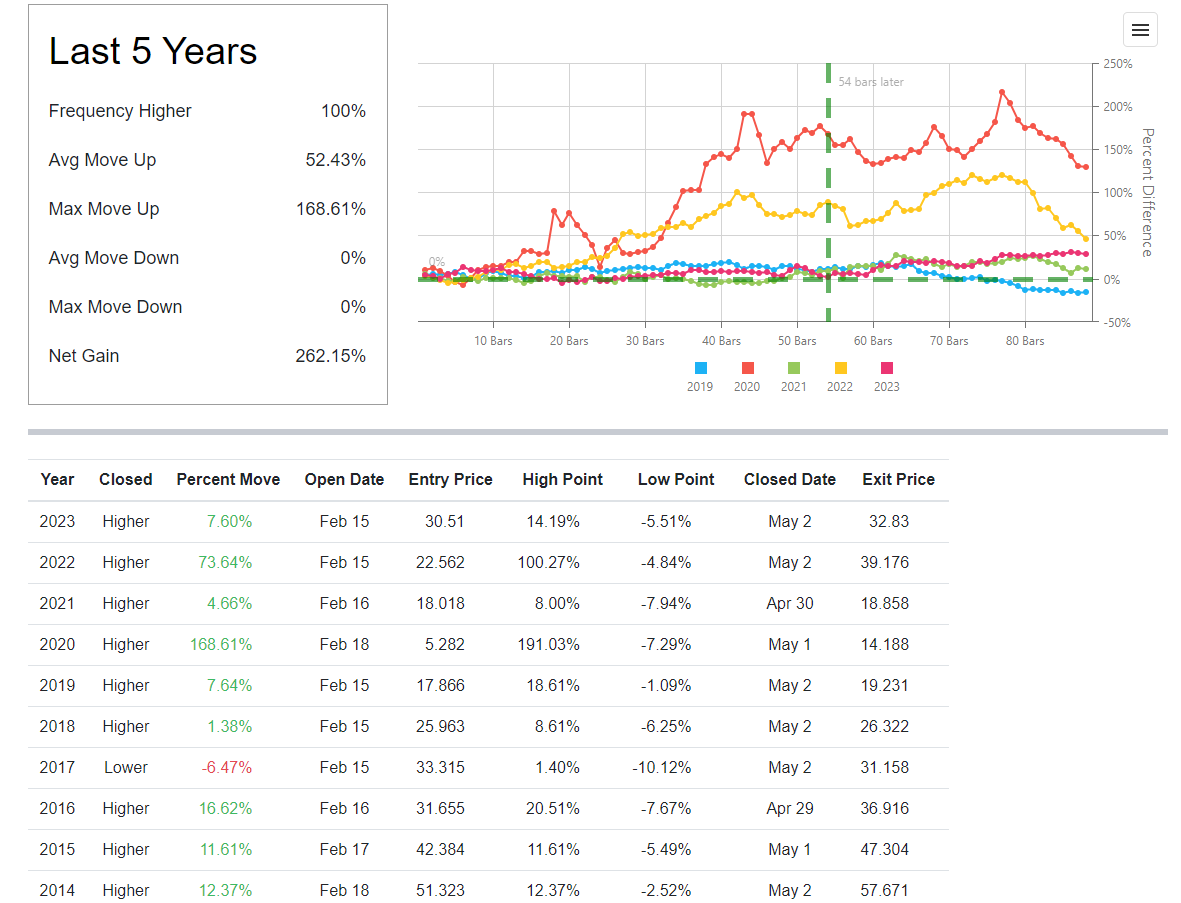

Below is a snippet of the the 5 years and 10 years of seasonal stats, which on the surface indicate that a seasonal tendencies might still likely be valid:

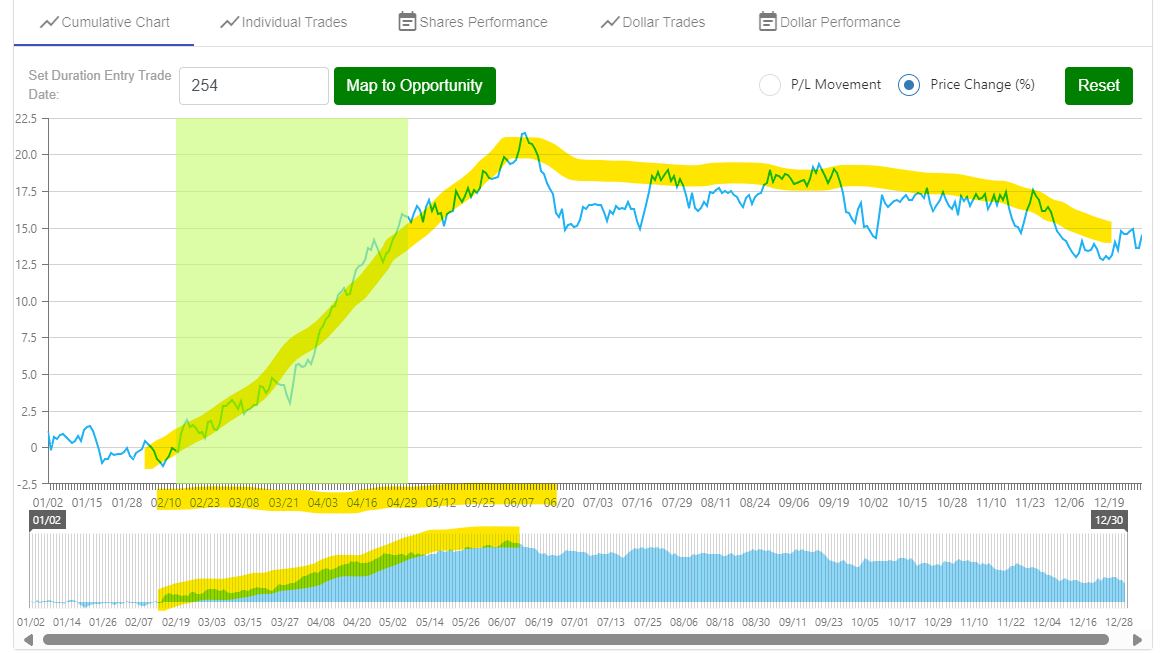

The Cumulative Chart below clearly exhibits that we are entering a strong seasonal trend…

As you likely know, there are literally dozens of solid ways to approach trading EQT Corp: EQT with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Keep in mind that seasonality is about probabilities, not certainties. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on EQT Corp: EQT and other solid seasonal opportunities click here SuperSeasonals .