In today’s Super Seasonal Trade of the Week we will look at Intercontinental Exchange (ICE).

ICE is a provider of data services and technology solutions in a large variety of asset classes. The company focuses on Futures & Equities, Fixed Income and mortgages. With an extensive history of M&A, the company managed to diversify its revenue streams a lot and 51% of revenues are recurring. Through the merger with Black Knight the company wants to expand its offering and create a “Life of Loan” platform, capturing the full value chain of a mortgage. The merger also aims to diversify the revenue further; Exchange revenue/Futures & Equities currently represent 56% of sales.

The quarter over quarter income statement looks good of late. The 1 year performance on the stock has been pretty good. The composite daily technicals are a Sell. And the Analysts have it as a Buy over the next 12-month time horizon.

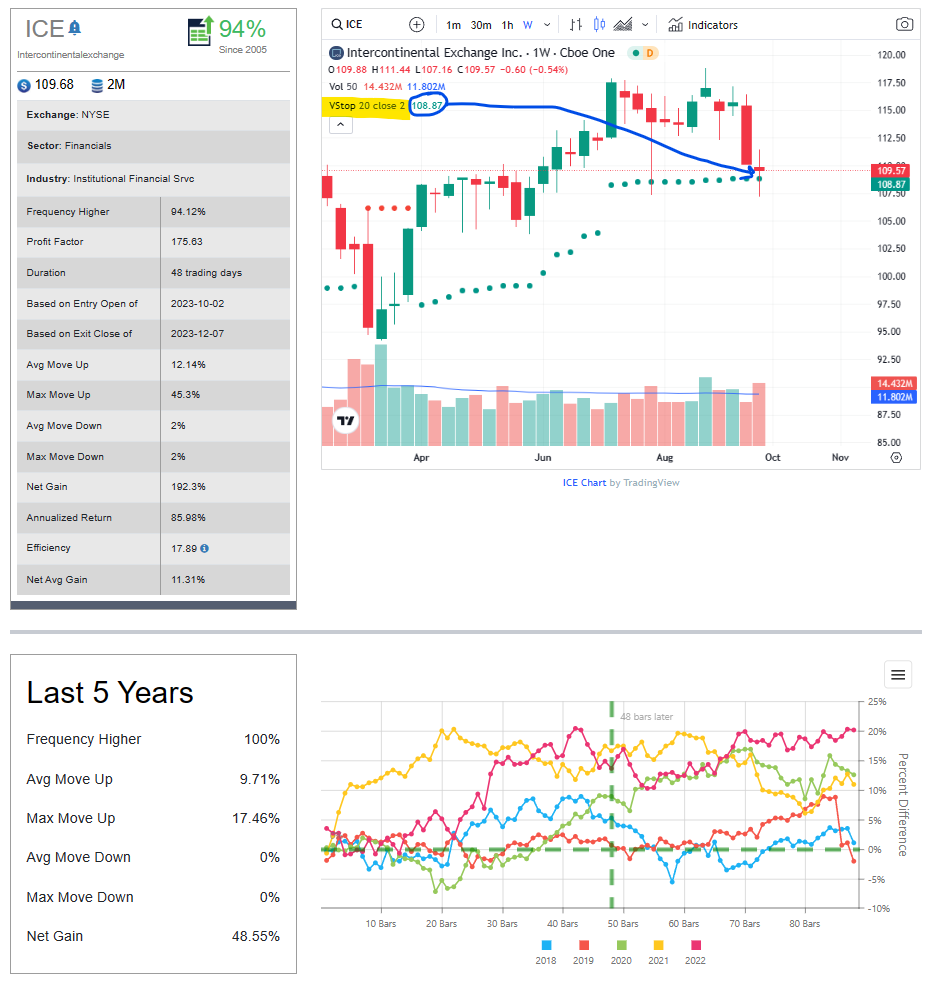

Below are the seasonal stats, if you look on the left side of the image below.

We are coming into a very solid seasonal period for ICE.

Glancing right, on the image below we see the Volatility Stop indicator which helps define the current trend. We are currently at a key inflection point on the Weekly chart below. Will the sell off the last 2 weeks hold, stall, or break down further?

Glancing at a Daily chart below, a breakout above the previous week’s high ($111.44) might be a good area to Buy for breakout traders. However, if traders believe there may be more of a pullback, the 105-106 area might be a decent place to consider buying shares. There appears to be multiple clusters of overhead resistance in the $122 area, so that may be an area to look for profit taking or potential upside stall in price movement.

From a bullish directional perspective, I do not like a Call purchase or Debit Call Spread purchase at the moment. The risk/reward metrics are not favorable, in my opinion. There’s other option positions that I may consider, but it’s beyond the scope of keeping it simple for the average reader.

As you likely know, there are literally dozens of solid ways to approach trading Intercontinental Exchange (ICE) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Hopefully this information has proved worth your time. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Intercontinental Exchange (ICE) and other solid seasonal opportunities click here SuperSeasonals . For other seasonal opportunities, please click on the link below to access the Super Seasonals software:

CLICK HERE FOR 50% OFF SUPER SEASONAL SCANNER