In today’s Super Seasonals Trade of the Week we will look at Williams Company (WMB).

The Williams Company. operates as an energy infrastructure company, which explores, produces, transports, sells and processes natural gas and petroleum products.

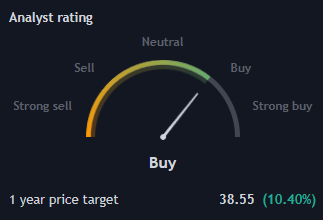

Analysts have the stock rated a Buy over the next 12-months.

Below are the seasonal snippets on Williams Companies since 1987…this upcoming seasonal period is 9.21 times more efficient than buy/hold of the stock!

Also, the Weekly chart shows we are ‘possibly’ in a Stage 2 Advancing Phase. You can reference Stan Weinstein’s market stage analysis with the 30-week moving average (thick blue line on chart below).

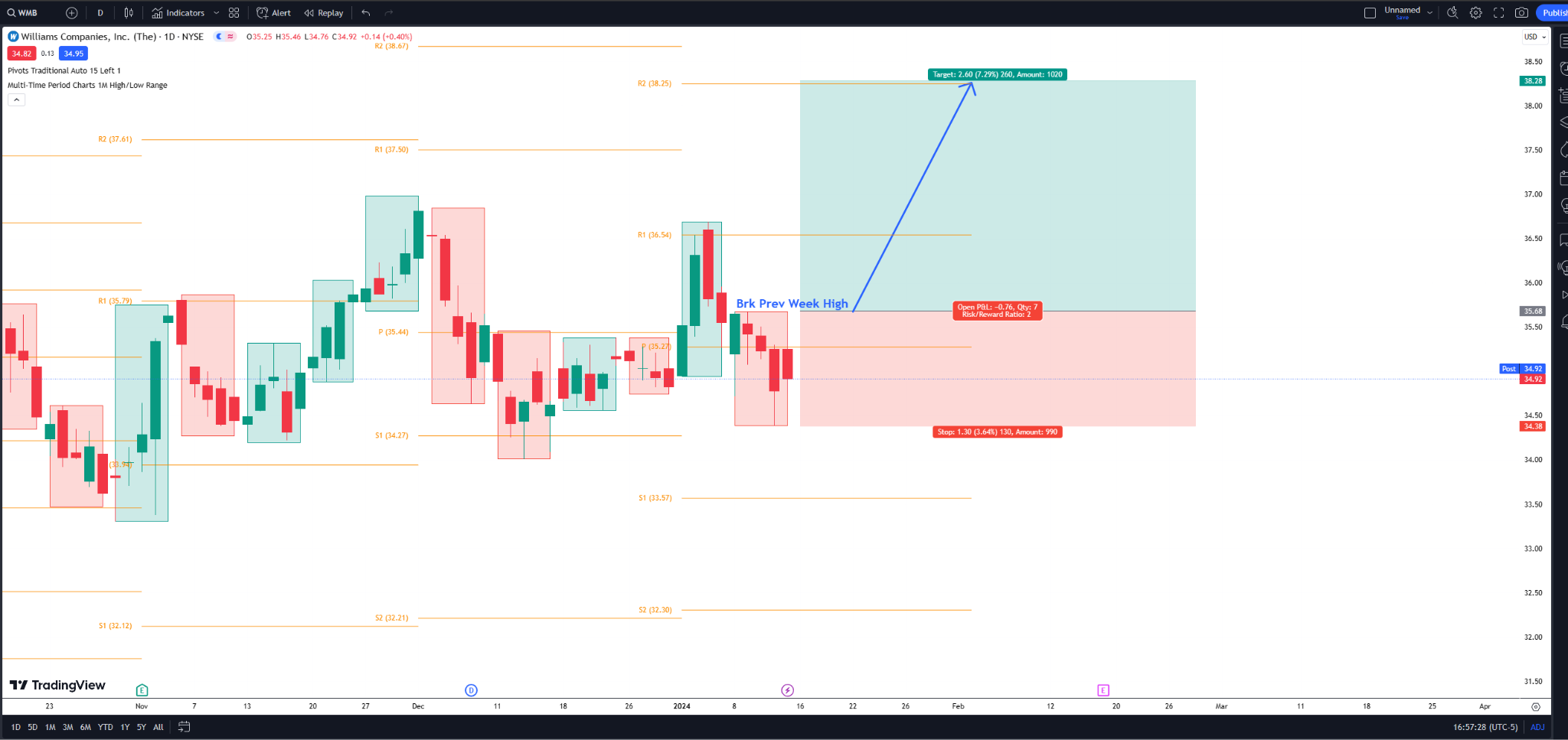

Below on the daily chart, the next pivot support area is at $33.57. If there’s buying confirmation, that might be a good area to buy shares of the stock if a reader is a pullback to support-area type of trader. A possible upside target is at the $36.54 upside pivot resistance.

Some readers might prefer a deeper pullback, depending on their risk/reward metrics.

Some readers might be breakout traders… play break above previous weeks high.Stop around previous weeks low. 2 to 1 Reward/Risk scenario given below.

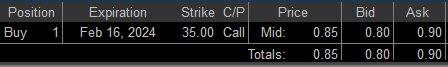

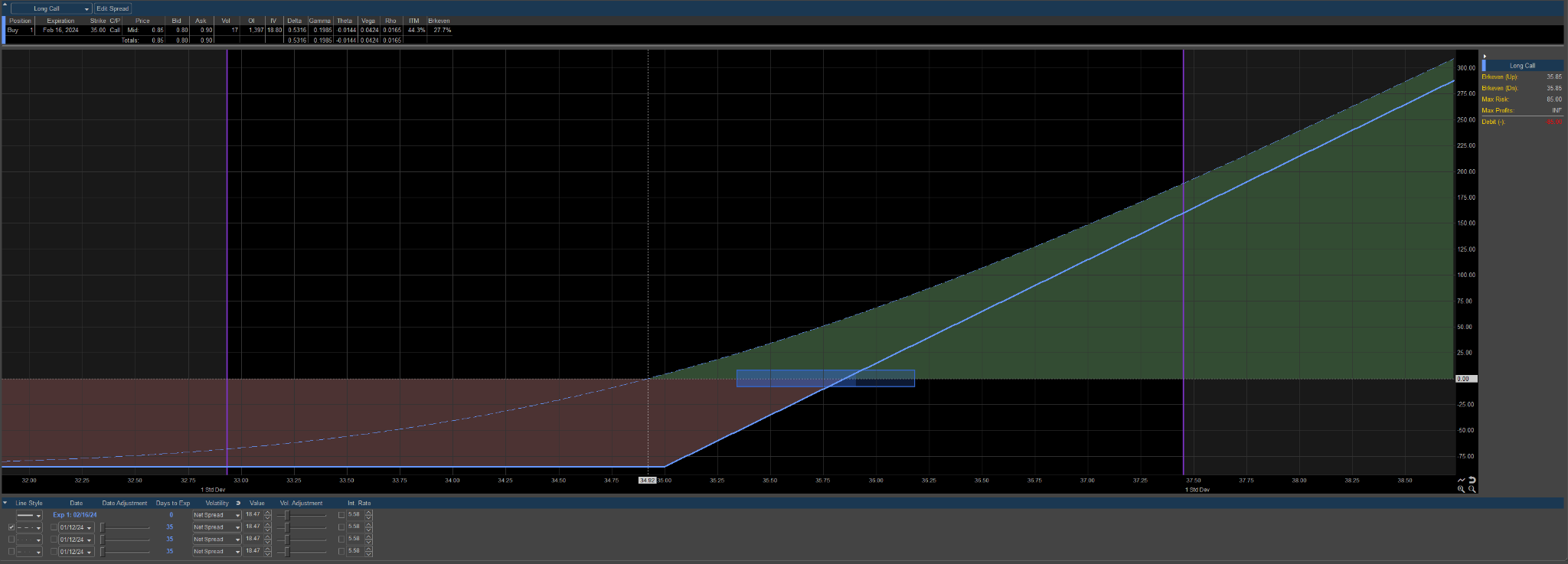

If a reader is bullish now, here is a potential Call option to consider buying

As you likely know, there are literally dozens of solid ways to approach trading Williams Company (WMB) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Hopefully this information has proved worth your time. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Williams Company (WMB) and other solid seasonal opportunities click here SuperSeasonals . For other seasonal opportunities, please click on the link below to access the Super Seasonals software:

CLICK HERE FOR 50% OFF SUPER SEASONAL SCANNER