In today’s Super Seasonal: Trade of the Week we will look at Range Resources Corp (RRC).

Range Resources Corp. engages in the exploration, development and acquisition of natural gas and oil properties in the Appalachian and Midcontinent regions.

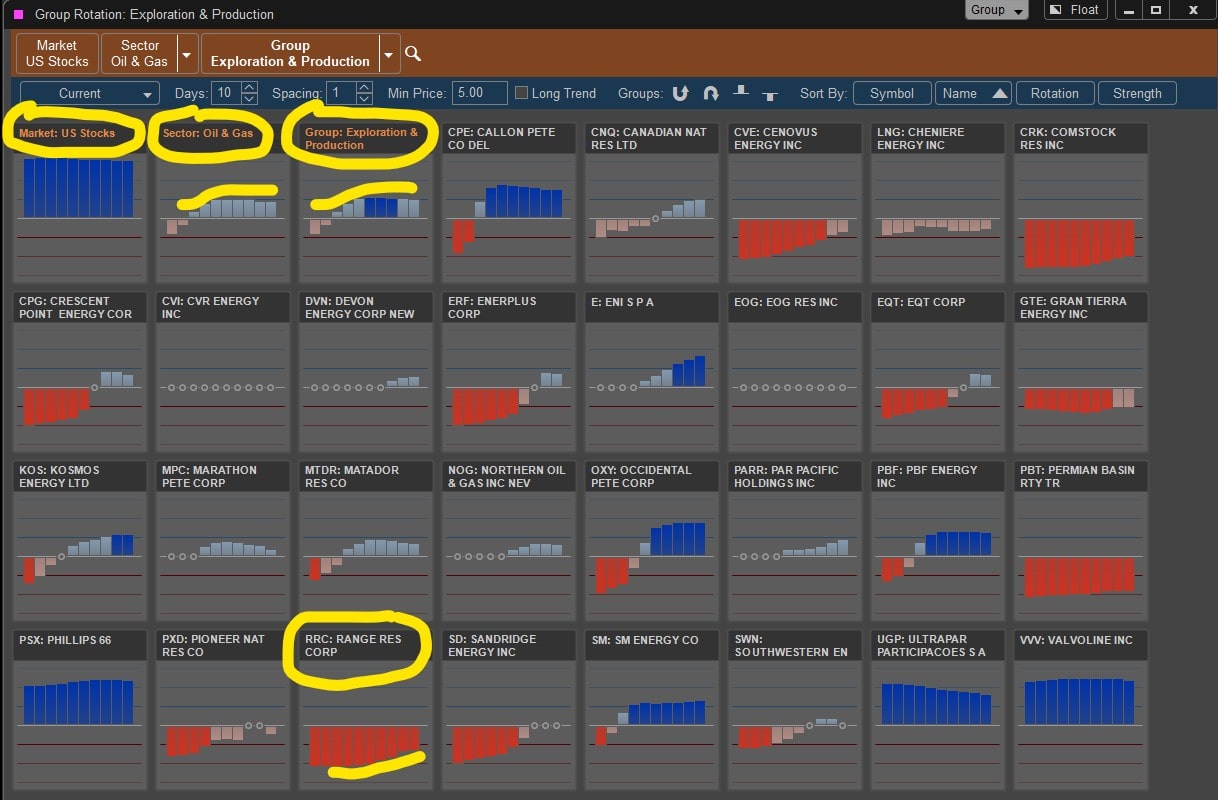

Let’s take a top down approach. Over the past 10 trading days, or past 2 weeks, the U.S. Stocks have been in a bullish trend. The Oil & Gas sector has been leaning bullish to neutral. And the Exploration & Production industry group has been leaning bullish to neutral. Looking at Range Resources stock itself, it’s been in a bearish mode and appears that it could be a slight let up of the selling pressure. If you glance across the board at other stocks in the group, the selling trend seems to be lessening as a whole.

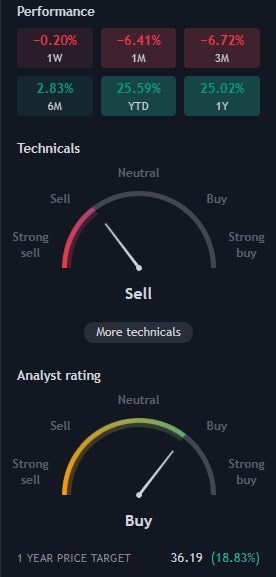

The year to date performance on the stock has been good. From a daily time frame perspective the technical rating composite has the stock still in a short term sell mode. While the analyst has it as a buy over the next 12 months.

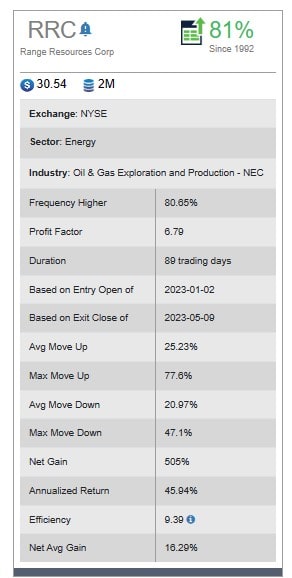

Below are the seasonal snapshot statistics of the stock over the next 4 months or so…+25% average move up during that time period, going back to 1992.

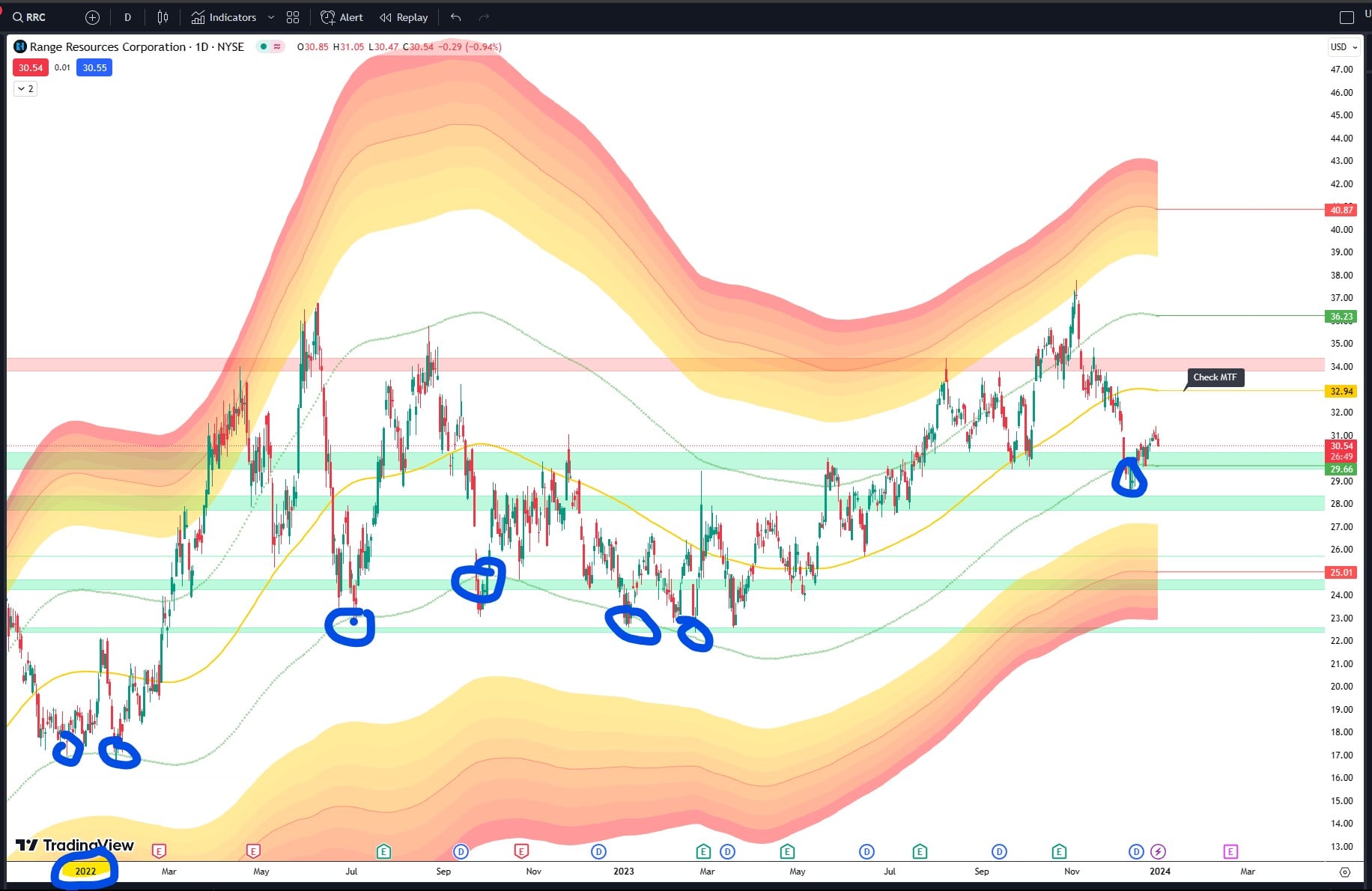

Below is a daily chart of RRC. You will see a Mean Reversion Channel indicator who’s objective, based on Mean Reversion theory ( everything has a tendency to revert back to its mean), is to help visualizing:

Inner Channel -> Dynamic Support and Resistance

Outer Channel -> Overbought/Oversold Zone which may signal consolidation phase or potential reversal due to unsustainable move

Currently we are -7.8% away from its mean, yellow line. Price has consistently bounced off and held well since 2022 off its dotted green inner channel line, which I’ve circled various points. Additionally there is a shaded green support channel around the that 29.66 level which as held of late.

Possible pullback buy idea…2:1 Risk:Reward

Possible breakout idea…2:1 Risk:Reward

Potential buy pullback to extreme oversold area…2:1 Risk:Reward

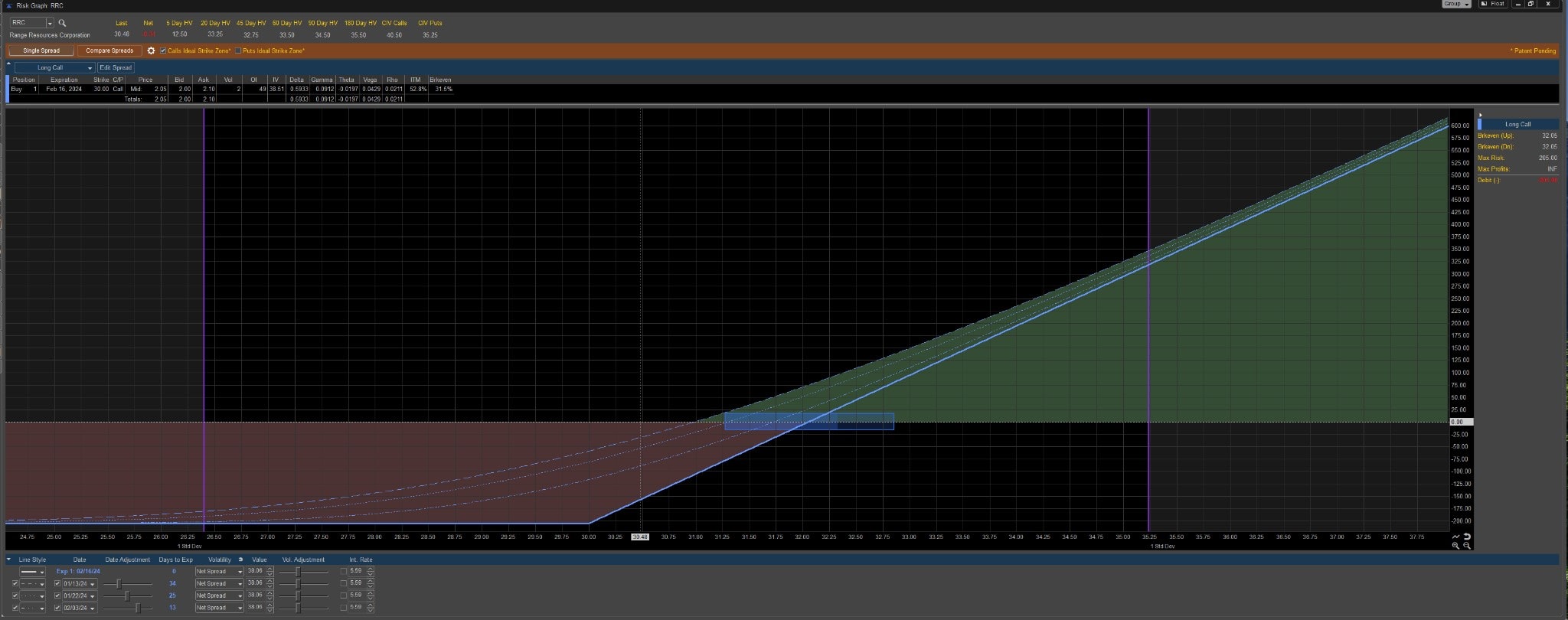

If a reader is bullish now, here’s a Call to consider buying…

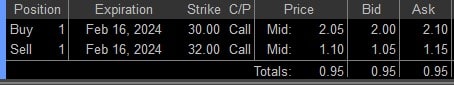

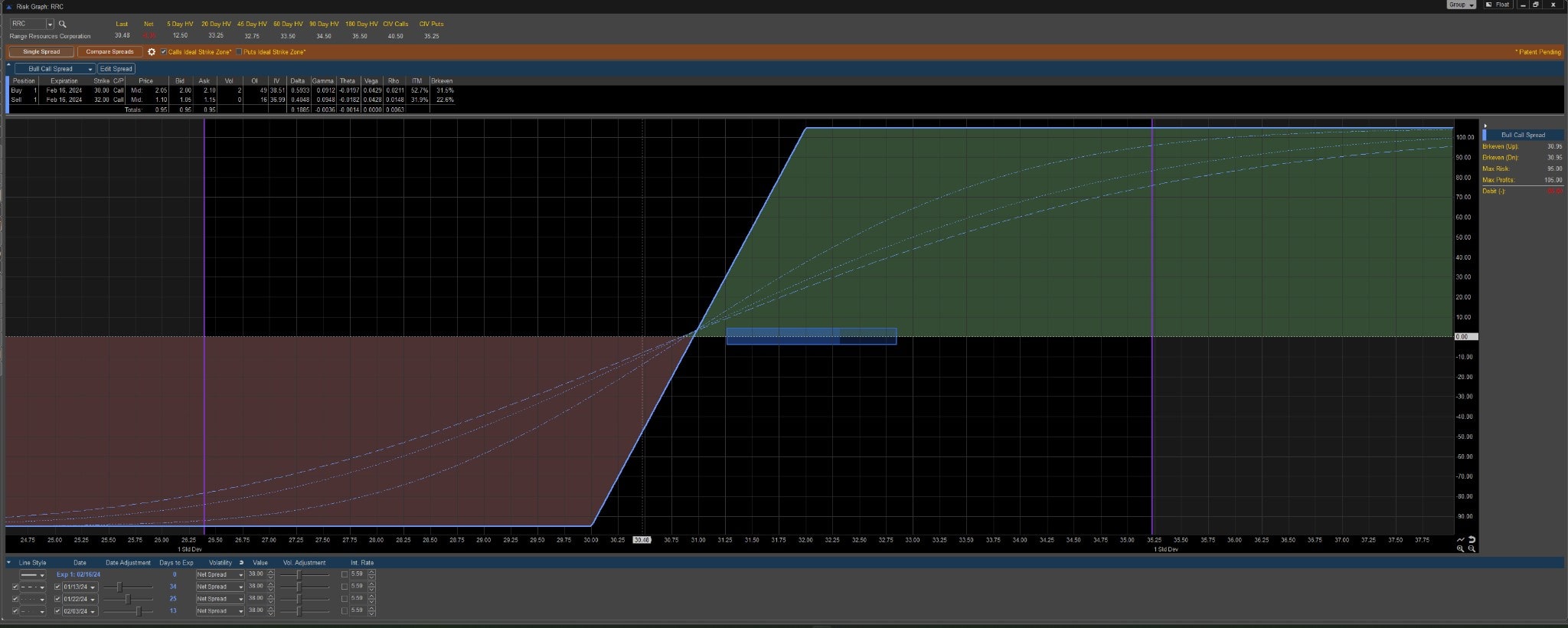

If a reader is bullish now, here’s a potential Call Debit Spread to consider…

As you likely know, there are literally dozens of solid ways to approach trading Range Resources Corp (RRC) with a bullish bias. The decision of how to best invest in the stock or trade the options is an individualized decision, unfortunately there is no one best way. Hopefully this information has proved worth your time. Please remember, do your homework, and fully understand the risk before trading anything.

To learn more about seasonal information on Range Resources Corp (RRC) and other solid seasonal opportunities click here SuperSeasonals . For other seasonal opportunities, please click on the link below to access the Super Seasonals software:

CLICK HERE FOR 50% OFF SUPER SEASONAL SCANNER